Australia

By MacRumors Staff

Australia Articles

Wallet App Support for Apple Account Cards Now Live in Australia and Canada

Support for Apple Account Cards in the Wallet app has gone live in Canada and Australia, over two years since it first launched in the United States.

The change means users can use the Wallet app to add an Apple Account Card, which displays the Apple credit balance associated with an Apple ID. If you receive an App Store or Apple Store gift card, for example, it is added to an Apple Account...

Read Full Article 33 comments

Apple Pay Express Mode Now Available in New South Wales

The government of New South Wales in Australia today announced that the Opal ticketing system now supports Express Mode for Apple Pay payments, allowing the fare card to be added to the Wallet app on a compatible iPhone or Apple Watch for tap-and-go payments across the public transport network.

Express Transit mode allows users to pay for rides without having to wake or unlock their iPhone...

Apple Launches Tap to Pay on iPhone in Australia

Apple has announced the launch of Tap to Pay on iPhone in Australia, allowing independent sellers, small merchants, and large retailers in the country to use iPhones as a payment terminal.

Introduced in February 2022, the feature allows compatible iPhones to accept payments via Apple Pay, contactless credit and debit cards, and other digital wallets, using only an iPhone - no...

Apple Defends Ecosystem in Australia as Antitrust Firefighting Around the World Continues

Apple has robustly defended its ecosystem in a submission to Australia's competition watchdog, amid growing global scrutiny of the power of big tech companies and "gatekeeping."

The Australian Competition and Consumer Commission (ACCC) has scrutinized Apple's ecosystem in a series of investigations since last year and encouraged the company to give users more control over preinstalled apps...

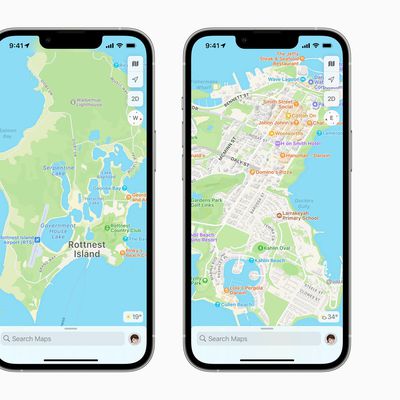

Apple Rolls Out Updated Maps Interface in Australia

Apple today announced that it has expanded its updated Apple Maps app to Australia, with Maps now offering more detailed road coverage, improved navigation, three-dimensional landmarks, and improved views of parks, buildings, airports, shopping centers, and more.

"Apple Maps is the best way to explore and navigate the world, all while protecting your privacy. We are excited to bring this...

Revamped Apple Maps Rolls Out in Australia [Updated]

Following a promise of "later this year" in June, Apple has officially rolled out its new and updated Apple Maps in Australia.

The new Apple Maps offers richer details in roads, parking lots, parks, buildings, airports, and more, and is part of Apple's push to rival Google Maps and other third-party map services. In Australia, customers will now have access to new Apple Maps. Apple last ...

Australia Continues to Scrutinize Apple Pay Amid Push for Regulation

The government of Australia is considering creating new laws that could more heavily regulate digital payments systems such as Apple Pay, Google Pay, and WeChat Pay (via Reuters).

An Australian government-commissioned report into digital payments systems has made a number of recommendations, one of which suggested actively regulating Apple Pay and other similar digital payments services....

Australian Government Now Offering COVID-19 Digital Vaccination Certificates for Apple Wallet

The Australian government has introduced support for adding COVID-19 vaccination digital certificates to Apple Wallet via the Express Plus Medicare app on iOS.

Image credit: Tap Down Under

As spotted by Tap Down Under, users who have received two doses of either the AstraZeneca or Pfizer vaccine now have access to the digital certificate through their Medicare online account or via the Medica...

Major Australian Healthcare Insurance Companies Now Support Apple Wallet

A number of the largest healthcare insurance companies in Australia now allow their customers to add their insurance cards to their digital Apple Wallet on their iPhone and Apple Watch, giving healthcare patients ease of access of by using their iPhone and Apple Watch instead of their plastic insurance card.

Bupa, Medibank, nib, and GU Health have announced support through electronic...

Australia Considers Case for Opening iPhone NFC Chip to Third Party Payment Systems

Apple on Monday responded to questions from Australia's parliament about its third-party access approach to the NFC chip in its iPhones, following claims that its Apple Pay system is stifling innovation in the contactless payment technology space.

The Parliamentary Joint Committee on Corporations and Financial Services heard for-and-against arguments from Apple, Google, and others relating...

Epic Wins Appeal to Continue Antitrust Case Against Apple in Australia

Australia's Federal Court has permitted Epic Games to sue Apple, reversing a previous ruling that said the two companies had to battle it out in the United States first before any legal action could take place Down Under.

Epic and Apple are involved in a highly public lawsuit in the United States, but Epic has also sued Apple in other countries, including Australia last November, in an...

Parents in Australia Warned to Keep AirTags Away From Children Due to Battery Choking Hazard

In May, a major Australian retailer took AirTags off its shelves in response to concerns that the Bluetooth-enabled item tracking device could pose a threat to children due to the size and "easy" access to its battery. Now, the Australian Competition and Consumer Commission is officially slapping Apple's AirTag with a warning.

In a press release, the ACCC says it is "urging parents" to keep ...

AirTag Removable Battery Sparks Child Safety Concerns

More than a week following their international debut, Apple's AirTag item tracker is now facing child safety concerns about its replaceable battery.

AirTags feature a standard replaceable CR2032 coin-cell battery that Apple says can power an AirTag for an entire year. The battery in an AirTag can be removed by pushing down and twisting the AirTag's back-plate, a fairly straightforward...

Australian Watchdog Wants iOS Users to Have More Control Over Preinstalled Apps

In an report related to its ongoing investigation into Apple and Google app marketplace dominance, Australia's consumer watchdog has warned both companies that it wants consumers to have more choice when it comes to preinstalled apps on Apple and Android devices (via ZDNet).

Specifically, the Australian Competition and Consumer Commission (ACCC) wants Apple and Google to give users more...

Apple Watch ECG Feature Coming to Australia and Vietnam Next Week

Apple on Tuesday seeded the release candidate of an upcoming watchOS 7.4 update to developers for testing purposes, and in the process revealed that the Apple Watch ECG feature is coming to additional countries very soon.

Along with iOS 14.5 and iPadOS 14.5, the official public version of watchOS 7.4 is set to be released next week, and Apple Watch users who install it in Australia and...

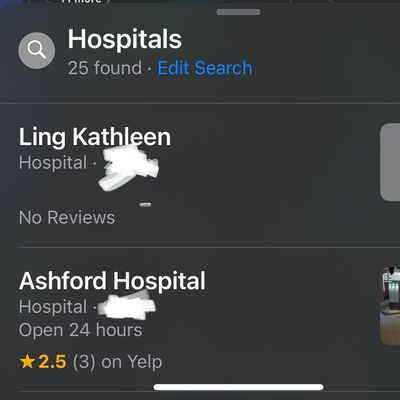

Longtime Apple Maps Bug in Australia Erroneously Lists Businesses in Residential Areas

There's a curious bug in the Apple Maps app that's affecting Australians, which appears to be caused by a bad data set. Multiple complaints on Twitter suggest that Apple Maps is listing certain businesses incorrectly, directing Australians to residential areas rather than the actual business location.

An erroneous hospital listing located near Twitter user Russell Ivanovic

Apple Maps...

Epic's Case Against Apple in Australia Might Be Over

Epic Games and Apple are involved in a highly public lawsuit in the United States, but Epic has also sued Apple in other countries, including Australia, in an attempt to boost its chances of getting a favorable ruling.

Things aren't quite going Epic's way, however, as the justice overseeing the case today decided that he's going to let the two companies battle it out in the United States.

...

Apple Says iOS Developers Have 'Multiple' Ways of Reaching Users and Are 'Far From Limited' to Using Only the App Store

As it faces a barrage of probes and investigations regarding the App Store and the distribution of apps on its devices, Apple has told Australia's consumer watchdog that developers have "multiple" ways to reach iOS users and claims that they are "far from limited" to simply using the App Store.

In a new filing (via ZDnet) responding to concerns from the Australian Competition & Consumer...

Epic Games' App Store Legal Challenge 'Self-Serving,' Apple Tells Australian Court

Apple has told an Australian court that Epic Games' legal challenge against the App Store is "self-serving," and that all the software company aims to do is "redefine the terms of access" that it's always been subject to on Apple's platforms.

As reported by The Guardian, Apple and Epic Games on Tuesday went head-to-head in a federal court in Sydney, Australia, following Epic's decision to...

Apple 'Surprised' By Developer Frustration With Its App Review Process

Apple has told Australia's competition watchdog that it's "surprised" to hear that some developers have concerns over the App Store and the process in which apps are reviewed, rejected, or approved for distribution on the platform.

In September of last year, the Australian Competition and Consumer Commission (ACCC) launched an investigation into Apple's App Store and Google's Play Store...