Strategy Analytics

By MacRumors Staff

Strategy Analytics Articles

Apple Was the Only Top Smartphone Vendor to Increase Shipments Year-Over-Year Last Quarter

Apple was the only top smartphone maker that saw a year-over-year increase in shipments in the last quarter, while Samsung, Oppo, Xiaomi, and others saw steep declines in their respective mobile smartphones.

Apple yesterday announced record earnings for the March quarter, with more than $97 billion in revenue, beating expectations. Following the results, Strategy Analytics, Canalys, and IDC...

Read Full Article 41 comments

HomePod Mini Helps Apple Nearly Double Its Market Share of Smart Speakers and Screens

Amazon continues to lead the market for smart speakers and smart screens with devices like the Echo Dot and Echo Show, but Apple has nearly doubled its market share in this segment thanks to the HomePod mini, according to research firm Strategy Analytics.

Strategy Analytics estimates that Apple shipped 4 million smart speakers in the third quarter of 2021, taking a 10.2% share of the...

MacBook Air Drives 6.5 Million Apple Laptop Shipments in Q3 2021

Apple shipped 6.5 million laptops in the third quarter of this year, thanks in large part to high demand for the M1-powered MacBook Air.

That's according to research firm Strategy Analytics, whose data put Apple as the fourth largest seller of laptops between July and September, earning it 10% of the global market share and 10% growth year-on-year.

Lenovo took first place in the top five ...

Apple's Notebook Shipments Grew an Estimated 94% in Q1 2021

Apple shipped an estimated 5.7 million notebook computers in the first calendar quarter of 2021, according to new notebook PC shipping estimates shared today by Strategy Analytics.

Mac notebooks include the MacBook Pro models and the MacBook Air models, excluding the Mac mini, Mac Pro, and iMac.

Apple was the number four worldwide notebook vendor, trailing behind Dell, HP, and Lenovo,...

AirPods Overwhelmingly Dominate Global Wireless Headset Market

AirPods held a disproportionately large share of the global wireless headset market in 2020, according to a new report by Strategy Analytics.

With sales of over 300 million units, the True Wireless Stereo (TWS) Bluetooth headset sales market grew by almost 90 percent last year. Apple's AirPods own almost half of the entire market, with the rest being made up of a large number of companies...

Apple Retains Fourth Place for Q3 Notebook PC Shipments, Industry Growth Limited by Supply Constraints

Apple retained its position as the fourth-largest global notebook PC vendor in the third quarter of 2020, shipping six million units in total, according to a new report by Strategy Analytics.

Apple shipped 1.7 million more notebook PC units in the third quarter of this year compared to last year, achieving growth of 39 percent. This is in line with significant increases across the...

Apple Watch Continues to Dominate Global Smartwatch Market in Q1 2020

Strong online sales ensured a growth in worldwide smartwatch shipments in the first three months of this year, despite the impact of the global health crisis, according to a new report by Strategy Analytics.

Shipments grew 20 percent year on year in the first quarter, reaching 13.7 million units, up from 11.4 million units in the previous quarter. Apple Watch retained its dominant top spot...

Global Smartphone Shipments See Biggest Fall Ever in February 2020

Global smartphone shipments dropped an estimated 38 percent in February 2020, marking the biggest ever fall in the history of the worldwide smartphone market, according to new data shared today by Strategy Analytics.

Smartphone companies shipped an estimated 61.8 million units in February 2020, down from 99.2 million units in February 2019.

Smartphone demand in Asia dropped heavily in...

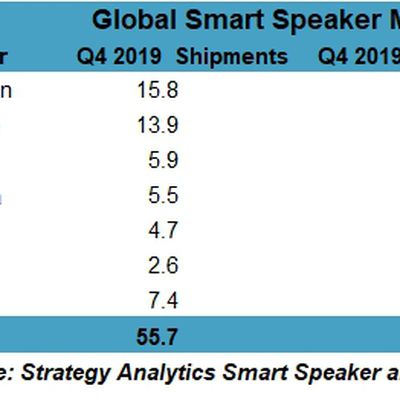

Apple’s HomePod Places Sixth in Global Smart Speaker Market in Q4 2019

Apple shipped an estimated 2.6 million HomePods during the fourth quarter of 2019, earning it 4.7 percent of the smart speaker market, according to new estimates shared today by Strategy Analytics.

Apple was the number six worldwide smart speaker market vendor, shipping fewer speakers than Amazon, Google, Baidu, Alibaba, and Xiaomi.

Amazon was the number one smart speaker vendor in the...

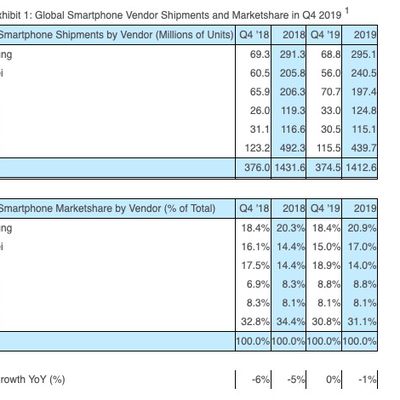

Apple Matched or Surpassed Samsung for Smartphone Shipments in Q4 2019

Apple matched or overtook Samsung to become the world's biggest smartphone maker in the fourth quarter of 2019, according to new data from market tracking firms.

A new report by Strategy Analytics put Apple's iPhone shipments for the fourth quarter of last year at 70.7 million units, slightly ahead of Samsung's estimated 68.8 million.

Apple grabbed first position with 19 percent global...

Apple Watch Sales Grew to 6.8 Million Units in Q3 2019, up 51% From Last Year

Apple shipped an estimated 6.8 million smartwatches in the third quarter of 2019, according to research firm Strategy Analytics.

Apple doesn't disclose Apple Watch sales in its earnings reports, grouping the wrist-worn device under its "Other Products" category, so we have do go from estimated figures, which can vary between research firms.

If Strategy Analytics' figures are accurate,...

Apple Watch Was Number One Smart Watch in Q2 2019 With an Estimated 5.7M Units Shipped

The Apple Watch accounted for close to half of all smart watches shipped in the second quarter of 2019, according to a new report shared this afternoon by Strategy Analytics.

Apple shipped an estimated 5.7 million smart watches worldwide during the quarter, earning it 46 percent marketshare and its continued position as the number one smart watch company.

Apple shipped 5.7 million...

Apple Watch Sales Comprised Half of Smartwatch Market in 2018

Apple Watch maintained pole position in the smartwatch market over last year's fourth quarter as global smartwatch shipments continued to grow, according to the latest research from Strategy Analytics.

Apple shipped 9.2 million Apple Watch units during Q4 2018, according to the report, rising 18 percent from 7.8 million units in Q4 2017. Global smartwatch shipments meanwhile grew 56 percent ...

HomePod Estimated to Have Just 4% Market Share Worldwide Despite 45% Sales Growth Last Quarter

HomePod shipments totaled 1.6 million units in the fourth quarter of 2018, a 45 percent increase on a year-over-year basis, according to Strategy Analytics. Despite the growth, the research firm estimates that Apple's share of the worldwide smart speaker market was just 4.1 percent during the quarter.

By comparison, Amazon and Google commanded the market with an estimated 13.7 million and...

Apple Shipped 14.5M iPads in Holiday Quarter According to Strategy Analytics

Apple shipped an estimated 14.5 million iPads in the fourth quarter of 2018, according to research firm Strategy Analytics.

Apple no longer discloses iPad, iPhone, or Mac unit sales in its earnings reports, leaving us with these estimated figures, which can vary quite significantly between research firms. With the iPhone, for example, estimated shipments have ranged from 65.9 million to 68.4 ...

Strategy Analytics: Apple Shipped an Estimated 65.9 Million iPhones in Holiday Quarter

Apple shipped an estimated 65.9 million iPhones during the first fiscal quarter of 2019 (aka the fourth calendar quarter of 2018) according to new data shared today by Strategy Analytics.

As of this quarter, Apple is no longer providing a breakdown of unit sales of the iPhone, iPad, and Mac, so we will not have concrete data on how well the iPhone is selling going forward.

Apple in Q1...

Strategy Analytics: Apple Shipped an Estimated 2.5 Million Fewer iPhones in China in 2018 Than in 2017

Apple shipped an estimated 34.2 million iPhones in China in 2018, down from 36.7 million in 2017, according to new data shared today by Strategy Analytics.

During the fourth calendar quarter of 2018 (Apple's first fiscal quarter), Apple shipped 10.9 million iPhones, down from 14 million in the fourth quarter of 2017.

Apple surpassed Xiaomi to become the number four smartphone vendor in...

HomePod is Ninth Most Popular Smart Speaker in United States According to Recent Survey

Apple's HomePod is the ninth most popular smart speaker model in the United States, according to an online survey of 1,011 smart speaker users conducted by research firm Strategy Analytics in July and August.

The top eight positions are held by various Amazon Echo and Google Home models in the Strategy Analytics rankings. The standard Amazon Echo tops the list with an estimated 23 percent...

HomePod Holds Estimated 70% Share of Growing $200+ Smart Speaker Market

While the HomePod did not rank among the top five smart speakers in worldwide shipments last quarter, it is dominating the premium end of the market, according to research firm Strategy Analytics.

Strategy Analytics claims the HomePod accounts for 70 percent of the small but growing $200-plus smart speaker market, topping competing products such as the Google Home Max and a variety of Sonos...

HomePod Sales May Be Closer to 1-1.5 Million Than 3 Million Since the Speaker Launched

HomePod shipments totaled an estimated 700,000 units in the second quarter of 2018, giving Apple a roughly six percent share of the worldwide smart speaker market, according to research firm Strategy Analytics.

Strategy Analytics previously estimated HomePod shipments totaled 600,000 units in the first quarter of 2018, suggesting that worldwide shipments have reached 1.3 million units since...