Morgan Stanley

By MacRumors Staff

Morgan Stanley Articles

1 in 2 Surveyed Willing to Pay at Least $10/Month for Apple Intelligence

A little more than half of respondents in a recent survey said they would be willing to pay at least $10 per month for unlimited access to Apple Intelligence.

In an online survey conducted in February and March, investment firm Morgan Stanley asked thousands of consumers in the U.S. to indicate the maximum amount of money per month that they would be willing to spend for unlimited access to...

Read Full Article 240 comments

New iPads or Not? iPad Revenue Predicted to Sharply Drop in Q4 2023

Apple's quarterly iPad revenue will significantly decline in the fourth quarter of 2023 on a year-over-year basis, according to estimated figures shared today by Erik Woodring, an analyst at investment firm Morgan Stanley.

Morgan Stanley estimates that Apple will report iPad revenue of $7.2 billion in the fourth quarter of 2023, which would be a decline of approximately 23% compared to the...

Apple's AR/VR Headset Expected to Enter Mass Production in October Ahead of Late 2023 Launch

Apple's long-rumored AR/VR headset will enter mass production in October and launch by December, according to investment firm Morgan Stanley. Apple is still expected to unveil the headset at WWDC next week, and provide developers with tools to create apps for the device, which is expected to have its own App Store.

Apple headset concept by designer Marcus Kane

"While we expect Apple's AR/VR...

Rival App Stores on iPhone Estimated to Have Limited Impact on Apple's Revenue

Bloomberg's Mark Gurman this week reported that Apple is preparing to allow alternative app stores on the iPhone and iPad in the European Union, as part of an effort to comply with the Digital Markets Act, which goes into full effect in 2024. The report said Apple is aiming for the changes to be introduced as part of iOS 17.

In a research note this week, a trio of analysts at investment bank ...

Apple AR Headset 'Approaching Liftoff' as Development Mirrors Period Before Apple Watch Launch

Apple's development of its rumored augmented reality (AR) headset is beginning to mirror the period before the launch of the Apple Watch, according to Morgan Stanley analysts.

In a note to investors, seen by Investor's Business Daily, Morgan Stanley analysts explained that after years of building expertise and a number of setbacks, Apple's long-awaited AR headset is "approaching liftoff."...

iPhone 13 Pro Pre-Orders Off to Promising Start With Strong Early Demand, Says Analyst

While it has been many years since Apple stopped providing first weekend sales numbers for new iPhones, Morgan Stanley analyst Katy Huberty today said that iPhone 13 Pro pre-orders are "off to a promising start" with "strong early demand."

Huberty based her opinion off of Apple's delivery estimates for iPhones, which she has been tracking for many years. Shortly after pre-orders began last...

Apple's Planned App Store Changes Will Barely Affect the Company's Bottom Line, Says Analyst

As a result of legal and regulatory pressures, Apple recently announced some upcoming changes to its App Store policies, such as letting developers email customers about payment options available outside of their iOS app and allowing "reader" apps like Spotify and Netflix to include an in-app link to their website for account signup.

Apple said the changes "will help make the App Store an...

Analyst Discusses Apple Car's Key to Success, Says Steve Jobs Would Be Proud of Tim Cook's Legacy

In the latest episode of the Apollo Effect podcast series, Morgan Stanley analyst Katy Huberty discussed the potential for a so-called "Apple Car" to disrupt the auto industry through vertical integration of hardware, software, and services. Huberty also praised Apple CEO Tim Cook, noting that the late Steve Jobs would have been proud.

A fan-made image of Tim Cook announcing an Apple Car via ...

At Least One New MacBook With Apple Silicon 'Likely' at WWDC, Says Morgan Stanley Analyst

We're just three days away from Apple's annual developers conference, WWDC, but rumors are still divided as to whether new MacBook Pro models with Apple silicon will be announced at Apple's opening keynote on Monday.

Morgan Stanley analyst Katy Huberty weighed in on the matter in a research note shared with MacRumors today, claiming it's "likely" that Apple will announce at least one new...

Apple Shifting Some Production From iPhone 12 mini to iPhone 12 Pro to Meet Demand

Apple has reportedly cut production of the iPhone 12 mini by two million units to create more manufacturing capacity for the iPhone 12 Pro, according to a new Morgan Stanley investment note seen by PED30.

Apple is believed to have made the switch for the first quarter of 2021 in an effort to combat continuing lead times for the more popular iPhone 12 Pro.

iPhone 12 Pro lead times...

iPhone 12 Demand Linked to Increased Air Pollution in China

Analysts for Morgan Stanley have said that air quality reports in some Chinese cities suggest an increase in industrial activity linked to iPhone 12 demand (via CNBC).

Morgan Stanley analysts led by Katy Huberty used tracked air quality data from cities such as Zhengzhou, which is a major production location for Apple, to aid iPhone 12 sales projections.

Using air quality data from a...

Morgan Stanley Predicts Apple TV+ Could Be a $9 Billion Business by 2025

Apple's services business is set to grow by 20 percent next year, boosted by its forthcoming Apple TV+ streaming service, according to the latest predictions by Morgan Stanley analyst Katy Huberty (via CNBC).

In a new investor note, Huberty predicts that Apple TV+ will grow into a $9 billion business by 2025, despite increasing competition in the streaming market and even if only 1 in...

Apple's Services Category Set to Be the Company's Main Revenue Driver Over the Next Five Years

Apple's services revenue is growing at a rapid pace and is on track to be the company's primary revenue driver in the future, according to a note Morgan Stanley analyst Katy Huberty shared with investors this morning (via Business Insider).

Huberty believes that over the course of the next five years, services revenue growth will contribute more than 50 percent of Apple's total revenue growth. ...

iPhone Scores 92% Loyalty Rate in Recent Survey Ahead of iPhone 8

92 percent of iPhone owners that are "somewhat likely" or "extremely likely" to upgrade their smartphone in the next 12 months plan to purchase another iPhone, according to investment banking firm Morgan Stanley.

Apple's loyalty rate, up from 86 percent a year ago, is based on an April 2017 survey of 1,000 smartphone owners aged 18 and above in the United States. It's the highest iPhone...

iPhone 8 With Longer Battery Life Said to Entice Those With Older iPhones to Upgrade

Apple's rumored iPhone with an edge-to-edge OLED display will have longer battery life, which will drive customers with older iPhone models to upgrade at an accelerated rate, according to Morgan Stanley analyst Katy Huberty.

Huberty also expects the high-end iPhone to have a significant form factor change with wireless charging, 3D sensors, and more advanced AI software capabilities, which are ...

Analysts See Record-Breaking Sales for iPhone and Mac in Holiday Quarter

Apple's iPhone 6 and 6 Plus may boost the company's iPhone sales to a new record in the year-ending Q1 2015, says Morgan Stanley analyst Katy Huberty in a recent investor note. In line with other analyst predictions, Huberty and her team expect iPhone sales in the December holiday quarter to reach as high as 69 million units, eclipsing last year's quarterly record of 51 million units sold in Q1...

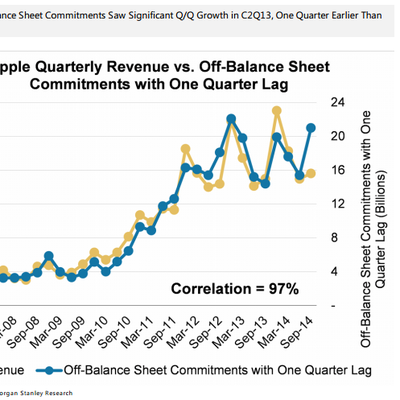

Apple's Quarterly Spending Points to Major Product Launches, Significant Revenue Growth

Looking at Apple's quarterly SEC quarterly filing, Katy Huberty of Morgan Stanley believes Apple's revenue is poised to explode in the coming quarters. Huberty based her prediction on increases in Apple's off-balance sheet commitments, which have a historical correlation with revenue growth.

Off-balance sheet commitments are those investments in components and services that are involved in...

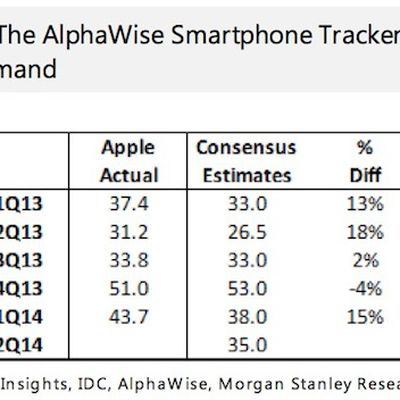

Apple Projected to Beat Wall Street Estimates with 39 Million Quarterly iPhones Shipped

Apple's quarterly iPhone sales may beat Wall Street estimates, based on new data from Morgan Stanley analyst Katy Huberty. According to the firm's AlphaWise Smartphone Tracker, Apple could sell as many as 39 million iPhones in the second calendar quarter of the year, beating Wall Street's predicted 35 million and topping the 31.2 million sold in the same quarter last year.

Huberty believes...

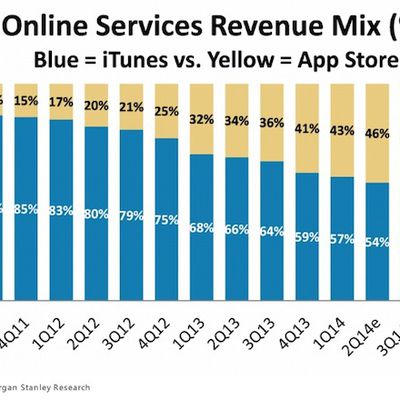

Apple's Beats Music Deal Seen as Key to Bolstering Declining iTunes Revenue Momentum

Apple reportedly is close to inking a deal with Beats Electronics for $3 billion, an acquisition that Morgan Stanley analyst Katy Huberty believes is important if Apple wants to further monetize its 800 million iTunes user base and boost revenue in its increasingly important online services division.

Apple's online services segment, which includes iTunes, is often overlooked because it...

Apple Predicted to Adopt NFC in iPhone 6 as Core Technology for Mobile Payments System

Rumors of Apple incorporating near field communication (NFC) technology into the iPhone have become a yearly ritual, but Morgan Stanley analysts believe that Apple may finally be poised to adopt the technology as part of a push to break open the mobile payments industry. In a recent note to investors, analyst Craig Hettenbach points to possible licensing deals, company financial disclosures and...