Barclaycard Launches New Apple Rewards Visa Card With 3x Points on Apple Store Purchases

Barclaycard last week announced a revamped version of its credit card partnership with Apple, the Barclaycard Apple Rewards Visa, offering a new Apple rewards program and financing deals (via AppleInsider).

The new reward card offers three points per dollar spent at the Apple Store (iTunes and App Stores do not qualify), two points spent in restaurants, and one point on all other purchases. Once a customer breaks 2,500 points, they receive a $25 Apple Store gift card.

Within the first thirty days of opening an account, users can also finance purchases made through Apple with deferred interest. Purchases under $498 can be financed for six months, $499-$998 for twelve months, and $999 and over for eighteen months.

The last Barclaycard with iTunes Rewards didn't have a triple-points reward tier for customers. It started at paying out two points for every dollar spent at the Apple Store or iTunes Store, and one point for every dollar spent everywhere else. Instead of an Apple Store gift card, the payout at 2,500 points was an iTunes gift card.

The card isn't yet confirmed to work with Apple Pay, but is expected to as both Visa and Barclaycard are participating partners. The new card also supports Chip & Pin security, not Chip & Signature like most other new cards in the United States, with an embedded EMV Chip for security.

The Barclaycard Apple Rewards Visa can be applied for today on Barclaycard's Official Website. Apple is also promoting the new card, touting its reward and financing options, on the company's online store.

Popular Stories

Following nearly two years of rumors about a fourth-generation iPhone SE, The Information today reported that Apple suppliers are finally planning to begin ramping up mass production of the device in October of this year. If accurate, that timeframe would mean that the next iPhone SE would not be announced alongside the iPhone 16 series in September, as expected. Instead, the report...

Key details about the overall specifications of the iPhone 17 lineup have been shared by the leaker known as "Ice Universe," clarifying several important aspects of next year's devices. Reports in recent months have converged in agreement that Apple will discontinue the "Plus" iPhone model in 2025 while introducing an all-new iPhone 17 "Slim" model as an even more high-end option sitting...

Apple supply chain analyst Ming-Chi Kuo today shared alleged specifications for a new ultra-thin iPhone 17 model rumored to launch next year. Kuo expects the device to be equipped with a 6.6-inch display with a current-size Dynamic Island, a standard A19 chip rather than an A19 Pro chip, a single rear camera, and an Apple-designed 5G chip. He also expects the device to have a...

Apple typically releases its new iPhone series around mid-September, which means we are about two months out from the launch of the iPhone 16. Like the iPhone 15 series, this year's lineup is expected to stick with four models – iPhone 16, iPhone 16 Plus, iPhone 16 Pro, and iPhone 16 Pro Max – although there are plenty of design differences and new features to take into account. To bring ...

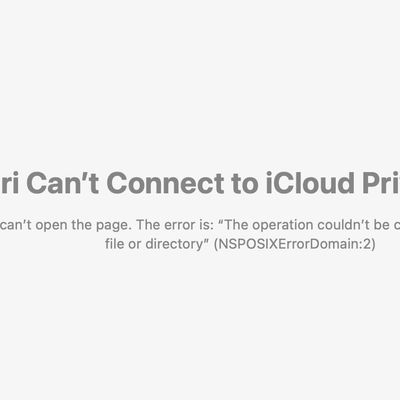

Apple’s iCloud Private Relay service is down for some users, according to Apple’s System Status page. Apple says that the iCloud Private Relay service may be slow or unavailable. The outage started at 2:34 p.m. Eastern Time, but it does not appear to be affecting all iCloud users. Some impacted users are unable to browse the web without turning iCloud Private Relay off, while others are...