Disney

By MacRumors Staff

Disney Articles

Disney+ Loses 700,000 Subscribers Following Price Increase

Disney+ lost 700,000 subscribers worldwide in recent months, according to Disney's earnings results for the first quarter of 2025.

Disney said it now has 124.6 million Disney+ subscribers, a decrease of 0.7 million compared to its subscriber numbers in the fourth quarter of 2024. The drop in subscribers comes after Disney+ prices increased in the fall. Disney+ with Ads went from $7.99 to...

Read Full Article 189 comments

Disney World and Disneyland Rolling Out Food Order Tracking on iPhone's Lock Screen

Disney today announced that it is rolling out support for the Live Activities feature on iPhones for mobile food and beverage orders at its two big U.S. parks.

The feature started rolling out today at select mobile order locations across Walt Disney World and Disneyland Resort, the company said. Where available, the feature allows you to track the status of your mobile order on the iPhone's...

Hulu and Disney+ No Longer Support Signups and Payment Using App Store

Disney is no longer allowing its customers to sign up for and purchase subscriptions to Hulu or Disney+ through Apple's App Store, cutting out any subscription fees that Disney would have needed to pay to Apple for using in-app purchase.

The change was noted on Reddit over the weekend, and there are details on the Disney+ and Hulu websites. Both the Disney+ and Hulu websites say that new and ...

Disney+ Account Sharing Crackdown Goes Global With Paid Sharing Plan

Disney+ has announced a new "Paid Sharing" program across multiple countries, including the United States, Canada, and parts of Europe, as its global account sharing crackdown kicks up a gear. The move, which was announced earlier this year by Disney CEO Bob Iger, aims to boost revenue and subscriber growth for the streaming service.

Similar to Netflix's approach, the new system restricts...

Disney Raising Prices for Hulu, ESPN+, and Disney+ This Fall

Disney will soon increase the cost of its suite of streaming services, including Hulu, ESPN+, and Disney+. Prices will go up for both ad-supported and ad-free plans, and some of Disney's bundles will also be more expensive. Most plans are increasing by $1 to $2.

Disney+ With Ads - $9.99, up from $7.99

Disney+ Ad-Free - $15.99, up from $13.99

Hulu With Ads - $9.99, up from $7.99

H...

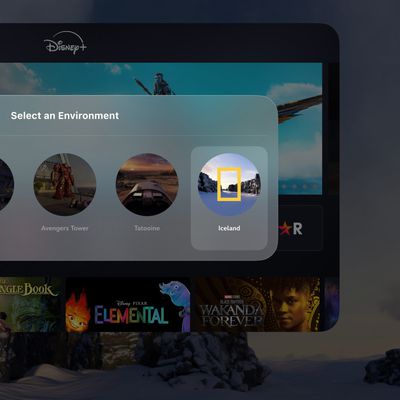

Disney+ Gains New National Geographic Apple Vision Pro Immersive Environment, New 3D Movies

When watching content through the Disney+ streaming service, Vision Pro users can now opt into a new Immersive Environment that launched today.

Available from National Geographic, the Immersive Environment features views of the Thingvellir National Park in Iceland. The new environment will allow Disney+ subscribers on Vision Pro to experience the rocky terrain of Thingvellir National Park on ...

Disney Shares Trailer for Immersive Vision Pro Marvel Story

Disney today shared a trailer for the hour-long interactive and immersive Disney+ Marvel story that is set to come to the Vision Pro on Thursday, May 30.

The Disney+ original from Marvel Studios is connected to the "What If...?" animated series and it will be released as a standalone app for the Vision Pro.What If... You Were Chosen? Step into the Multiverse and harness the power of the...

Disney+ Password Sharing Crackdown to Start in June

Disney plans to start cracking down on Disney+ password sharing starting in June, Disney CEO Bob Iger said in an interview with CNBC earlier this week. Iger said that Disney needs to turn its streaming business into a growth business, and one way to do that is to force households that are sharing passwords to sign up for their own accounts.

"In June, we'll be launching our first real foray...

Hulu on Disney+ Beta Launches for Bundle Subscribers

Disney today announced that customers who subscribe to its Hulu and Disney+ bundle can access Hulu content through a new "Hulu on Disney+" beta that aims to combine the two apps into a single app.

The beta is available to bundle subscribers as of now, with Disney planning to test the combined service before it rolls out in the spring. Bundle subscribers will see a Hulu title appear alongside ...

Disney+ and Hulu Merging Into Single App, Beta Coming in December

Disney today said that it will soon combine Disney+ and Hulu into one streaming service, with a unified app to be available in a beta capacity next month.

Disney CEO Bob Iger first announced plans to merge Hulu and Disney+ into a single app earlier this year. The app will first be offered to those who subscribe to the Disney+ and Hulu bundle, providing those customers with one app to access...

Disney+ to Start Cracking Down on Password Sharing in November

Following in the footsteps of Netflix, Disney will start cracking down on password sharing on the Disney+ streaming service. Disney+ password sharing will end in Canada starting on November 1, according to emails that Canadian subscribers are receiving.

As reported by Mobile Syrup, Disney is updating its terms of service to restrict account sharing."Unless otherwise permitted by your Service ...

Disney+ and Hulu Ad-Free Pricing Going Up in October, Password Sharing Crackdown Coming

Disney is planning to raise the price of its ad-free Disney+ and Hulu streaming services starting on October 12, the company said today during an earnings call (via CNBC). The ad-free Disney+ plan will be priced at $13.99 per month, while the ad-free Hulu plan will be priced at $17.99 per month.

Right now, ad-free Disney+ is $10.99 per month, while ad-free Hulu is priced at $14.99 per month. ...

Apple Reportedly an Ideal Partner to Distribute ESPN, But Deal Unlikely

Apple is one of several tech companies on Disney's radar as the media giant looks for a strategic partner to help expand distribution of ESPN, according to the New York Post. However, the report does not indicate if Disney has actually held discussions with Apple, and there are a few reasons why a sports partnership between the companies is unlikely.

First, the report says that the idea of...

Disney+ and Hulu to Be Combined Into One App

Disney plans to combine the Hulu and Disney+ streaming services into a single app by the end of this year, Disney CEO Bob Iger said yesterday during Disney's Q2 earnings call (via TechCrunch).

A single streaming app will include programming from both Hulu and Disney+, but Disney+, Hulu, and ESPN+ will also still be available as standalone services. The combined app will be provided first to...

Disney Raising Price of Disney+ Subscription to $10.99 and Launching $7.99 Ad-Supported Tier

Disney today announced that it is increasing the cost of its ad-free Disney+ subscription by 38 percent, raising the price from $7.99 per month to $10.99 per month. This is the most significant price increase Disney has introduced since the 2019 launch of the service.

The price of the ad-free plan is increasing to $10.99 per month because Disney is also launching a new ad-supported tier that ...

Apple Highlights 'Disney Melee Mania' Apple Arcade Exclusive, Shares 'Fraggle Rock: Back to the Rock' Teaser

Apple today announced that "Disney Melee Mania," a new game featuring iconic Disney and Pixar characters, will soon be coming exclusively to Apple Arcade.

Developed by Mighty Bear Games, Disney Melee Mania brings a large number of Disney and Pixar characters together to battle in a virtual arena. Characters from "Wreck-It Ralph," "Frozen," "The Incredibles," "Toy Story," and more battle...

Disney+ Has 118.1 Million Subscribers Two Years After Launch

Disney+ now has more than 118 million global paid subscribers, Disney announced today in its earnings report for the fourth quarter of 2021 [PDF]. The streaming service has gained 2.1 million subscribers in the last quarter, and 44.4 million subscribers over the course of the last 12 months.

In November 2020, Disney+ had 73.7 million subscribers, so its growth over the last year has been...

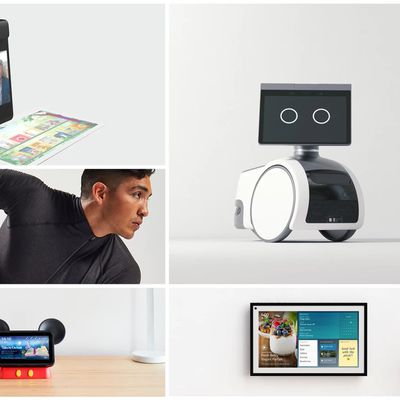

Amazon Announces 'Astro' Home Robot, Echo Show 15, Apple Fitness+ Competitor and More

Amazon today held a media event that saw the introduction of a slew of new products, ranging from an in-home Alexa robot to a new fitness service that mimics Apple Fitness+. We've rounded up all of Amazon's most interesting announcements below.

Astro Household Robot

Astro is an Alexa-integrated home robot that can monitor the home, help users keep in touch with family, and more. Astro can...

Disney Raising Prices for ESPN+ to $6.99 Per Month/$69.99 Per Year

Disney today told subscribers that it is raising the price for its ESPN+ standalone streaming service. Starting on August 13, the monthly price will increase from $5.99 to $6.99, and the yearly price will increase from $59.99 per year to $69.99 per year.

Prices for UFC pay-per-view matches will remain unchanged, and the bundle that includes Disney+, Hulu, and ESPN+ will not be increasing....

Disney+ Now Has 103.6 Million Subscribers

Disney+ now has more than 103 million global paid subscribers, Disney said today in its Q2 earnings report [PDF]. The streaming service has gained more than three million subscribers since March, which was the last time subscriber details were shared.

In April 2020, Disney+ had just 33 million subscribers, so the service's growth has been astronomical, exceeding all expectations in the year...