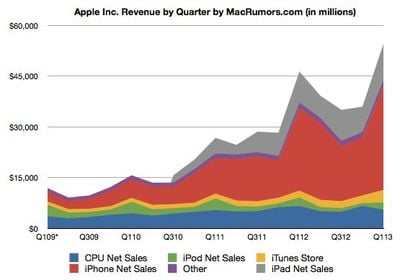

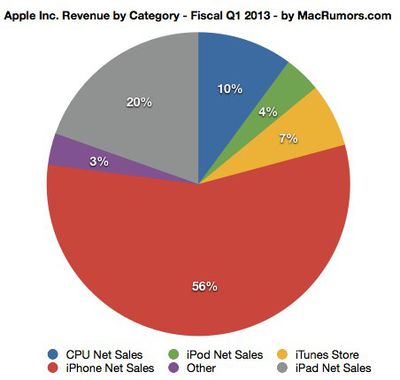

Apple today announced financial results for the fourth calendar quarter of 2012 and first fiscal quarter of 2013. For the quarter, Apple posted revenue of $54.5 billion and net quarterly profit of $13.1 billion, or $13.81 per diluted share, compared to revenue of $46.33 billion and net quarterly profit of $13.06 billion, or $13.87 per diluted share in the year-ago quarter. Apple's quarterly profit and revenue were both all-time company records, but Wall Street analysts had projected even slightly higher numbers.

Gross margin for the quarter was 38.6 percent, compared to 44.7 percent in the year-ago quarter, and international sales accounted for 61 percent of revenue. Apple also declared another dividend payment of $2.65 per share, payable on February 14 to shareholders as of the close of trading on February 11. The company currently holds $137.1 billion in cash and marketable securities.

Quarterly iPhone unit sales reached 47.8 million, compared to 37 million in the year-ago quarter and the company sold 22.9 million iPads, up from 15.4 million in the year-ago quarter. Apple sold 4.1 million Macintosh computers, compared to 5.2 million in the year-ago period, as well as 12.7 million iPods, down from 15.4 million a year ago. Apple set new sales records for both iPhone and iPad sales.

“We’re thrilled with record revenue of over $54 billion and sales of over 75 million iOS devices in a single quarter,” said Tim Cook, Apple’s CEO. “We’re very confident in our product pipeline as we continue to focus on innovation and making the best products in the world.”

Apple's guidance for the second quarter of fiscal 2013 includes expected revenue of $41-43 billion.

Apple will provide live streaming of its Q1 2013 financial results conference call at 2:00 PM Pacific, and MacRumors will update this story with coverage of the conference call highlights.

Despite the record revenue and earnings, Apple's stock is currently down nearly 5% in after-hours trading after falling short of analysts' expectations and issuing weaker guidance than many had expected.

Conference Call Highlights, Q&A Follows

Tim Cook:

- We are incredibly pleased to report an extraordinary quarter. New records for iPhone and iPad sales. No technology company has ever reported these kinds of results. Most prolific period of innovation and new products in Apple's history. New products in every category we make in the past few months.

- One team to surprise and delight our customers. Part of Cook's job is to preserve corporate culture. No greater reward than seeing how customers love our products. Our fundamentals: people, strategy and pipeline, ecosystem and retail stores will serve us well.

- Tomorrow is anniversary of Mac revolution. 1984, Jobs introduced Macintosh at shareholder's meeting in Cupertino. We've come a long way.

- We don't measure success just by the numbers. The most important thing to us is that our customers love our products, not just buy them. Laser focused on unprecedented customer experience.

- Sold more than 500 million iOS devices, more than 10 per second last quarter.

Peter Oppenheimer:

- New all-time quarterly records for iPhone and iPad sales, broadened ecosystem and generated highest quarterly revenue and net income ever. $4.2 billion per week this quarter vs. $3.3 billion per week in year ago quarter, thanks to 14-week quarter last year.

- Net income was record $13.1 billion, just ahead of amount generated in last year's 14-week quarter.

- Reorganizing the presentation of our results to provide greater transparency. Established new segment of "greater China". Mainland China, Hong Kong and Taiwan.

- Allocating certain manufacturing costs and variances to "operating segment" instead of including these expenses to corporate expenses.

- Retasked earnings for last two years on Apple.com/investor -- no affect to overall operating income.

- Realigned information related to product category. iPod, Mac, iPad and iPhone sales are now separate from related software and services. Third party accessory sales is a separate line item.

- 47 million iPhones versus 37 million in year ago quarter. 3.7 million per week, vs 2.6 million per week a year ago. Up 39% per week. Strong iPhone growth in greater China, up more than 100% year over year.

- iPhone market share up to 51% in the U.S. this year.

- iPhones in target for channel inventory.

- iPhone and iOS continue to deliver exceptional experience and secure ecosystem that IT departments require.

- Embraced by Gov. and Enterprise. Many agencies issuing iPhones by the thousands.

- NASA, NOAA, etc.

- Neiman Marcus, Volvo, etc.

- 22.9 million iPhones versus 15 million last quarter, 1.7 million per week versus 1.1 million, up 60% per week.

- Customers loving 4th generation iPad, iPad mini is tremendous hit.

- iPad is tablet of choice for biz and Gov.

- Barclays, Bank of Beijing, etc. Barclays rolling out 8,000 iPads, most successful IT deployment in Barclay history.

- State and local Gov are rolling iPad out too.

- State legislatures in VA, TX and WV rolling out iPads to legislators.

- 10,000 iPads being deployed to local Gov's in Sweden, more going to Netherlands for court system and tax authority.

- Below 4-6 range of channel inventory.

- Sold 312k Macs per week versus 371k per week last year, down 16%.

- Significantly constrained on new iMacs, only able to ship them for December. Mac sales would have been much higher without constraints.

- Between 3-4 weeks of inventory, below target of 4-5 weeks.

- 12.7m iPods versus 15.4m a year ago. iPod Touch was popular, accounts for more than 50% of all iPods sold.

- Share was over 70% in U.S. according to NPD. Continues to be best selling mp3 player in most countries.

- $2.1 billion for iTunes sales, new records for music, movies and apps.

- Expanded footprint, adding iTMS in 56 countries including Russia, Turkey, India and South Africa. 119 countries total.

- App Store had record breaking quarter with 2 billion downloads in December alone. 775,000 apps to 500 million account holders in 155 countries and 300,000 iPad apps. Cumulative app downloads have passed 40 billion, $7 billion total to app developers.

- 250 million iCloud accounts, 2 billion+ iMessages per day.

- $6.4 billion revenue through retail stores, fueled by iPhone and iPad sales. 11 new stores including 4 new stores in Greater China. 401 stores, 150 outside the U.S. Relocated or expanded 14 stores that had outgrown their space.

- 396 stores open with $16.3 million per store.

- 121 million visitors versus 110 million in year ago quarter. 23,000 visitors per store per week, up 17% year over year.

- Cash from short and long term investments was $137.1 billion, up $16 billion from last quarter. Net of 2 billion in stock repurchase and $2.5 billion in dividends.

- $94 billion in cash was offshore.

- $23.4 billion in cash from operations, up 33% from last year.

- Dividend of $2.65 payable in February.

- Changing our approach to guidance. Reflected conservative point estimate of results that we had reasonable confidence in achieving.

- Plan to offer range of guidance for what we believe we can achieve. We believe we are likely to report in the range of guidance we can provide. $41-43 billion in revenue for next quarter, gross margin between 37.5 and 38.5%.

Q&A

Q: iPhone 5 did incredibly well in the U.S., but internationally data has been more mixed. How would you characterize trends outside the U.S. for iPhone? Do you feel you have right screen sizes and price points to capture demand?

A: Sequentially we increased over 70% from September quarter, 3.5x market. We could not be happier with that. In terms of geographic distribution, we saw our highest growth in China. It was into the triple digits which was higher than the market there. I would characterize it as "we're extremely pleased."

Q: With such a large cash generation this quarter and stock price off its highs, why not step up and buy back even more stock than you had originally planned?

A: We continually assess this. We are pleased to have started our share repurchase program this quarter. Combined with the dividend, we returned $4.5b in cash this quarter. Expect to return $45 billion to our shareholders over the next 3 years.

Q: Many of your competitors are differentiating themselves with larger screen sizes. How do you feel about the market in that respect? Is there a long term case for larger screen sizes for smartphones?

A: iPhone 5 offers a new 4" retina display. The most advanced display in the industry. No one comes close to matching the level of quality as our retina display. It also provides a larger screen size without sacrificing one-handed ease of use. We believe we've picked the right screen size.

Q: Can you give us some color regarding iPhone demand trends coming out of the quarter?

A: If you look at iPhone sales across the quarter, we were constrained for much of the quarter on iPhone 5. As we begin to ship more, sales went up with production. iPhone 4 was in constraint for the whole quarter and sales remained strong.

Months of rumors about order cuts and so forth, so let me take a moment to comment on these. No comment on any particular rumor as I'd spend my life doing that. I suggest its good to question the accuracy of any kind of rumor about build plans. Even if a particular data point were factual, it would be impossible to interpret that data point as to what it meant to our business. The supply chain is very complex and we have multiple sources for things. Yields can vary, supplier performance can vary. There is an inordinate long list of things that can make any single data point not a great proxy for what is going on.

Q: When you provided guidance before, was it uniquely conservative? Is it no longer conservative? Are we getting a real planning range that's fundamentally different from before?

A: In the past we provided a single conservative point estimate that we were confident of achieving. Our new guidance provides a range that we believe we will report within. No guidance is guaranteed.

Q: You think you'll report in the range -- was the guidance before something you felt reasonably confident in achieving? Historically you eclipsed your estimates enormously. Now you say you'll land in the range.

A: In the past we gave a single point of conservative guidance. We were reasonably confident we would achieve it. We now provide a range of guidance that we expect to report within.

Q: Tim, you started the call talking about Apple's philosophy of ensuring that you satisfy your customers and make great products. Into that backdrop, how important is market share preservation? Is holding share in the smartphone market in 2013 a priority for Apple? Yes or no and why?

A: The most important thing to Apple is to make the best products in the world. We aren't interested in revenue for revenue's sake. We could put the Apple brand on a lot of things and sell a lot more stuff. We only want to make the best products. We've been able to build market share and have a great track record with iPod of doing different products at different price points. I wouldn't view those as mutually exclusive as some might. We're focused on making great products that enrich lives.

Q: Talk a little more about Macs? Shortfall there is $1 to $1.5 billion. How much of that is pushed into March quarter?

A: Thanks for asking the question. The best way to answer this is to look at the previous year. The difference is $1.1 billion from last year. iMacs were down by 700k units year over year. As you remember, we announced new iMacs late in October. Announced they would ship in November and December. Did ship by those dates. Limited weeks of ramping on those products during the quarter. Significant constraints on the iMac at the end of the quarter. Sales would have been materially higher without those constraints. Tried to share this on the conference call in October.

If you look at last year, we had 14 weeks in the quarter last year. 13 weeks this year. Channel inventory was down from the beginning of the quarter by more than 100k units. Didn't have the iMacs in channel. These factors bridge more than the difference between this year's sales and last year's.

These are lesser things: the market for PC's is weak. IDC estimate is -6%. We sold 23 million iPads, could have sold more than this because we were constrained on iPad mini. Some cannibalization there, sure there was some there. Mostly was iMacs, 13 versus 14 week, channel inventory more than explains difference from last year to this year.

Our portables alone were in line with IDC projections of market growth.

Q: Lot of publicity around Maps, can we have an update? How does year look in terms of innovation and iOS 7 and your online and web services? How will that drive Apple?

A: We're working on some incredible stuff. The pipeline is chock full. We feel great about what we've got in store.

In terms of Maps, we've made a number of improvements since the introduction of iOS 6. Roll out even more improvements throughout the rest of the year. Going to keep working on this until it lives up to our standards. Include improved satellite imagery, improved local information and so forth. Usage of Maps is significantly higher than prior to iOS 6.

Feel fantastic as to how we're doing. 4 trillion notifications through notification center. 450 billion iMessages, 2 billion per day. 200 million registered game center users. 40 billion App Store downloads. More stuff we can do and we're thinking about all of it.

Q: Gross margin in the quarter? Looking ahead, comment on a few areas on -- where on your product cost curve? What about iPhone mix? iPad of mini to regular?

A: iPad mini, it's hard to know. Couldn't make enough. Constrained every week. Customers love the mini and we wish we could have made more. Significant backlog at end of the quarter.

Gross margin, we were 260 basis pts ahead of our guidance. Half from lower product and transitory costs. Rest came from higher mix of iPhones, weaker dollar and leverage on higher revenue. Gross margin will be 10 to 110 basis points lower sequentially. Teams have made meaningful progress in product and transitory costs, and will benefit from that. Typical level of deferred revenue from device sales going forward. Will be offset by loss of leverage coming out of December quarter, and different mix of current products. Regarding mix, we'll have lower gross margin on iPad mini that is significantly lower than corporate average.

ASP on iPhones was essentially the same YoY. Underneath that, if you look at the mix of iPhone 5 versus total iPhone, versus iPhone 4S the prior year, those mixes were similar. For capacity, we saw similar results in Q1 as we saw in Q1 of the prior year.

Q: You spent almost as much as Intel did on CapEx. You said you weren't gonna become integrated, but you're presumably buying equipment for partners. What does this do for strategy? How deep will you go on semiconductor and componentry?

A: $10 billion in CapEx this fiscal year, up $2 billion year over year. A billion in retail stores, plus equipment we will own that we put in partner facilities. Our primary motivation there is for supply. Adding to data center capabilities, as well as infrastructure.

Q: What happened last year in terms of refresh cycle? You say you ship products when they're ready, but are you going to stagger them out this year or will it be a similar situation to 2012?

A: 80% was unusually high percentage for us last year. The number of ramps were unprecedented in that we had new products in every category which we haven't done before. We feel great to have delivered so many great products for the holidays and our customers have expressed joy over it.

Q: What are you hearing on China from customers and partners? What do you expect going forward?

A: If you include retail stores in China, our revenues were $7.3 billion on he quarter. Up over 60% year over year. Comparing 13 to 14 weeks, underlying growth is higher than that. Exceptional growth in iPhones into triple digits, iPad was shipped very late in the quarter and despite that saw very nice growth. Expanding in Apple Retail there. Year ago, we had 6 stores -- now have 11. Have many more to open. In our premium resellers, we went over 400 in the region, up from 200 in the previous year. 7k to 17k in iPhone point of sale. Not nearly what we need and not the final by any means. Making great progress.

It's clear that China is our second largest region and there is a lot of potential there.

Q: You've said the Apple TV experience was dated. Can you step outside the form factor and talk about how important this market is to Apple? Can you accomplish what you want to accomplish with the reality of where content is distributed today?

A: You're asking lots of questions I won't answer. In terms of products we sell today, we sold more last quarter than we've sold before. Eclipsed 2 million during the quarter. Up 60% year over year. Very good growth in that product. What was a small niche at one time is now a much larger number.

This is an area of intense interest for us and remains that. I tend to believe that there is a lot we can contribute in this space and we continue to pull the string and see where it leads us. Don't want to be more specific.

Q: Didn't give EPS guidance -- is there any parts to EPS and gross margin that you want to address?

A: Gave a line item on each estimate across the P&L -- for the future, we'll give a range for revenue, gross margin and OpEx. There are many possibilities for EPS across the range for you to figure out. We will report our actual results in April.

Q: How did iPhone 5 sales proceed in terms of new customers versus upgrades and how does that compare to the 4S last year?

A: Don't have specifics, but iPhone 5 volume shows that we're selling to a lot of new customers.

Q: We heard that it was a lot of upgrades to existing customers but it doesn't sound like you'd agree with that.

A: Don't use what you heard as a proxy for the world. Many carriers are created differently.

Q: Confused as how to think about iPads for March quarter. iPad mini was constrained, any comments on seasonality? How are you thinking about aggregate inventory in the channel? Will that be going up or down in March quarter?

A: iPad mini was very constrained -- ended underneath our target channel range. We believe we can achieve supply/demand balance later this quarter. That would likely mean that we would need more units in the channel than we have today. That's a fair conclusion to draw.

For total iPad sales, we don't provide a sub level forecast. We would expect a large year over year increase in holiday sales, but a drop sequentially. We expect to meet demand for the mini.

Worth pointing out that for last quarter, we had strong sales of iPad and iPad mini.

Q: Discuss the tablet market a little bit? And also constraints going forward? Where do you see challenges in meeting demand?

A: Overall, our team did a fantastic job ramping a record number of new products. Significant shortages due to robust demand on iPad mini and both iMacs that persisted across the quarter. Short on both products today. Supply of iPhone 5 was short to demand until late in the quarter. iPhone 4 was short for entire quarter. Can achieve supply demand balance of mini and iPhone 4 this quarter. Significantly increase supply on iMac this quarter, but not sure if we can achieve balance this quarter.

Cannibilization is a huge opportunity for us. We never fear it because if we do, someone else will do it. iPhone has cannibalized iPod, that doesn't worry us. iPad has on the Mac, and that doesn't concern us. For iPad, Windows market is much larger than Mac market. Tremendous amount of opportunity there for us. I believe the tablet market will be larger than the PC market at some point. You can see by the growth in tablets and pressure on PC's that those lines are beginning to converge.

The other thing for us, maybe not for others, if somebody buys an iPad mini and it's their first Apple product, we have great experience through the years — if someone buys their first Apple product, these people buy another Apple product.

It's the halo effect, as we termed it, that we saw with the iPod and the Mac — we've seen some of that with the iPad as well.

I see it as a huge opportunity.

Q: How should we think about the iPhone family year over year and quarter over quarter increases or decreases? Any dynamics related to slower pace of LTE rollouts having an impact?

A: For iPhone, in the year ago quarter, we built 2.6 million units of channel inventory. We did the China launch in the March quarter versus December. Underlying sell through was 32.5 while sell-in was 35. In thinking through the number of iPhones to predict, we look to the 35 number as a base line. We believe we'll grow year over year, but don't want to be more specific than that. We guide in the aggregate instead of the product level.

Q: Pace of LTE rollout around the world, has slower rollout had impact on iPhone sales philosophy? Could that change?

A: Today we have 24 carriers on LTE around the world for iPHone 5. Those are in countries like the US, Korea, UK, Germany, Canada, Japan, Australia and a few others. Next week, we're adding 36 more carriers for LTE support in countries we're not currently supporting LTE -- Italy, Denmark, Switzerland, Philippines and several Middle Eastern countries, covering 300 million customers. iPhone 5 supports other ultrafast networks like HSPA+. Feel very good about the situation, particularly with these adds next week.

Q: Guiding high single digits on iPhone sell through going forward. Why?

A: Not talking about guidance on a specific product level. Here are some things we talked about. 5 to 10% year over year increase on revenue. 2.6 million units of iPhone channel inventory built last year. Increased revenue by $1.6 billion. Hit distribution to 100 countries in December, versus March last year. Introduced iPad mini last quarter, kept price-reduced iPad 2 in the line. Saw reduction in iPad ASP of $101 year over year in December quarter. iPad units grew faster than iPad revenue. Expect iPad ASP to continue to drop on a year over year basis for same reasons.

PC market grew 4% last year, IDC is projecting it to decline this year by 3%. Underlying performance in business is stronger than 5-10% YoY growth implies. Feel strongly about pipeline.

Q: iPhone 4 is constrained during quarter, seems to be a lot of demand at lower price points. Why not get more aggressive and move downmarket in the iPhone business?

A: I'm not going to go into our pricing strategy. We feel great about the opportunity for getting products to customers and getting a percentage of those buying other Apple products. We see evidence of that through history and evidence of that through today.

Top Rated Comments

AAPL "missed" analysts expectations and is now doomed. :rolleyes:

Keep up the great work Apple!

Apple didn't miss anything..in fact they beat their guidance which should be what matters along with increased profits and revenues..which were both up.

Meanwhile Google missed on their guidance and the stock went up. Meanwhile Apple makes theirs and it's down...

Just proves the market is manipulated.

do you people really not get it?

let's see, AMD with deep losses BUT far smaller than expected: stock up

Google with negligible YOY profit increase BUT significant slowing of decline in ad sales: Stock up

Apple with best quarter ever BUT decline in EPS and significant increase in costs: Stock down.

If you want to actually try to understand the situation, it makes perfect sense

The simple fact is they are no longer creating the trend, but trying to keep up with it. It's simple, they need to step their game up. Samsung is killing them.

Apple USED to have the best Ads.

Apple USED to have the best OS, iOS.

Apple USED to have the best phone.

Apple USED to have the best innovation.

This is no longer the case. Straighten up fellas, begin acting like you're part of the company Steve Jobs resurrected.