AAPL

By MacRumors Staff

AAPL Articles

Apple's Q2 2024 Earnings Call Takeaways

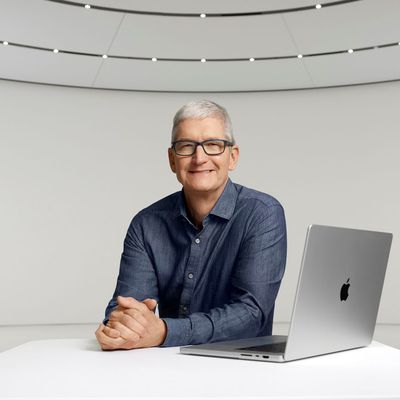

Apple today held its earnings call for the second fiscal quarter of 2024 (first calendar quarter), with Apple CEO Tim Cook and Apple CFO Luca Maestri providing us with some details on Apple's performance, Vision Pro sales, services growth, AI plans, and other topics. We've highlighted the most interesting takeaways from today's earnings call. Next Week's Announcements Apple CEO Tim Cook...

Read Full Article 166 comments

Tim Cook on Generative AI: 'We Have Advantages That Will Differentiate Us'

During today's earnings call covering the second fiscal quarter of 2024, Apple CEO Tim Cook again spoke about Apple's work on generative AI. He said that Apple has "advantages" that will "differentiate" the company in the era of AI, and some "very exciting things" will be shared with customers in the near future. We continue to feel very bullish about our opportunity in generative AI. We are ...

What to Expect From Apple's Earnings Report This Week Following Vision Pro Launch

Apple will report its earnings results for the second quarter of its 2024 fiscal year on Thursday, May 2 at 1:30 p.m. Pacific Time. Apple's CEO Tim Cook and CFO Luca Maestri will discuss the results on a conference call with analysts a half hour later. Keep reading for some key things to know about the quarter, including a recap of new products announced, revenue expectations, and more. Ne...

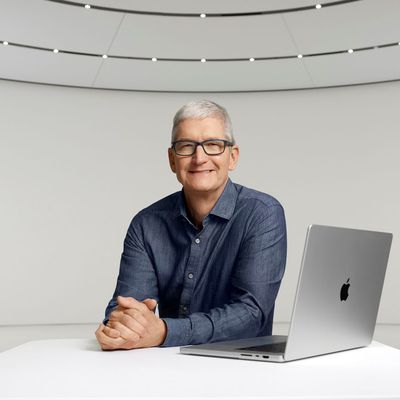

Tim Cook Sells Nearly 200,000 Apple Shares

Apple's CEO Tim Cook this week sold 196,410 shares of the company's stock, which had a total value of approximately $33.2 million based on the average sale price of the transactions, according to a U.S. Securities and Exchange Commission filing. After taxes, Cook netted nearly $16.4 million from the sales. Cook received all of the shares that he sold this week as a performance-based stock...

Apple to Report Earnings on May 2 Following Vision Pro Launch

Apple today announced that its next quarterly earnings conference call will be held on Thursday, May 2 at 2 p.m. Pacific Time. On the call, which will be streamed live on Apple's investor website, Apple's CEO Tim Cook and CFO Luca Maestri will discuss the company's earnings results for the second quarter of the 2024 fiscal year. During the quarter, which ran from December 31, 2023 through...

Tim Cook Says Apple Will 'Break New Ground' in Generative AI

Apple today held its annual shareholders meeting, and during the event, Apple CEO Tim Cook once again commented on Apple's AI plans. Cook said that the company will "break new ground" in generative AI in 2024. "We believe it will unlock transformative opportunities for our users," said Cook. Cook has made several statements on Apple's artificial intelligence ambitions in recent months. Back...

Major Shareholders Planning to Force Apple to Reveal Use of AI

Some of Apple's biggest investors are set to pressure the company tomorrow to reveal its use of artificial intelligence tools (via the Financial Times). Apple's annual shareholder meeting takes place tomorrow, allowing those with a major stake in the company to put forward proposals. One resolution proposed by the American Federation of Labor and Congress of Industrial Organizations...

Apple's Q1 2024 Earnings Call Takeaways

Apple today held its earnings call for the first fiscal quarter of 2024 (fourth calendar quarter of 2023), with Apple CEO Tim Cook and Apple CFO Luca Maestri sharing details on Apple's performance, recent product sales, services growth, and more. We've highlighted the most interesting takeaways from the earnings call. EU App Ecosystem Changes Maestri and Cook were asked about possible...

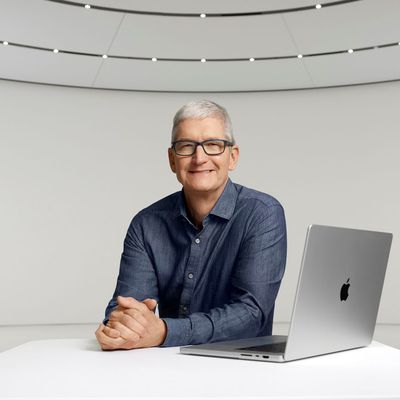

Microsoft Overtakes Apple as World's Most Valuable Company [Updated]

Microsoft today overtook Apple as the world's most valuable public company by market value. Apple's share price dropped by just one percent, enabling Microsoft to narrowly pull ahead of Apple at a value of $2.87 trillion. Microsoft has briefly overtaken Apple as the most valuable company since 2018, most recently in 2020 and 2021 when concerns about supply chain shortages dented Apple's...

Apple to Hold February 1 Earnings Call Just Ahead of Vision Pro Launch

Apple has announced that its first earnings call of 2024 will be held on February 1, one day before the Vision Pro launches in the United States. On the call, Apple's CEO Tim Cook and CFO Luca Maestri will discuss the company's earnings results for the first quarter of the 2024 fiscal year. The executives will almost certainly provide some additional commentary about the Vision Pro. A...

What to Expect From Apple's Earnings Report Tomorrow Following iPhone 15 Launch

Apple will report its earnings results for the fourth quarter of its 2023 fiscal year on Thursday, November 2 at 1:30 p.m. Pacific Time. Apple's CEO Tim Cook and CFO Luca Maestri will discuss the results on a conference call with analysts a half hour later. Keep reading for some key things to know about the quarter, including a recap of new products announced, revenue expectations, and more. ...

Apple to Report Earnings on November 2 Following iPhone 15 Launch

Apple has announced that it will report its earnings results for the fourth quarter of the 2023 fiscal year on Thursday, November 2. The report will be available at 1:30 p.m. Pacific Time on that day, and Apple's CEO Tim Cook and CFO Luca Maestri will discuss the results on a conference call with analysts at 2:00 p.m. Pacific Time. A live audio stream of the call will be available on Apple's ...

Tim Cook Nets $41.5 Million After Selling Over 500,000 Apple Shares

Apple CEO Tim Cook netted around $41.5 million after taxes this week after selling 511,000 shares of Apple stock that he received as part of a performance-based award, according to a filing released by the U.S. Securities and Exchange Commission. The stock award was determined based on Apple's total shareholder return relative to the other companies in the S&P 500 between the first day of...

What to Expect From Apple's Earnings Next Week Following New Macs

Apple will report its earnings results for the third quarter of its 2023 fiscal year on Thursday, August 3 at 1:30 p.m. Pacific Time. Apple's CEO Tim Cook and CFO Luca Maestri will discuss the results on a conference call with analysts a half hour later. Keep reading for some key things to know about the quarter, including a recap of new products announced, revenue expectations, and more. ...

Apple to Announce Q3 2023 Earnings on August 3 Following New Macs

Apple has announced that it will report its earnings results for the third quarter of the 2023 fiscal year on Thursday, August 3. The report will be available at 1:30 p.m. Pacific Time, and Apple's CEO Tim Cook and CFO Luca Maestri will discuss the results on a conference call with analysts at 2:00 p.m. Pacific Time. A live audio stream of the call will be available on Apple's Investor...

Apple's Market Valuation Returns to $3 Trillion After Almost 18 Months

Apple's market capitalization has once again hit $3 trillion as the company's shares opened at $191.78 this morning, up just over 1% compared to yesterday's closing price. It has been nearly 18 months since Apple very briefly hit the milestone in January 2022 before declining along with the overall market. At the beginning of this year, Apple's value dipped below $2 trillion, but the...

AAPL Shares Close at First All-Time Record High Since January 2022

Apple shares closed at a new all-time high on Monday, rising 1.6% to finish the regular trading day at $183.79. It was Apple's first closing high since January 2022, barring an intraday record following Apple's Vision Pro unveiling last week. Apple's stock gain this year has resulted in a market capitalization of $2.89 trillion, according to Bloomberg, putting it in range of hitting the $3...

Tim Cook Says Apple Still Not Considering 'Mass Layoffs'

Apple CEO Tim Cook today said he still views mass layoffs as a "last resort," and ensured this is not something the company is considering right now. "I view that as a last resort and, so, mass layoffs is not something that we're talking about at this moment," said Cook, in an interview with CNBC. Major tech companies like Google and Facebook parent Meta have laid off tens of thousands of ...

What to Expect From Apple's Earnings Results Following New Macs and HomePod

Apple will report its earnings results for the second quarter of its 2023 fiscal year on Thursday, May 4 at 1:30 p.m. Pacific Time. Apple's CEO Tim Cook and CFO Luca Maestri will discuss the results on a conference call for investors a half hour later. Keep reading for some key things to know about the quarter, including a recap of new products announced, revenue expectations, and more. Ne...

Apple to Announce Q2 2023 Earnings Results on May 4

Apple today announced plans to report its earnings results for the second fiscal quarter (first calendar quarter) of 2023 on Thursday, May 4. The earnings report and investor call afterward will provide insight into the period between late December and March, which is often a slow quarter for Apple following the holiday quarter. Apple in January introduced new M2 Pro and M2 Max MacBook Pro ...