ComScore

By MacRumors Staff

ComScore Articles

iPhone Ownership Reaches All-Time High in United States

Apple currently has more iPhone users in the United States than at any point in history, according to market research firm comScore. There are now over an estimated 85.8 million iPhone owners aged 13 and older in the United States, based on a three-month average ending December 2016, according to comScore MobiLens Plus. Apple's latest iPhone 7 and iPhone 7 Plus models accounted for...

Read Full Article 101 comments

iPhone Continues to Increase Lead in U.S. Smartphone Market Share Ahead of 'iPhone 6s' Debut

The latest data from digital media analytics firm comScore shows that Apple continues to increase its lead over Samsung, LG, Motorola, HTC and other handset makers in U.S. smartphone market share, less than one week before the launch of the iPhone 6s and iPhone 6s Plus. iPhones captured 44.2% market share among U.S. smartphone subscribers aged 13 and older based on a three-month average...

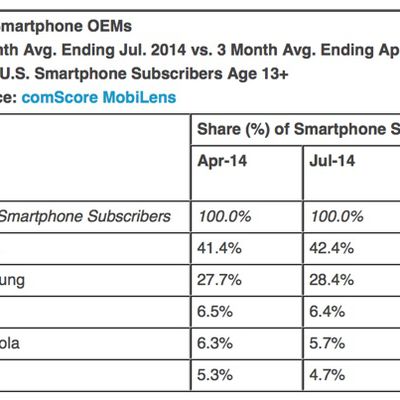

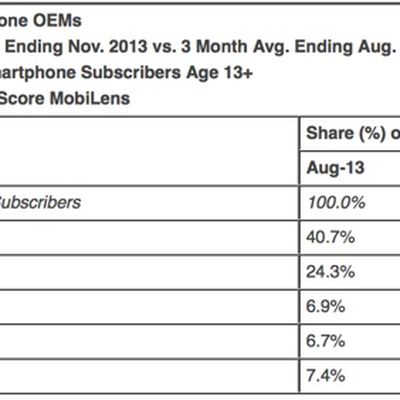

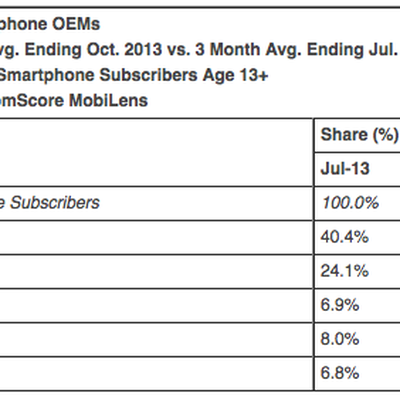

Apple Makes Gains in U.S. Smartphone Market Share as Launch of iPhone 6 Approaches

As the launch of the iPhone 6 approaches, Apple continues to hold its title as the number one handset manufacturer among consumers in the United States, making significant gains in share during the three month period ending in July. According to ComScore's latest numbers, the iPhone had a 42.4 percent share of the market, up from 41.4 percent in April. Samsung also saw small gains, jumping to...

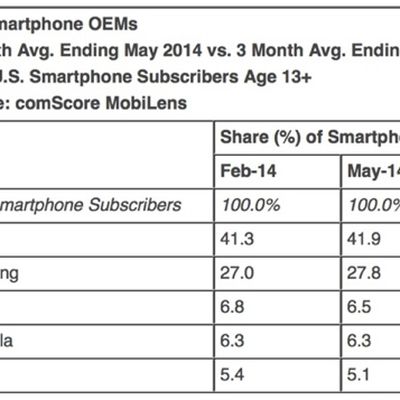

Apple Makes Gains in U.S. Smartphone Market Share

Apple continues to be the number one handset manufacturer among consumers in the United States and has also made small gains in operating system share, according to ComScore's newest monthly survey of U.S. mobile phone users covering the February-May 2014 period. Apple's smartphone market share increased from 41.3 percent in February to 41.9 percent in May, allowing Apple to retain its...

Apple Narrows Gap in U.S. Advertising Spending With Rival Samsung

Samsung is the leader in mobile advertising, significantly outspending all its rivals on commercials that target the U.S. market. Though still number one, the Korean company's advertising dollar lead is shrinking, reports the Wall Street Journal, with Samsung's rivals increasing their advertising spending by 33 percent year over year in 2013. According to ad research company Kantar Media,...

Apple and iOS Continue to Make Small Gains in U.S. Smartphone Market Share

Apple retained its crown as the number one handset manufacturer among consumers in the U.S., while Google's Android operating system remained the number one platform, according to comScore's latest MobiLens and Mobile Metrix reports. These figures measure smartphone ownership and cover the three months ending January 2014. Apple beat out rival Samsung with 41.6 percent market share as...

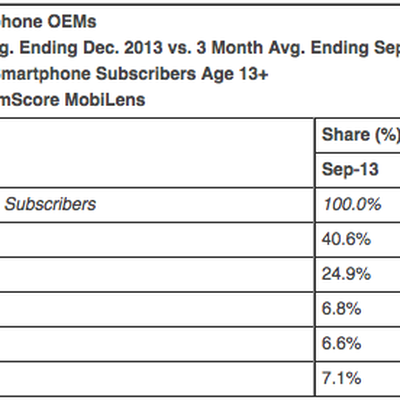

Apple and Samsung Continue to Dominate U.S. Smartphone Usage Share

ComScore today released the results of its monthly rolling survey of U.S. mobile phone users for the October-December 2013 period, showing that Apple's U.S. smartphone market share has increased 1.2 percentage points since September, for a total share of 41.8 percent. Though Apple's share continues to grow, it still lags behind Android's total share of 51.5 percent, down 0.3 percent since...

Apple Widens Lead Over Samsung in U.S. Smartphone Race in 2013

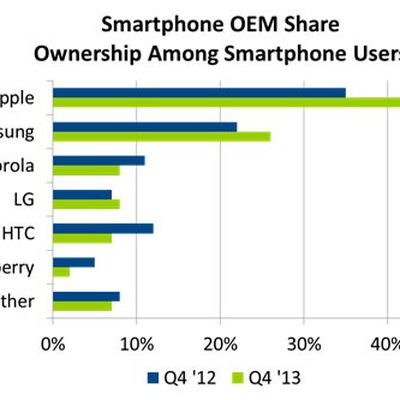

Research firm NPD today announced the results of its latest Connected Home Report, showing that Apple increased its share of the U.S. smartphone installed user base by seven percentage points, from 35 percent in the fourth quarter of 2012 to 42 percent in the same quarter of 2013. Second-place Samsung increased its share of the market by a smaller margin from 22 percent to 26 percent, while other ...

Apple's U.S. Smartphone Usage Share Continues to Climb

ComScore today released the results of its monthly rolling survey of U.S. mobile phone users for the September-November 2013 period, showing that Apple's U.S. smartphone market share has increased 0.5 percentage points for a total share of 41.2 percent. Though Apple's share continues to grow, it still lags behind Android's total share of 51.9 percent. When measuring usage by handset...

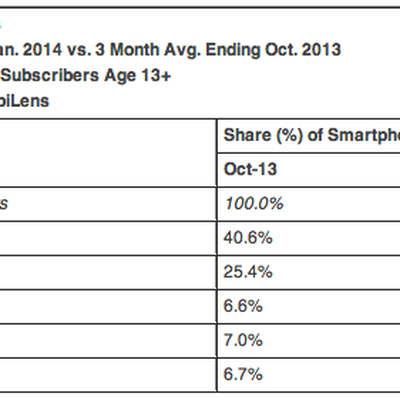

Apple's U.S. Smartphone Usage Share Remains Above 40%

comScore today released the results of its monthly rolling survey of U.S. mobile phone users for the August-September 2013 period, showing that Apple's smartphone market share rose to 40.6 percent, compared to Android's 51.8 percent over the same period.For handset manufacturers, Apple was in first place by a wide margin, with second place Samsung holding 25.4 percent of the market.149.2...

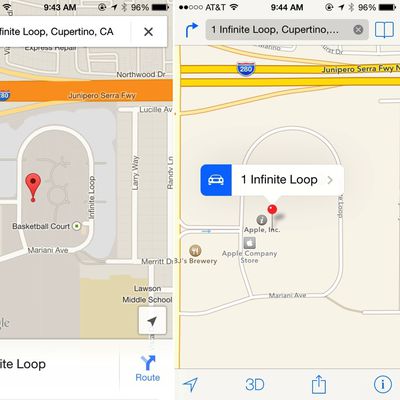

Apple Maps Significantly More Popular Than All Other iOS Mapping Apps, Including Google

After a rough launch last year, Apple Maps appears to be doing very well for itself, with 35 million U.S. iPhone owners using the app in September 2013, versus 6 million iOS users of the downloadable Google Maps according to data from comScore and The Guardian.The data remains a little fuzzy as neither Google nor Apple publicly release their usage figures, but if they are even close to correct, ...

Apple's U.S. Smartphone Usage Share Approaches 40%

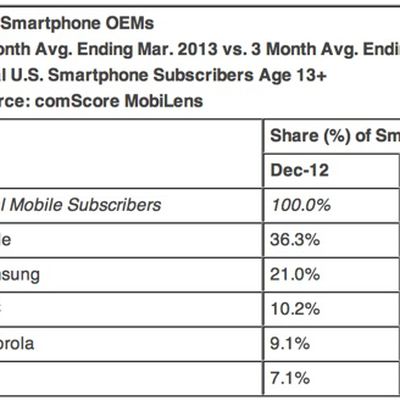

comScore today released the results of its monthly rolling survey of U.S. mobile phone users for the January-March period, showing that Apple's smartphone market share rose 2.7 points from December to March, from 36.3% of total U.S. smartphone platform and hardware sales to 39%, marking a record high share for the company. Samsung was the hardware manufacturer with the second largest share...

Apple Continues to Gain Smartphone Market Share in U.S.

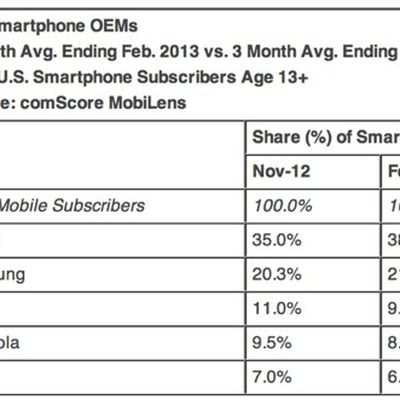

comScore today released the results of its monthly rolling survey of U.S. mobile phone users for the December-February period, revealing that Apple's smartphone market share rose 3.9 points from November to February going from 35% of total U.S. smartphone platform and hardware sales to 38.9%. Last month's report demonstrated similar growth for Apple. Samsung was the hardware manufacturer...

Apple Makes Gains in U.S. Smartphone Market Share

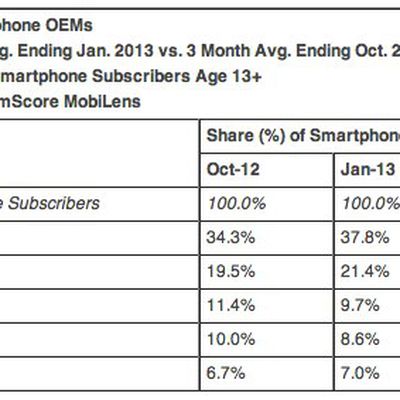

comScore today released the results of its monthly rolling survey of U.S. mobile phone users for the November-January period, finding that Apple's smartphone marketshare rose 3.5 percentage points between October and January, up to 37.8% of both U.S. smartphone platform and hardware sales.Samsung was second in hardware makers with 21.4%, up from 19.5% three months earlier. HTC and Motorola both ...

18.5% of U.S. Mobile Phone Subscribers Now Using iPhones

comScore today released the results of its monthly rolling survey of U.S. mobile phone users for the September-November period, finding that 18.5% of U.S. mobile phone subscribers are now using an iPhone, up 1.4 percentage points from the June-August period. Samsung continues to lead the market at 26.9% on 1.2 percentage point growth, while the remainder of the top five vendors all lost share. ...

Apple Overtakes LG to Become No. 2 Mobile Phone Maker in U.S.

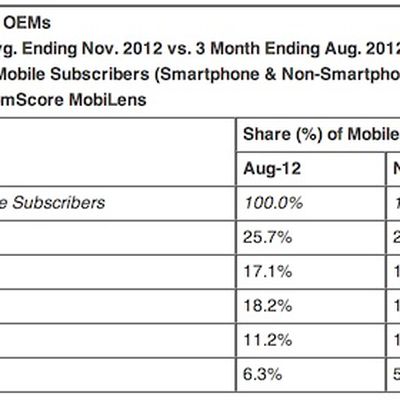

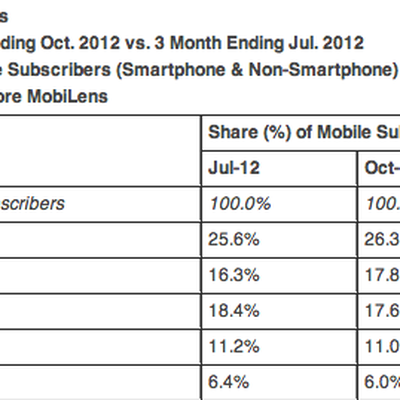

Apple captured the number two slot in all U.S. mobile phone makers, both smartphone and non-smartphone, for the first time, according to a new report by research firm comScore. Samsung maintained their lead with 26.3% in overall mobile phone userbase, with Apple coming in second at 17.8% and LG .2 points behind in the number three slot with 17.6%. Apple gained 1.5% in the three month period...

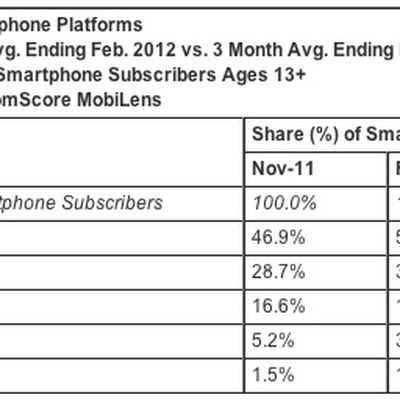

Android Tops 50%, iOS Hits 30% in U.S. Smartphone Installed User Base

Research firm comScore today released the results of its latest survey of mobile phone users in the United States, finding that Google's Android and Apple's iOS continue to dominate the smartphone landscape. The highlight of comScore's report is Android passing 50% of installed smartphone user base for the first time, grabbing 50.1% of the market during the three-month period of December...

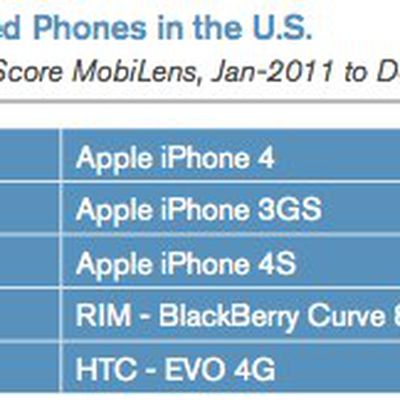

Apple Sells Top 3 U.S. Smartphone Models for All of 2011

Apple's iPhones were the top three most popular smartphones in the United States for all of 2011, according to comScore's 2012 Mobile Future in Focus whitepaper. NPD reported similar results for the months of October and November, when the iPhone 4S was the most popular smartphone in the country after it was released. For the full year, the iPhone 4S was the country's third most popular...

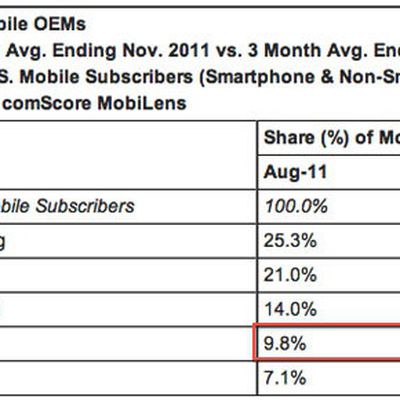

Apple and Android Gain Smartphone Marketshare at Expense of RIM and Microsoft

comScore released their latest numbers for the relative market shares of the mobile market. Apple continues to inch upward with 11.2% of total U.S. Mobile Subscribers. This percent share is up from 9.8% in August and 10.2% in September. Apple's growth was greater than its competitors during this time which covers the introduction of the iPhone 4S. Apple has historically trended well...

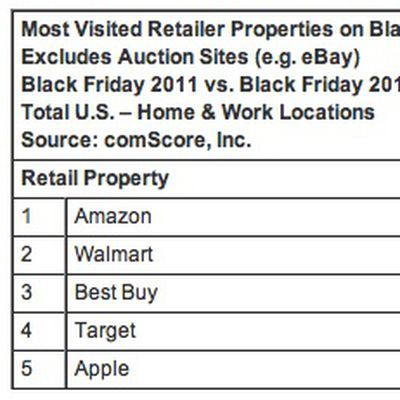

Apple Ranks as Fifth Most-Visited U.S. Online Retail Site on Black Friday

Market research firm comScore today released data on U.S. online shopping for Black Friday, showing strong sales of $816 million, up 26% over last year's numbers. According to the data, Apple ranked as the fifth most-visited online retailer in the country on Black Friday, trailing Amazon, Walmart, Best Buy, and Target. comScore noted in a statement to AllThingsD that Apple was "nipping at...