European Union

By MacRumors Staff

European Union Guides

The EU Wants All Phones to Work With Interoperable Chargers, Here’s What That Means for Apple's Lightning Port

Despite pushback from Apple, the European Parliament in January voted overwhelmingly for new rules to establish a common charging standard for mobile device makers across the European Union. This article explores what form the EU laws might ultimately take and how they could affect Apple device users in Europe and elsewhere. What Exactly is the EU Calling For? To reduce cost, electronic...

Read Full Article (506 comments)

European Union Articles

Spotify and Apple Again Clash Over App Store Rules and Fees

Spotify has not been able to get Apple to approve an EU app update that added information on subscription pricing and links to the Spotify website, and it turns out that's because Spotify has not agreed to the terms of Apple's Music Streaming Services Entitlement. A recent antitrust ruling from the European Commission fined Apple nearly $2 billion and mandated that Apple "remove...

EU Right to Repair Rules Force Companies to Fix Out-of-Warranty Devices

The European Commission has waved through new 'right to repair' legislation that aims to make it easier for consumers to get their broken devices fixed, even if products are out of warranty. The EU already requires companies to offer a two-year minimum warranty on common household appliances and electronics, such as smartphones, TVs, washing machines, and vacuum cleaners, but the new rules...

European Regulators Will Soon Approve Apple's Plan to Open Up Tap-to-Pay to Banks and Payment Providers

As part of the changes introduced in Europe in iOS 17.4, Apple gave third-party payment apps and banks direct access to the NFC chip, allowing for non-Apple Pay tap-to-pay payment options. The European Commission is set to approve Apple's plan to open up tap-and-go mobile payments "as soon as next month," according to Reuters. With NFC access, banks and third-party payment apps can offer...

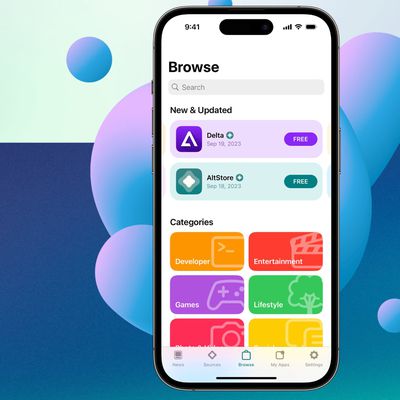

AltStore PAL Alternative App Marketplace Launches on iPhone in EU

One of the first alternative app marketplaces went live in the European Union today, with developer Riley Testut introducing AltStore PAL, a version of his AltStore that can be accessed in EU countries. AltStore PAL is an open-source app that is designed to distribute apps from independent developers. At launch, it features two apps, including Testut's Delta game emulator and clipboard...

Browser Companies Criticize Apple's EU Choice Screen in iOS 17.4

Several third-party browser companies have experienced a spike in iPhone installs since Apple made major changes to iOS in order to comply with the Digital Markets Act in the European Union, but many are not happy with Apple's implementation of its default browser choice screen. In iOS 17.4, released last month, Apple no longer limits EU users to the handful of browser options that iOS...

Apple Updates App Store Guidelines to Permit Game Emulators, Website Links in EU Music Apps

Apple today updated its App Store guidelines to comply with an anti-steering mandate levied by the European Commission. Music streaming apps like Spotify are now permitted to include a link or buy button that leads to a website with information about alternative music purchasing options, though this is only permitted in the European Economic Area. Music Streaming Services Entitlements: music...

AltStore for iPhone in EU Will Have Apps Backed By Patreon

With iOS 17.4, Apple began supporting alternative app marketplaces in the European Union, and the first of these stores will be launching soon to give consumers new ways to install apps without having to use the App Store. Developer Riley Testut, known for Game Boy Advance emulator GBA4iOS, is working on AltStore, one of several alternative app marketplaces. As noted by TechCrunch, app...

EU Opens Non-Compliance Investigations into Apple, Meta, and Google

Apple's compliance with new EU laws designed to rein in the market power of big tech companies is set to be investigated by regulators, the European Commission has announced. The Commission said on Monday that non-compliance investigations have been opened against Apple, Google, and Meta, under the new Digital Markets Act (DMA). The probe into Apple will look at whether the company...

EU Antitrust Chief Warns Apple About App Store Fees and Safety Warnings

Key parts of Apple's compliance with the Digital Markets Act (DMA) are set to be investigated by European regulators based on developer feedback, the EU's antitrust chief warned on Tuesday. In an interview with Reuters, the European Commission's Executive Vice-President Margrethe Vestager said that Apple's introduction of new fees was already being looked at as a potential attempt to...

Apple Working on Solution for EU Core Technology Fee Possibly Bankrupting Apps That Go Unexpectedly Viral

Since Apple announced plans for the 0.50 euro Core Technology Fee that apps distributed using the new EU App Store business terms must pay, there have been ongoing concerns about what that fee might mean for a developer that suddenly has a free app go viral. Apple's VP of regulatory law Kyle Andeers today met with developers during a workshop on Apple's Digital Markets Act compliance. iOS...

Brave Browser Reports Spike in EU Installs After iOS 17.4 DMA Changes

Alternative browser company Brave has reported a sharp increase in iPhone installs since Apple made sweeping changes to iOS in order to comply with the Digital Markets Act in the European Union. With the recent iOS 17.4 update, users in the EU are presented with a splash screen upon opening Safari that allows them to choose a new default browser. Apple is not providing just the standard ...

Apple Announces Ability to Download iPhone Apps From Websites in EU

Apple today announced three further changes for developers in the European Union, allowing them to distribute apps directly from webpages, choose how to design in-app promotions, and more. Apple last week enabled alternative app stores in the EU in iOS 17.4, allowing third-party app stores to offer a catalog of other developers' apps as well as the marketplace developer's own apps. As of...

Apple Reinstates Epic Games EU Developer Account, Paving the Way for Alternative App Store

Apple today reversed a decision to shut down Epic Games' developer account in the European Union, and the account has now been reinstated. In a statement to MacRumors, Apple said that Epic Games has committed to following the rules, allowing Epic Sweden to be reaccepted into the Apple Developer Program. Following conversations with Epic, they have committed to follow the rules, including our ...

Apple to Let EU iPhone Users Delete Safari and More Easily Transition to Android

In addition to adding support for alternative app marketplaces and alternative payment methods in the European Union, Apple is making several other changes to comply with the terms of the Digital Markets Act. Apple today outlined some of its upcoming plans in a DMA Compliance Report [PDF]. Apple is going to make it easier for iPhone users to switch over to another operating system in the...

EU Probes Apple's Decision to Shut Down Epic's Developer Account

The European Commission has requested "further explanations" from Apple over its decision yesterday to terminate the developer account of Epic Games, the Financial Times reports. The EC said it was investigating under the Digital Markets Act (DMA), a new law aimed at curbing the power of the biggest online platforms. Tech companies faced a March 7 deadline to comply with the legislation. The ...

Alternative iOS App Stores Only Work for 'Grace Period' When Traveling Outside of EU

With the release of iOS 17.4, iPhone users in the European Union can access third-party app stores, but Apple warns that EU users traveling outside of the bloc will only have a "grace period" before some features stop working altogether when they're away. From Apple's support document detailing alternative app marketplaces: If you leave the European Union for short-term travel, you'll...

Spotify Lauds $2 Billion EU Fine, Says Apple Has 'Muzzled' Streaming Music Services

Apple was today fined €1.8 billion ($1.95 billion) for anti-competitive conduct against rival streaming music services in the European Union, and following the ruling, Spotify has praised the European Commission for its decision. For context, the European Commission's investigation into Apple's practices started due to a 2019 complaint from Spotify over App Store policies. Spotify has long...

EU Fines Apple $2 Billion for Anti-Competitive Behavior Toward Spotify

The European Commission today fined Apple €1.8 billion ($1.95 billion) for anti-competitive conduct against rival music streaming services. In a response published on its website, Apple fiercely attacked the Commission's decision, as well as Spotify's behavior. The fine comes as the conclusion to a long-running investigation by the EU, triggered by a complaint from Spotify, into Apple's...

Spotify, Epic Games, and Others Argue Apple's App Store Changes Do Not Comply With DMA

Spotify, Epic Games, Deezer, Paddle, and several other developers and EU associations today sent a joint letter to the European Commission to complain about Apple's "proposed scheme for compliance" with the Digital Markets Act (DMA). The 34 companies and associations do not believe Apple's plans "meet the law's requirements." Apple's changes "disregard both the spirit and letter of the law"...

Apple Does Deep Dive Into Security Protections and Risks With Alternative App Marketplaces

Apple today published a whitepaper [PDF] detailing the privacy and security protections that it is implementing in the European Union to keep users as safe as possible while also complying with the requirements of the Digital Markets Act. As a recap, with the upcoming iOS 17.4 update, iPhone users in the European Union will be able to install apps through alternative app marketplaces rather...