CIRP

By MacRumors Staff

CIRP Articles

iPhone 16e Sales Outperform SE in First Quarter YoY, Pro Models Decline

New data from Consumer Intelligence Research Partners (CIRP) suggests Apple's iPhone 16e is off to a strong start, capturing 7% of U.S. iPhone sales in its first partial quarter of availability. The new mid-range offering outperformed the iPhone SE's share from the same quarter last year.

The entire iPhone 16 lineup, now consisting of five models with the addition of the 16e, accounted for...

Read Full Article 49 comments

Leaker Hints at iPhone 17e Next Year as Report Predicts Annual Cycle

Apple will very likely launch an iPhone 17e next year around the same February window, claims a new consumer report, coinciding with a claim by a proven leaker that references to the device have already been spotted in the Chinese supply chain.

According to a new report by Consumer Intelligence Research Partners (CIRP), Apple's iPhone 16e is just the first in an annual cycle of more...

iPhone Upgrade Cycles Are Getting Shorter Again

iPhone users are upgrading their devices at a slightly faster rate, reversing a long-term trend of increasingly long upgrade cycles, Consumer Intelligence Research Partners (CIRP) reports.

According to data from the quarter ending in December 2024, more iPhone buyers retired their devices at an earlier point compared to previous years. Specifically, 36% of those who purchased a new iPhone...

Here Are the Three Apple Products You're Most Likely to Unwrap This Christmas

With such a wide array of products now available, Apple devices will be under the Christmas trees of many families this season. However, there are three that are most likely to be there.

According to Piper Jaffray surveys, Apple is constantly among the most desired brands among teens, appearing in 10% of all holiday wish lists, far ahead of competitors like Nike and Louis Vuitton.

AirPods

...

iPhone Base Models Remain Best-Sellers Despite Pro Max Appeal

Apple's base model iPhones have collectively accounted for 42% of its smartphone sales this year, but iPhone Pro Max devices stand as the best-selling individual model, according to new data from Consumer Intelligence Research Partners (CIRP).

The report reveals an interesting sales distribution across Apple's iPhone lineup, but the data needs to be interpreted carefully owing to Apple's...

Report: iCloud Is the Most Popular Apple Subscription Service in the US

Paid iCloud storage overwhelmingly remains the most popular Apple service in the United States, according to a new report from Consumer Intelligence Research Partners (CIRP).

Nearly two-thirds of Apple customers in the United States opt for paid iCloud storage, surpassing other services like Apple Music, Apple TV+, and AppleCare in terms of user adoption. In comparison, Apple Music and A...

Report: Apple Watch Ultra More Popular Than Apple Watch SE

The Apple Watch Ultra is considerably more popular than the entry-level Apple Watch SE despite its high price point, according to a new report from Consumer Intelligence Research Partners (CIRP).

The report provides a detailed look at how the various Apple Watch models are performing in the market. Apple Watch Series 9, introduced in September 2023 alongside the iPhone 15 lineup, is the most ...

Report: iPad Pro Popularity Cutting Into iPad Air and iPad Mini Sales

iPad Pro models accounted for the majority of Apple's iPad sales in the June quarter, up from the same quarter a year ago, based on the latest report from Consumer Intelligence Research Partners (CIRP).

Apple updated the 11-inch and 13-inch iPad Pro models in May 2024 with the M4 chip, OLED display technology, and a thinner, lighter design. Pricing on the 11-inch OLED iPad Pro starts at...

Apple Users Are Keeping Their Devices for Longer as Upgrades Slow

Apple users are holding onto their devices for increasingly long periods of time as upgrade cycles slow, data from Consumer Intelligence Research Partners (CIRP) suggests.

In recent years, a shift has occurred in the behavior of Apple customers, who are increasingly opting to retain their iPhones, iPads, and Macs for extended periods before upgrading. In the most recent 12-month period, 71%...

Report: iPads Retained and Repurposed Much More Often Than iPhones

iPad owners are more likely to keep or repurpose their old devices compared to iPhones, according to data from Consumer Intelligence Research Partners (CIRP).

The data, covering the twelve months ending in March 2024, shows that 67 percent of repeat iPad buyers keep their old iPads or pass them on to family and friends. This is a notable contrast to iPhone users, where only 41 percent keep ...

iPhone 15 and 15 Plus Proving Less Popular With Buyers This Year

Apple's iPhone 15 Pro models were its most purchased smartphones in the U.S. in the first quarter of this year, according to the latest Consumer Intelligence Research Partners (CIRP) report.

The iPhone 15 Pro and Pro Max accounted for 22% and 23% of all iPhones sold in Q1 2024, for a 45% combined share. The iPhone 15 Plus took a 9% share of all iPhones sold, while the iPhone 15 and iPho...

Android Bosses iPhone in Smartphone Activation Market Share

New iPhone activations are down to a low not seen in the U.S. smartphone market for the last six years, according to a new Consumer Intelligence Research Partners (CIRP) report.

While CIRP notes that Apple's installed smartphone base is higher than recorded activations, the figures show its share of new iPhone activations fell from 40% to 33% over the past year, suggesting a shift away from...

Just 3% of U.S. iPhone Sales in March Quarter Were iPhone 13 Mini Models

The 5.4-inch iPhone 13 mini continues to be unpopular with customers, according to U.S. iPhone sales data for the March quarter that was shared by Consumer Research Intelligence Partners (CIRP).

The iPhone 13 mini had the smallest share of sales of all the iPhone 13 models, and it made up just three percent of total iPhone sales during the quarter. Comparatively, the other iPhone...

Only a 'Small Fraction' of iPhone Users Will Use Self Service Repair Program, Study Suggests

Very few iPhone users will repair their own iPhone to postpone their next smartphone purchase, despite the Self Service Repair program, according to research by Consumer Intelligence Research Partners (CIRP).

Earlier this week, Apple announced the Self Service Repair program, giving customers who are comfortable with the idea of completing their own repairs access to Apple genuine parts,...

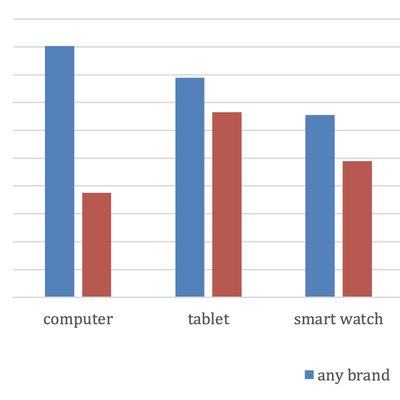

iPhone Serves as Gateway to iPad and Apple Watch Sales, but Mac, Apple TV, and HomePod Lag Behind

The iPhone has failed to serve as a gateway product to the Mac, Apple TV, and HomePod for over 50 percent of iPhone users, while the iPad, Apple Watch, and AirPods have seen considerably better popularity among iPhone owners, according to data gathered by Consumer Intelligence Research Partners (CIRP).

The device ownership of iPhone buyers (twelve months ending June 2021).

The CIRP...

Apple Remains 'Largely Absent' in U.S. Smart Speaker Market

Apple remains "largely absent" in the U.S. smart speaker market while Amazon and Google continue to dominate, according to data gathered by Consumer Research Intelligence Partners (CIRP).

Since 2017, Amazon has been the dominant company in the smart speaker market, with over two-thirds of smart speakers in U.S. homes being Amazon devices. Google holds about a one-quarter share of smart...

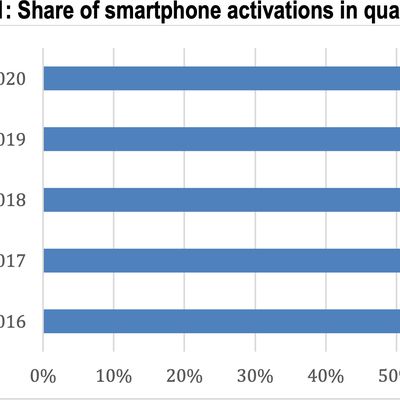

iOS and Android Activations Now Split Evenly in the U.S., Research Shows

Activations of iOS and Android devices are now evenly split in the United States, with little sign of movement toward either platform dominating over the past two years, according to data sourced by Consumer Research Intelligence Partners (CIRP).

CIRP estimates that iOS and Android each had 50 percent of new smartphone activations in the year ending this quarter. iOS's share of new...

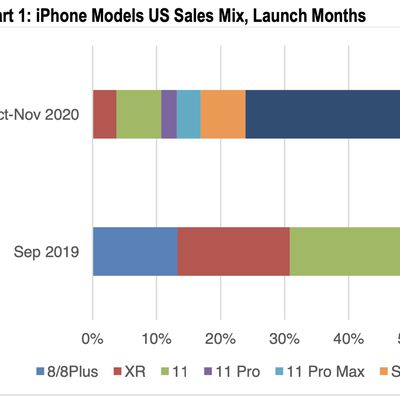

iPhone 12 Pro Max Seeing Strong Demand in U.S. as Consumer Spending Rises

The latest research from Consumer Intelligence Research Partners (CIRP) shows that all four iPhone 12 models accounted for 63% of total iPhone sales in the United States in the quarter ending June 2021.

The highest-end iPhone 12 Pro Max tied with the year-old iPhone 11 for the largest share of any single model at 23%, while the iPhone 12 mini and iPhone XR had the smallest share, each at 5%, ...

iPhone 12 Mini Sales Lackluster Compared to Other Models

Apple's 5.4-inch iPhone 12 mini, which is the smallest iPhone that has been released since the 2016 iPhone SE, may not be selling as well as Apple hoped. According to new sales numbers from Consumer Intelligence Research Partners, the iPhone 12 mini accounted for a lower number of sales than other iPhone 12 models that Apple offers.

Combined, all new iPhone 12 models accounted for 76 ...

iOS Devices Accounted for 44% of All U.S. Smartphone Activations in Q1 2020

iOS devices accounted for 44 percent of all U.S. smartphone activations during the first calendar quarter of 2020, the highest number of activations Apple has seen in a single quarter since 2016.

According to the data sourced from Consumer Research Intelligence Partners, Google's Android operating system was responsible for 56 percent of all activations due to the higher number of Android...