European Union

By MacRumors Staff

European Union How Tos

How to Get Apple Intelligence in the EU

With the release of iOS 18.1 beta 2, Apple has apparently opened up access to Apple Intelligence for English speakers located in the European Union, something that was not possible in previous versions.

One of the reasons Apple limited region access to Apple Intelligence was that it only supports US English. Another reason Apple Intelligence was previously not available in the EU was because ...

Read Full Article (88 comments)

European Union Guides

The EU Wants All Phones to Work With Interoperable Chargers, Here’s What That Means for Apple's Lightning Port

Despite pushback from Apple, the European Parliament in January voted overwhelmingly for new rules to establish a common charging standard for mobile device makers across the European Union. This article explores what form the EU laws might ultimately take and how they could affect Apple device users in Europe and elsewhere.

What Exactly is the EU Calling For?

To reduce cost, electronic...

European Union Articles

Apple Will Delay Bringing New Features to Users in the EU

Apple will delay bringing some features to users in the European Union because regulations are making it increasingly difficult for it to do so, the Wall Street Journal reports.

Speaking at a workshop with EU officials and developers in Brussels earlier today, Apple's vice president of legal, Kyle Andeer, said, "We've already had to make the decision to delay the release of products and...

Apple Again Changes EU App Store Rules and Fees to Comply With DMA

Apple is updating its App Store linking rules and fees in the European Union to comply with the requirements of the Digital Markets Act, Apple said today.

Apps distributed through EU storefronts can now communicate information about non-App Store purchase options and deals for digital goods available through websites, alternative app marketplaces, or other apps. Developers can let customers...

Report: Apple to Announce More App Store Concessions for the EU

Apple is engaged in eleventh-hour negotiations with European Union regulators in an effort to delay or avoid a new wave of financial penalties stemming from noncompliance with the bloc's Digital Markets Act (DMA), the Financial Times reports.

The company is under pressure to make significant changes to its App Store policies in the European Union after being fined €500 million earlier this ...

Apple Adds Energy and Battery Labels to iPhone and iPad Pages in EU

To comply with a new regulation that takes effect today, Apple has added an energy efficiency label to its iPhone and iPad pages in EU countries. Apple is also required to start including a printed version of the label with the devices sold there.

The label grades a given iPhone or iPad model's energy efficiency from a high of A to a low of G, based on the EU's testing parameters. However,...

Apple Escapes Immediate EU Fines, But Penalties Still Likely

Apple will not face immediate financial penalties from the European Commission if it fails to meet its Digital Markets Act (DMA) compliance deadline on June 26, despite previously receiving a €500 million fine for violations related to the App Store.

The European Commission confirmed to Euronews that financial sanctions against Apple will not be automatically imposed once the company's...

Apple Explains Why iPhone Mirroring Remains Unavailable in the EU on macOS Tahoe

Apple's year-old iPhone Mirroring feature is still unavailable in the European Union, and it appears that will remain the case on macOS Tahoe.

During its WWDC 2025 developer conference last week, Apple told French tech website Numerama that iPhone Mirroring will remain unavailable in the European Union for now due to continued regulatory uncertainty there.

Apple did not elaborate, but it...

Apple Appeals EU Digital Markets Act Interoperability Rules

Apple has filed an appeal against the European Union's Digital Markets Act interoperability requirements, calling the rules "deeply flawed" and a threat to user security (via The Wall Street Journal).

Apple submitted its challenge to the EU's General Court in Luxembourg on May 30, targeting the Commission's March decision that requires Apple to make iOS more compatible with rival products...

Apple Ordered to Change App Store in Europe Again

Apple has been given until June 22 to bring the App Store into full compliance with the European Union's Digital Markets Act (DMA) or face recurring financial penalties following a €500 million fine imposed in April.

The European Commission yesterday published its complete 67-page ruling outlining Apple's violations of the DMA's anti-steering provisions. The Commission concluded that Apple's ...

Apple Will Reportedly Let iPhone Users in the EU Switch Away From Siri

Apple is planning to give users in the EU the ability to set a default voice assistant other than Siri, according to Bloomberg's Mark Gurman and Drake Bennett.

In a lengthy report about Apple's artificial intelligence shortcomings today, Gurman and Bennett said Apple plans to introduce this change across multiple software platforms, which likely means the iPhone, iPad, and Mac at a minimum.

...

Apple Says Fortnite for iOS Isn't Blocked Worldwide, Just the U.S.

Apple today clarified that it has not blocked Epic Games from updating the iOS Fortnite app in the European Union, but it is not planning to allow Epic Games to offer Fortnite in the United States App Store at the current time.

In a statement to Bloomberg, Apple said that Epic Games tied its U.S. App Store submission to the update that was also being submitted to the Epic Games Store ...

Apple Slaps Warnings on Apps Using External Purchases in the EU [Updated]

Update: According to Apple, the user-disclosure screens have been live on the EU App Store since the beginning of Apple’s DMA Compliance Plan back in March 2024. The screen is not new. Original story follows.

Apple has begun placing prominent warning labels on EU App Store listings that use alternative payment methods. The warning symbols appear as a red exclamation mark in a triangle,...

White House Hits Back at Apple's Massive EU Fine

Apple's $570 million fine from the EU has triggered a sharp rebuke from the White House, which called the fine a form of economic extortion, Reuters reports.

The fine was announced on Wednesday by the European Commission, following a formal investigation into Apple's compliance with the bloc's Digital Markets Act (DMA), a landmark piece of legislation aimed at curbing the market dominance of ...

Apple Hit With €500M Fine as EU Enforces Digital Markets Act

The European Commission has fined Apple 500 million euros ($570 million) and Meta 200 million euros ($230 million) for violating the Digital Markets Act (DMA), in the first penalties ever issued under the new EU tech regulation.

Apple was penalized for restricting app developers from informing users about alternative payment options outside the App Store. The Commission said it had...

iOS 18.4: iPhone Mirroring, SharePlay Screen Sharing Still Missing in EU

Apple is on the cusp of releasing iOS 18.4, which brings Apple Intelligence to the European Union for the first time. However, iPhone Mirroring and SharePlay Screen Sharing is still missing from Apple's RC build of the operating system in the EU because of regulatory concerns.

Apple this week seeded to developers and beta testers its RC (Release Candidate) build of iOS 18.4, which is meant...

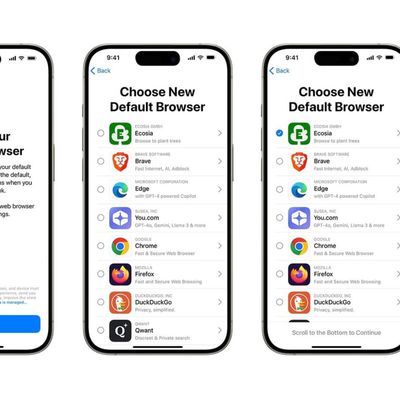

EU to Close Antitrust Investigation into Apple's Browser Choice Screen

The European Commission is set to close its year-long investigation into Apple's default browser choice screen on iPhones in the EU after the company made changes to comply with the requirements in the Digital Markets Act (via Reuters).

The Commission launched a non-compliance investigation in March last year under the DMA, concerned that Apple's design of the web browser choice screen could ...

Apple Says New EU Interoperability Rules 'Bad for Our Products and Our Users'

The European Commission today announced the decisions of its interoperability proceedings to assist Apple in complying with its obligations under the EU's Digital Markets Act (DMA), but Apple has come out swinging, calling them "bad for our products and bad for our European users."

The DMA, which came into force last year, requires major platform holders or "gatekeepers" like Apple to...

Apple Facing 'Modest' Fine for Violating EU's Digital Markets Act

The European Union plans to levy a "modest" fine against Apple for violating the Digital Markets Act (DMA), reports Reuters.

Last year, the European Commission decided that Apple has not complied with the anti-steering rules outlined in the DMA, and that it has not done enough to allow developers to inform customers about lower prices available outside of the App Store.

Back in June, then ...

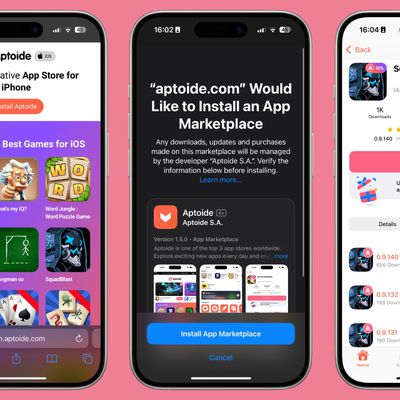

Aptoide Alternative App Store Launches in the EU With Access to Older Versions of Games

iPhone and iPad users in the European Union now have access to another alternative app store with the official launch of Aptoide, a gaming marketplace.

Aptoide has been around for quite some time as an app marketplace on Android devices, but the company began working on an iOS marketplace when Apple added support for sideloading apps last year. The marketplace has been in testing in a beta...

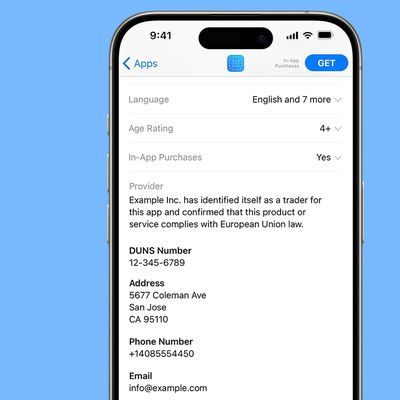

Apps That Didn't Add 'Trader' Contact Info in the EU Removed From App Store

Apps that have not complied with the trader requirement in the European Union have been removed from the App Store, Apple informed developers today. The apps that have been removed will not be allowed back in the App Store until trader status is provided and verified by Apple.

Disclosing trader status is a requirement of the Digital Services Act (DSA) in the EU. Developers who distribute...

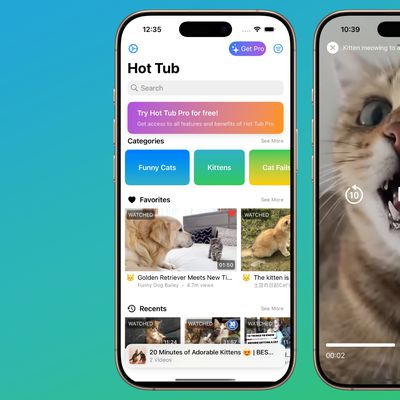

EU's AltStore Gets First Native iOS Pornography App

In the European Union, the Digital Markets Act allows developers to distribute iOS apps through alternate app stores. While Apple checks those apps for malware and other malicious content, there are few restrictions on subject matter, unlike Apple's own App Store. As a result, EU users can now download the first dedicated native pornography app created for the iPhone.

Called Hot Tub, the app ...