Apple today announced financial results for its second fiscal quarter of 2021, which corresponds to the first calendar quarter of the year.

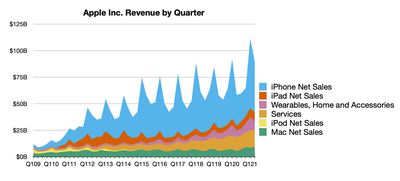

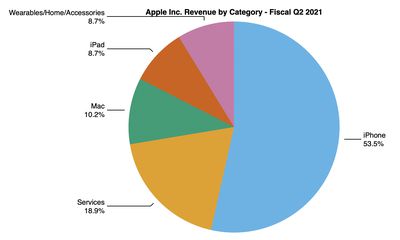

For the quarter, Apple posted revenue of $89.6 billion and net quarterly profit of $23.6 billion, or $1.40 per diluted share, compared to revenue of $58.3 billion and net quarterly profit of $11.2 billion, or $0.64 per diluted share, in the year-ago quarter.

Apple set new all-time records for Mac and Services revenue for the quarter, while overall revenue set a March quarter record.

Gross margin for the quarter was 42.5 percent, compared to 38.4 percent in the year-ago quarter, with international sales accounting for 67 percent of revenue. Apple also declared an increased dividend payment of $0.22 per share, up from $0.205 per share. The dividend is payable May 13 to shareholders of record as of May 10.

"This quarter reflects both the enduring ways our products have helped our users meet this moment in their own lives, as well as the optimism consumers seem to feel about better days ahead for all of us," said Tim Cook, Apple's CEO. "Apple is in a period of sweeping innovation across our product lineup, and we're keeping focus on how we can help our teams and the communities where we work emerge from this pandemic into a better world. That certainly begins with products like the all-new iMac and iPad Pro, but it extends to efforts like the 8 gigawatts of new clean energy we'll help bring onto the grid and our $430 billion investment in the United States over the next 5 years."

As has been the case for over a year now, Apple is once again not issuing guidance for the current quarter ending in June, as considerable uncertainty surrounding the global health situation's impact remains.

Apple will provide live streaming of its fiscal Q2 2021 financial results conference call at 2:00 p.m. Pacific, and MacRumors will update this story with coverage of the conference call highlights.

Apple earnings call recap ahead...

1:39 pm: Apple's stock price is currently up nearly 4% in after-hours trading.

1:41 pm: Apple's revenue was up 54% year-over-year, and net income more than doubled. Mac revenue was up 70% to a new all-time record, while iPhone revenue was up 65%, likely thanks partly to a later launch for the iPhone 12 that pushed some purchases into the March quarter.

1:45 pm: Services revenue was up nearly 27% year-over-year to set a new all-time record, while iPad revenue was up almost 79%. Wearables, Home and Accessories revenue was up almost 25%.

1:47 pm: Apple's gross margin of 42.5% was the company's highest since the third fiscal quarter of 2012. Apple's gross margin has typically hovered in the 38% range in recent years.

1:54 pm: Apple increased its quarterly dividend by 7% to 22 cents per share, and the board of directors authorized an additional $90 billion for the company's share repurchase program. Apple CFO Luca Maestri says Apple generated $24 billion in operating cash flow for the quarter and the company returned nearly $23 billion to shareholders in the form of dividends and share buybacks.

2:00 pm: Apple's earnings call with analysts should begin momentarily. Expected on the call are Apple CEO Tim Cook and CFO Luca Maestri.

2:01 pm: The call is beginning.

2:03 pm: They are beginning with routine risk warnings about forward-looking statements.

2:03 pm: Tim Cook: Good afternoon everyone — Apple is proud to report another strong quarter. We set new March quarter records for revenue and earnings.

2:03 pm: There is optimism consumers seem to have about good days ahead. Mac and Services delivered all-time record results, and March-quarter records for iPhone and Wearables/Home/Accessories.

2:04 pm: We saw very strong performance for iPhone, up 66% year over year.

2:04 pm: Over the past year, 10's of millions of iPads and Macs have been deployed to help students and workers be productive from home.

2:05 pm: Mac revenue record. Last three quarters have been the best for Mac ever.

2:05 pm: Touting Apple Silicon and the release of the new iMac and M1 iPad Pro.

2:06 pm: Apple Watch Series 6 and SE led Wearable/Home/Accessories, and new AirTag and Apple TV devices should help drive growth.

2:06 pm: 27% year over year growth in Services, with new records for services across all geos.

2:06 pm: Mentioning Apple Podcasts Subscriptions and Apple Card Family as new initiatives.

2:07 pm: We continued to deploy industry-leading tools to protect users' fundamental right to privacy. Privacy nutrition labels and app-tracking transparency.

2:07 pm: Give users a choice over how data is used and shared across apps.

2:08 pm: Apple TV+ got the first Oscar nomination, and Ted Lasso has won a number of awards.

2:09 pm: Cook is discussing Apple's renewable energy commitments and investments in green energy efforts.

2:10 pm: Solar, wind, and more. Mentioning $200 million Restore Fund to help communities build sustainable industry and remove carbon from the atmosphere.

2:11 pm: Working to support minority app developers and to help build and scale those businesses.

2:11 pm: Apple will invest $430 billion in the US economy in the next five years.

2:12 pm: Now talking about challenges of COVID-19 and new lockdowns worldwide. "Instead of simply assuming the end is in sight, we at Apple are doing what we can to make it a reality."

2:13 pm: Thinking about what we felt at this time last year... thanks to researchers and scientists, we have reached new years of hopeful resolve.

2:14 pm: Luca is on now to reiterate the numbers from this quarter.

2:15 pm: Products gross margin was 36.1 percent. Services gross margin was 70.1 percent.

2:16 pm: iPhone revenue set a March quarter record, growing 66% year over year. Performance was consistently strong across the world. Set quarter records in most markets tracked.

2:16 pm: Active install base was a new all-time high. In the US, the latest survey from 451 research indicated customer satisfaction of more than 99% for the iPhone 12 family.

2:17 pm: $16.9 billion in Services, with all-time records for App Store, cloud services, music, video, advertising and payment services.

2:17 pm: Key drivers for services all continue to move in a positive direction.

2:17 pm: Installed base, transacting and paid accounts reached new all-tiem high, with paid accounts increasing double-digits in each geo.

2:18 pm: Up 40 million paid subs, 660-million paid subscriptions across all services. Up 145 million from a year ago, and 2x what they had 2.5 years ago.

2:18 pm: Apple Arcade expansion. Arcade originals and two entirely new categories, App Store Greats and Timeless Classics.

2:19 pm: Wearables/Home set new March-quarter record in every geographic segment. 75% of Apple Watch buyers were new to the product.

2:19 pm: All-time revenue record for Mac. Up 70% year over year. Grew strongly in each geographic segment.

2:19 pm: Enthusiastic customer response to M1 Macs.

2:20 pm: iPad performance was outstanding, with revenue up 79%. Grew in every geographic segment, with all-time records in Japan and March record for the rest of Asia-Pacific.

2:20 pm: Surveys of US consumers from 451 Research measured satisfaction of 91% for Mac and 94% for iPad.

2:20 pm: More than half of iPad and Mac buyers were new to the products.

2:21 pm: Delta Air Lines is putting iPhone 12 into the hands of all its flight attendants.

2:21 pm: Touting corporate adoption of Apple products.

2:22 pm: Total debt is $122 billion. Net cash of $83 billion.

2:23 pm: Return nearly $23 billion to shareholders during the quarter, including $3.4 billion in dividends and $19 billion to repurchase Apple shares.

2:23 pm: New allocation of $90 billion to share repurchases, plus increase in dividends and annual increases going forward.

2:25 pm: Given continued uncertainty around the world in the near term, we are sharing insights but not specific forecasts. June quarter revenues to grow strong double digits year over year, but we believe sequential revenue decline from March to June will be greater than prior years. First, due to later launch timing and strong demand, iPhone only achieved supply/demand balance during the March quarter. Steeper sequential decline than usual. Supply constraints will have revenue impact of $3-4 billion. GM between 41.5 and 42.5%. OpEx of $11.1-$11.3 billion. Tax rate around 14.5%.

2:25 pm: Q&A session starting.

2:27 pm: Shannon Cross: Big picture question on iPhone. So many different things happening this cycle, 5G, pandemic, how are you thinking about the opportunity for refreshing the install base and attracting new customers, and are you seeing product lives shorten because of programs from carriers and Apple?

Cook: We saw double-digit increases on a year-over-year basis on both new-to-iPhone and upgraders. In March quarter, there was a record number of upgraders for a March quarter. We like what we see, it's early days of 5G. Different countries are in different points, but global penetration is still low. A lot of 5G upgrades will be in front of us, not behind us.

In China, things have moved quickly to 5G. They're moving quickly in the United States, but a lot of the other regions are slower to adopt and gain 5G coverage.

2:29 pm: Cross: Can you talk gross margin? That's higher than it's been in my memory at this point. Were there any offsets from higher components costs or logistics costs that were overshadowed by currency?

Luca: We guided to slightly lower levels than this quarter in June. We were up 270 basis points sequentially driven by cost savings, a strong mix on iPhone and in general across all product categories, and foreign exchange sequentially from December to March was favorable by 90 basis points. Those are the three major factors there.

Going into June, we will expect some level of deleverage, but offset by cost-savings. FX doesn't have much of an impact from March to June.

2:31 pm: Amit Daryanani: On services, I'd love to understand if mid-20% is the growth norm for services?

Luca: Services did better than we expected. It was stronger across the board. One of the things we noticed throughout COVID was that digital services have done very well and a couple of categories like AppleCare and Advertising were negatively affected. During March quarter we saw return to growth of AppleCare and we've reopened a lot of our stores during the quarter, and Advertising as consumer sentiment has improved and advertising is coming back. The combination of these factors has delivered strong performance during the March quarter. We don't provide specific guidance for product categories but in general, there are things we always look at through the services business, new paid accounts, new subscriptions, and is our install base continued to grow. When we look at these fundamental factors, we feel very good about it.

2:33 pm: Amit: Engagement with iPhones and Apple devices have gone up, but we don't see replacement cycles shrink or change. Does increased usage and replacement cycle not changing, if I'm using something more do I have to replace it more often?

Cook: We're clearly seeing strong performance in both new to iPhone/switcher component and upgraders. Upgrader was the best March quarter that we've had. That speaks to what you're seeing a lot. It's difficult with just this far into the cycle to make a statement about the cycle in general, we just launched mid-way through the Q1 period. We've only been operating for 4.5 months or so, but clearly we like what we see right now. If you look at how the iPhone did around the world, we had top 5 models of smartphone in the US. Top 2 in Urban China. 4/5 in Japan. Top 4 in UK. Top 6 in Australia. It was an across the board, in key countries, we did really well. 5G cycle is important and we're in the early days of it, frankly.

2:36 pm: Katy Huberty: Pretty unbelievable quarter and investors are going to ask about the sustainability of current demand trends as you lapse some of the benefits from COVID in Services and Macs. Don't guide or provide outlook beyond the next quarter, but can you talk about a high level, which segments do you see an opportunity or maintain strong revenue growth, vs where is it reasonable to see digestion as consumers shift spending priorities?

Cook: Look at different products, the compare that we're running to would be the Q2 of last year as the quarter that China would have entered a shutdown first and then the rest of the world entered a shutdown in the middle part of March. Part of the growth is comparison point there. That said, the results were fabulous across the board. Shortages that Luca spoke about in the color he provided on the future affect the iPad and Mac. Challenges in there. Challenges meeting demand that we have. Demand feels very strong right now, both on Mac side (M1 and work from home and remote learning) and on iPad you have (WFH and remote learning), and the product that we just announced is really killer. There's a lot of great things going. The strength of product cycle and trends in the marketplace. Where the pandemic will end, it seems like many companies will be operating in a hybrid mode, so it would seem that work from home and productivity from work from home will remain very critical. In wearables, the Watch had a fabulous quarter. We're still in early innings on the Watch. New to the Watch buyers are 3/4. This is a long way from being a mature market. Services by itself has really accelerated so all-in-all we feel very good.

2:39 pm: Katy: How should we think about revenue growth deceleration or are there supply disruptions during the quarter that might have drained component inventory?

Luca: In prepared remarks, we mentioned iPhone launching later than usual and supply/demand balance only in the March quarter so we'll have a sequential decline there. And then $3-4 billion in supply constraints on Mac and iPad. For channel inventory, we did what we normally do. Reduce inventory on iPhone, we exited within our target range, so I would say that on the inventory side we're pretty straightforward given the supply constraints on iPad and Mac we wish we had more inventory there but this is a function of high demand for all our products.

2:41 pm: Wamsi Mohan: Content offerings are at compelling price points, other providers are making price increases. How does pricing affect your offerings and updates on Apple TV+ paid subs?

Tim: TV+ is going very well. As you know the objective and philosophy on TV+ is to create high-quality original content and to be one of the most desired platforms for storytellers. I see that happening day by day as we sign more shows and storytellers. To date, we've received the Apple Originals, 352 award nominations and 98 wins. This is from Oscar nominations to Emmy awards, Critics Choice Awards and all the rest. Some of our shows have gotten significant buzz like Ted Lasso and The Morning Show. We feel really good about where we are. We're not releasing subscriber numbers but we feel good about where we are. In terms of other services and pricing, I don't have anything to announce today. We try to give the customer a great value and we feel that we're doing that with the prices that we have and we'll see where we go from here.

2:43 pm: Wamsi: Sequential decline to June, are the supply constraints of the 3-4 billion impact included in that or is that in addition to the more than average sequential decline? What's driving supply constraints at subcomponent level?

Luca: Normal seasonality, what we're saying is that we believe the sequential decline this year is higher than normal. Timing of iPhone launch and high demand for iPhone, plus $3-4 billion for supply constraints that we mentioned. The constraints come from semiconductor shortages that are affecting many industries and it's a combination of the shortages and the very high level of demand that we're seeing for both iPad and Mac. For Mac, the last three quarters of Mac have been the best ever in the history of the product. WFH and learning from home is great but it's also the innovation and creativity that we put in the products over the last couple quarters.

2:45 pm: Aaron Rakers: Congratulations on the quarter. As I think about iPhone 12 cycle, it would appear that the mix has been quite healthy. Can you give context to the mix this cycle vs prior cycles, is that mix sustainable? What's the mix within the iPhones and how that's driving gross margin?

Tim: iPhone 12, of the family, it's the most popular. We saw very strong sales of the Pro and Pro Max, and the revenue that you're seeing is a function of unit growth and revenue per unit growth.

Aaron: Can you give context on how that might have changed this cycle versus prior cycles? Is there a structural change that can be sustained?

Cook: We don't predict beyond internal use, but we're really happy with the results.

2:46 pm: Aaron: To supply constraints, it's hard to look beyond this quarter, but when might supply constraints ease? For industry in general overcoming some of the supply dynamics?

Cook: Most of the issue is legacy nodes, not just in our industry but other industries. In order to answer that question accurately, we would need to know the true demand from each player and how that changes over the next few months so it's difficult to give a good answer. We have a good handle on our demand but what everybody else is doing, I don't know. We will do our best, that's what I can tell you.

2:47 pm: Harsh Kumar: Question on semiconductor supplies, you beat by a substantial margin on top line. What went in your favor to secure that kind of supply that you can beat by that amount?

Tim: We did not have a material supply shortage in Q2. How did we do that? You collapse all your buffers and offsets. That happens all the way through the supply chain and that enables you to go a bit higher than what we were expecting to sell.

2:48 pm: Harsh: With economy reopening here in the US, can we get thoughts on what you would expect for Macs and iPads in the second half of this year?

Tim: We don't guide to product level detail, and we're not guiding to the top level because of COVID. To Luca's point about shortages, those shortages primarily affect iPad and Mac. We expect to be supply gated, not demand gated.

2:50 pm: Krish Sankar: The greater China sales were very strong in March quarter. What drove the trend and what enabled that performance?

Tim: We were very pleased with our performance in China. Set March quarter revenue record. Revenue growth was broad across categories. Pleased by iPhone 12 response, and you have to remember that China entered the shutdown phase earlier in Q2 than other countries, so they were more affected in that quarter last year.

We had the top two selling smartphones and we're very proud of that, iPad and Mac both had enormously positive quarters with great strength across the board. Seeing strong reception to the new iPad Pro that we just announced. A lot of great comments. About two-thirds of people buying Mac and iPad were buying them for the first time, so attracting new customers in China.

2:52 pm: Krish: One of the concerns many investors have is because of overhang of regulatory risks. Do you think giving more public disclosure on services like App Store would help alleviate or do you think giving details... what do you think on services disclosure?

Tim: With regulatory and scrutiny, we have to tell our story and why we do what we do. We're focused on doing that. If we feel that more disclosure would help, we'd move in that direction. The App Store and other parts of Apple are not cast in concrete so we can move and are flexible with the times. Just a couple of quarters ago, we lowered the commission rate for small developers to 15%. That's an example of moving with the times and we've gotten a great reception for that. We continue to learn. Curating the App Store to get privacy and security that our customers want is very important and we have to convey that in a straightforward manner.

2:54 pm: Kyle McNealy: Growing iPhone sales can pull along Watch and AirPod sales, but through COVID that accessories do better in a physical store environment. Have you seen improvement in attach rate for Watch and AirPods in iPhone and can it get better from here?

Tim: We get a lot of benefit from our stores, when they're open and fully operational, we were in better shape for parts of Q2 than previously but we're still operating with limited operational model in many stores and some stores are still closed. Michigan and France, for example. It will take some amount of time but my view would be that as the stores get back up to speed, we should be able to increase some of the accessory sales. But I think we're doing fairly well at the moment so it's not something that we're not doing well. Online has been much more beneficial and productive than we would have guessed going into this.

2:55 pm: David Vogt: Early days, but any commentary or color from developers on App Tracking and what does initial feedback and data?

Tim: The focus is really on the user and giving the user the ability to make a decision about whether they want to be tracked or not. Putting the user in control, not Apple or another company. Feedback from users, both before it went live and after has been tremendous. We're really standing up on behalf of the consumer here.

2:56 pm: David: Can you discuss downloads and acceptance by the consumer? Opt-in or opt-out from consumer perspective?

Tim: It's not something that we would have predicted beforehand and even if it's very low for people who don't want to be tracked, it's worth doing because those people should make their own mind up whether they want to be tracked or not.

2:58 pm: Samik Chatterjee: Some of 5G iPhone upgrades are still in front of you and I assume Europe is in that category. What's driving exceptional growth here in Europe?

Luca: You're right, we had great performance in Europe, up 56%, and one of the geos where we saw results than even our own expectations. Strong double digits across every product category. iPad and Mac, they really were very strong. Again, Europe has been affected by lockdowns more than most parts of the world. The lockdowns have lasted longer than here in the US, Tim was mentioning there are places still where our stores are closed. Strong online business that has helped us, but working from home, learning from home, limited entertainment options, that has all played in our favor. Europe segment is very broad version of Europe because it includes Western Europe, doing very well, and then Eastern Europe and Middle East and even India is part of Europe. Those emerging markets have done incredibly well and significantly better than company average. In India, Russia, Middle East in general, it's very broad across product categories and across countries in Europe.

3:01 pm: Samik: What's the implication of the investment plans that you announced for the US for that $430 billion investment

Luca: We announced in 2018 that we were making a sizable commitment to the US, $315 billion in vestment over 5 years. During the last three years since then, we've overachieved on those commitments and felt it was the right time to update these types of investments. They span from investments directly at Apple for creation of new jobs at Apple over next five years in the US, and of course as our business has grown. Commitment to US suppliers grows over time and shows in higher numbers, but we've gotten into new businesses too. A lot of Apple TV+ content is produced in the US. From OpEx standpoint, we're getting a lot of leverage. Sometimes our OpEx grows faster than revenue, and some cycles where the opposite happens. We want to continue to make the necessary investments in the business, and you will continue to see that we will continue to grow operating expenses on R&D side. That continues to be the core of the company.

3:01 pm: The call is complete. Thanks for joining us.