How to Adjust Mac Volume and Brightness More Precisely

Charge AirPods (or Even an iPhone) With Your iPhone

Get Creative With Sound by Layering Tracks in Voice Memos

Share Audio Over Two Pairs of AirPods

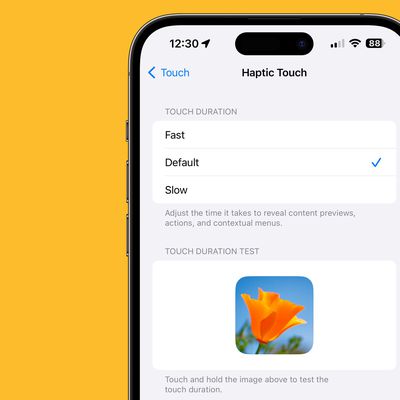

iPhone Long Press Too Slow? Speed Up Haptic Touch in Seconds

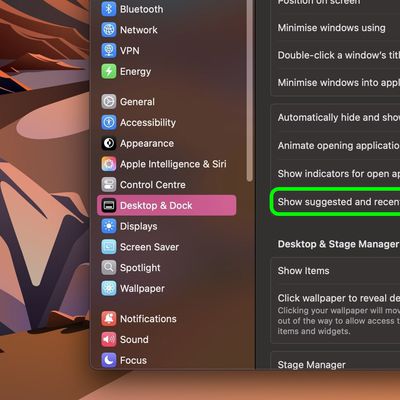

Show More (or Fewer) Recent Apps in Your Mac's Dock

Give Your iPhone Screen Recording a Voiceover

How to Install the macOS Tahoe Developer Beta

How to Downgrade From the iOS 26 Beta to iOS 18

How to Get the iOS 26 Developer Beta on Your iPhone

How to Watch Apple's WWDC 2025 Keynote on June 9

Apple TV 4K: Play Game Console or Cable Box Audio on HomePod

Use Your iPhone as a Microphone for Your Mac

Take Control of Favicons in Safari's Favorites Bar

Make Live Photos Loop, Bounce, and More on iPhone

Use Apple Watch Backtrack to Retrace Your Steps

How to Split a Bill and Tip on Apple Watch

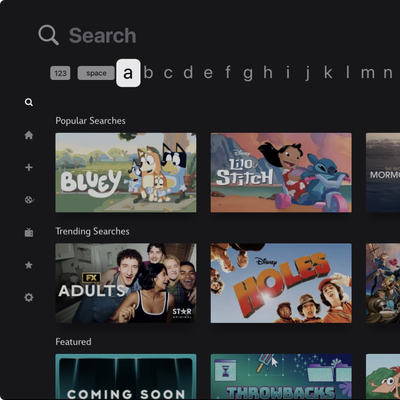

How to Fix Apple TV's Annoying Default Keyboard Layout

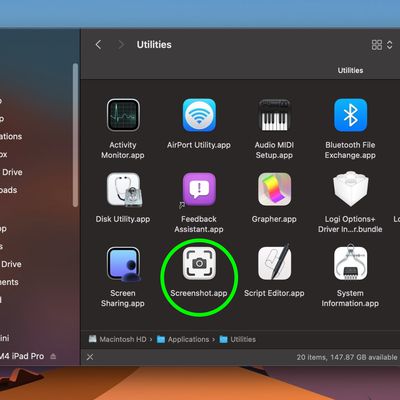

macOS Quick Tip: Screenshot Straight to the Clipboard