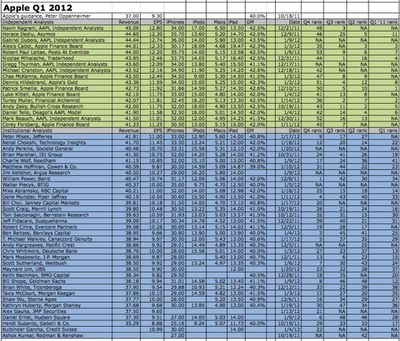

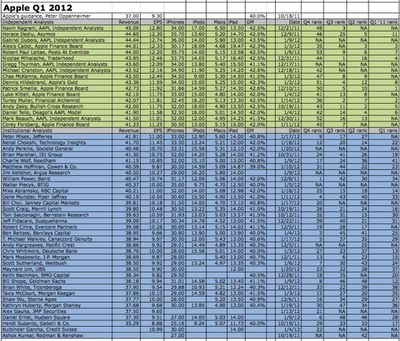

Roundup of Analyst Expectations Ahead of Apple's Q1 2012 Earnings Call

Philip Elmer-Dewitt has assembled his list of analyst expectations ahead of Apple's quarterly earnings report Tuesday afternoon. The list includes estimates from 17 "independent" analysts and 34 "affiliated" analysts who work for large investment houses or research organizations.

As usual, the independent analysts are much more bullish than the affiliated analysts. The independent consensus expects earnings per share (EPS) of $12.01 on revenue of $43.14 billion. The institutional consensus is EPS of $10.19 on $39.23 billion in revenue.

Click through to Elmer-DeWitt's post at Fortune to see the full-size chart.

Last quarter Apple announced it had broken $100 billion in sales for fiscal 2011, the first time it had breached that figure, and posted $6.62 billion in profit on revenue of $28.27 billion. For the first fiscal quarter of 2012, Apple has issued guidance of $37 billion in revenue with profits of $9.30 per diluted share.

Apple's best quarter ever was fiscal Q311 when it posted $7.31 billion in profit on sales of $28.57 billion. It appears Apple will solidly beat those numbers this quarter, posting its best results ever.

Apple will announce its earnings for the first fiscal quarter of 2012 (fourth calendar quarter of 2011) and host a conference call regarding the release on Tuesday January 24th at 5:00 PM Eastern / 2:00 PM Pacific. The earnings release itself typically comes in around 4:30 PM Eastern.

Popular Stories

Apple is set to unveil iOS 18 during its WWDC keynote on June 10, so the software update is a little over six weeks away from being announced. Below, we recap rumored features and changes planned for the iPhone with iOS 18. iOS 18 will reportedly be the "biggest" update in the iPhone's history, with new ChatGPT-inspired generative AI features, a more customizable Home Screen, and much more....

There are widespread reports of Apple users being locked out of their Apple ID overnight for no apparent reason, requiring a password reset before they can log in again. Users say the sudden inexplicable Apple ID sign-out is occurring across multiple devices. When they attempt to sign in again they are locked out of their account and asked to reset their password in order to regain access. ...

Apple used to regularly increase the base memory of its Macs up until 2011, the same year Tim Cook was appointed CEO, charts posted on Mastodon by David Schaub show. Earlier this year, Schaub generated two charts: One showing the base memory capacities of Apple's all-in-one Macs from 1984 onwards, and a second depicting Apple's consumer laptop base RAM from 1999 onwards. Both charts were...

On this week's episode of The MacRumors Show, we discuss the announcement of Apple's upcoming "Let loose" event, where the company is widely expected to announce new iPad models and accessories. Subscribe to The MacRumors Show YouTube channel for more videos Apple's event invite shows an artistic render of an Apple Pencil, suggesting that iPads will be a focus of the event. Apple CEO Tim...

In his Power On newsletter today, Bloomberg's Mark Gurman outlined some of the new products he expects Apple to announce at its "Let Loose" event on May 7. First, Gurman now believes there is a "strong possibility" that the upcoming iPad Pro models will be equipped with Apple's next-generation M4 chip, rather than the M3 chip that debuted in the MacBook Pro and iMac six months ago. He said a ...

Apple has announced it will be holding a special event on Tuesday, May 7 at 7 a.m. Pacific Time (10 a.m. Eastern Time), with a live stream to be available on Apple.com and on YouTube as usual. The event invitation has a tagline of "Let Loose" and shows an artistic render of an Apple Pencil, suggesting that iPads will be a focus of the event. Subscribe to the MacRumors YouTube channel for more ...

Top Rated Comments

Simple math shows that Apple will crush estimates this quarter. Looks like the consensus for iPhone unit sales is about 30 million. My estimate is 35.5 million. This is based on simple math. Here are some notes I made a couple of days ago.

* In Q3 Verizon sold 2 million iphones while Apple sold a total of over 17 million. Therefore, Verizon's iPhone sales represented 12% of total iPhone sales. In Q4 Verizon sold 4.2 million. 4.2 million is 12% of 35 million--pointing to 35 million iPhone sales.

* Apple recorded 1.7 million iPhone sales when the iPhone 4 was launched. This represents about 12% of total sales for that quarter. This year Apple recorded over 4 million iPhone sales during the opening weekend of the iPhone 4S. 4 million is 12% of 34 million--pointing to 34 million iPhone sales.

* This quarter an additional carrier was added in the United States: Sprint.

* Sprint declared its sales record was broken by 1PM EST on iPhone 4S launch day.

* AT&T was on track to double record iPhone activations in a single day for iPhone 4S launch--meaning double the day they released the iPhone 4. So if Apple's iPhone sales doubled for the 4S quarter just as they did with the iPhone 4 quarter, this is pointing to 34 million iPhone sales this quarter.

* There is an extra week in Q4 compared with Q3.

* The iPhone 4S launch falls in a quarter that leads right up to Christmas, including all holiday sales. The iPhone 4 was released in the summer. It is very likely that iPhone 4S sales kept more momentum than the iPhone 4 due to the holidays.

* Tim Cook's (Apple CEO) words should not be taken lightly: this marks "our fastest iPhone rollout ever"; "Customer response to products in China has been off the charts"; "we--in our wildest dreams, we couldn't have gotten off to a start as great as we have on the 4S."

* Apple has lower priced and more competitive iPhones available for purchase than it did when the iPhone 4 launched.

* Apple's Asia-Pacific segment is exploding and difficult for analysts to keep up with.

Wasn't that long ago that 5 million iPhones per quarter was incredibly impressive.

I don't understand the point you are trying to make?

bad timing....where were you 5 years ago.. ;)