Roundup of Analyst Expectations Ahead of Q2 2013 Earnings Call

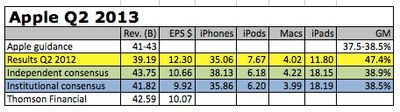

Philip Elmer-Dewitt has assembled his quarterly list of analyst predictions ahead of Apple's earnings report this afternoon. The list includes estimates from 67 analysts: 26 "independent" and 41 "institutional" who work for large investment houses or research organizations.

This is one of the most important earnings calls of Apple CEO Tim Cook's tenure as CEO. Apple's stock price is down significantly from its highs of last year, and investors are concerned about Apple's growth prospects across both existing and new product lines.

Typically, the amateur analysts expect significantly higher revenue and earnings than the professionals, but Elmer-Dewitt notes the gap is less than usual this time. The independent consensus has Apple just beating its guidance, while the pro's are expecting Apple to hit near the middle of its range.

The pros, as usual, are more cautious than the independents -- but not that much. The gap between the two group's average estimates (summarized above) as as close as I've ever seen them, with the amateurs calling for revenues only 1.3% higher than professionals.

In the first quarter, the company earned $13.1 billion in profit on revenue of $54.5 billion.

Last quarter Apple changed how it provides guidance, choosing to offer a range of guidance for what the company believes it can achieve, rather than a point prediction. Apple provided guidance for the second quarter for revenue of between $41 and $43 billion and gross margin between 37.5% and 38.5%.

Apple will announce its earnings for the second fiscal quarter of 2013 (first calendar quarter of 2012) and host a conference call regarding the release this afternoon at 5:00 PM Eastern / 2:00 PM Pacific. The earnings release itself typically comes in around 4:30 PM Eastern. MacRumors will have live coverage of the proceedings.

Popular Stories

Apple is set to unveil iOS 18 during its WWDC keynote on June 10, so the software update is a little over six weeks away from being announced. Below, we recap rumored features and changes planned for the iPhone with iOS 18. iOS 18 will reportedly be the "biggest" update in the iPhone's history, with new ChatGPT-inspired generative AI features, a more customizable Home Screen, and much more....

Apple today released several open source large language models (LLMs) that are designed to run on-device rather than through cloud servers. Called OpenELM (Open-source Efficient Language Models), the LLMs are available on the Hugging Face Hub, a community for sharing AI code. As outlined in a white paper [PDF], there are eight total OpenELM models, four of which were pre-trained using the...

Apple has announced it will be holding a special event on Tuesday, May 7 at 7 a.m. Pacific Time (10 a.m. Eastern Time), with a live stream to be available on Apple.com and on YouTube as usual. The event invitation has a tagline of "Let Loose" and shows an artistic render of an Apple Pencil, suggesting that iPads will be a focus of the event. Subscribe to the MacRumors YouTube channel for more ...

There are widespread reports of Apple users being locked out of their Apple ID overnight for no apparent reason, requiring a password reset before they can log in again. Users say the sudden inexplicable Apple ID sign-out is occurring across multiple devices. When they attempt to sign in again they are locked out of their account and asked to reset their password in order to regain access. ...

Best Buy is discounting a collection of M3 MacBook Pro computers today, this time focusing on the 14-inch version of the laptop. Every deal in this sale requires you to have a My Best Buy Plus or Total membership, although non-members can still get solid second-best prices on these MacBook Pro models. Note: MacRumors is an affiliate partner with Best Buy. When you click a link and make a...

Apple used to regularly increase the base memory of its Macs up until 2011, the same year Tim Cook was appointed CEO, charts posted on Mastodon by David Schaub show. Earlier this year, Schaub generated two charts: One showing the base memory capacities of Apple's all-in-one Macs from 1984 onwards, and a second depicting Apple's consumer laptop base RAM from 1999 onwards. Both charts were...

Top Rated Comments

Even if Apple has, by a large margin, the highest profit share in 3 of the most profitable industries on earth (computers, smartphones and tablets), they're expected to continue growing very fast by introducing new super-profitable categories and again, grabbing most of their profits while said categories grow exponentially. All that without losing profit share in past categories while they also continue to grow. Easy task eh?

Meanwhile, companies like Amazon see their stock going up while they report no profit at all.

You don't seem to understand investors. They are not fan boys. They invest their money in hopes it will grow, not stagnate. So just because Apple makes billions if it's not making billions more quarter over quarter, i.e., growing, that's NOT a good thing.

----------

Wrong. They want their money to double RIGHT NOW instead of exercising the patience that a sensible person would. That's why Warren Buffet plays the long game and reaps amazing success, and these other airchair experts are little more than get-rich-quick-demanding fools.