IHS iSuppli

By MacRumors Staff

IHS iSuppli Articles

iPhone SE Component Costs Estimated to Start at $160

Component costs for the new 16GB iPhone SE are estimated to be at about $160, according to a preliminary teardown report from IHS iSuppli. When a new iPhone is released, IHS often takes it apart to estimate the cost of each component to ultimately predict how much Apple spends on hardware.

IHS estimates that the materials for the device cost $156.20, rounded up to $160 with the addition of...

Read Full Article 130 comments

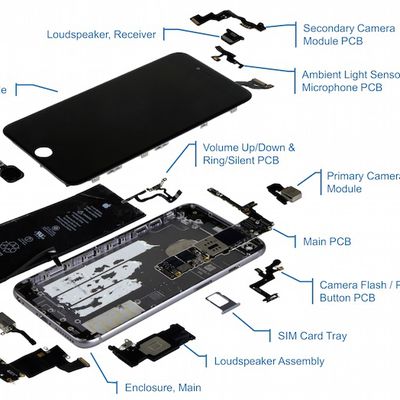

iPhone 6s Plus Component Costs Estimated to Begin at $236, $16 More Than iPhone 6 Plus

IHS iSuppli has once again taken apart the newest set of iPhones in an attempt to come as close as possible to estimating the actual component cost of the new devices. According to IHS iSuppli's teardown of the iPhone 6s Plus, the bill of materials for a 16 GB version comes to $231.50, with manufacturing costs and other minor items raising the overall price slightly to $236.

One of the...

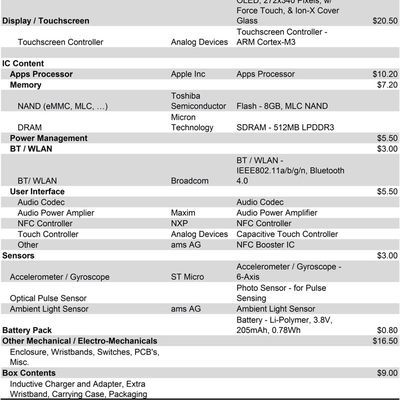

Apple Watch Sport Component Costs Estimated at $83.70, Which Won't Sit Well With Tim Cook

IHS iSuppli often tears down devices to estimate component costs, and today, the research firm released its report on the Apple Watch, suggesting it has the lowest hardware costs compared to retail price of any Apple product IHS has researched.

The 38mm Apple Watch Sport dissected by IHS was estimated to cost $81.20 when broken down by component. In IHS' estimation, the most expensive...

Tim Cook: Component Cost Breakdowns on Apple Products Are Nowhere Close to Being Accurate

During today's Q2 2015 earnings call, Apple CEO Tim Cook noted that Apple Watch margins are lower than the company average, and on a followup question about those margins in the context of the Apple Watch Edition's high price, Cook commented on the inaccuracy of estimated cost breakdowns on Apple products.

"I haven't seen [them for Apple Watch], but generally there are cost breakdowns around...

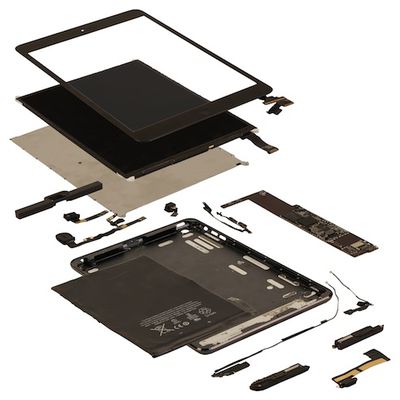

iPad Air 2 Material Costs Hold Steady Starting at $275, but New Storage Tiers Erode Profit Margin

As it always does with Apple's major new iOS devices, research firm IHS iSuppli has torn down the new iPad Air 2 in an attempt to estimate Apple's component costs for the device (via Re/code). According to IHS iSuppli's estimates, the 16 GB iPad Air 2 costs Apple roughly $275 to build, just one dollar more than last year's iPad Air.

The report unsurprisingly points out that Apple benefits...

iPhone 6 Component Costs Estimated to Begin at $200, Samsung Supplying Some A8 Chips

As it routinely does for new devices, IHS iSuppli has taken apart the iPhone 6 and iPhone 6 Plus in an effort to estimate Apple's costs for the components included in the new devices, sharing the results with Re/code. According to IHS iSuppli's teardowns, parts and labor costs for the iPhone 6 are estimated to begin at $200 for the 16 GB iPhone 6 model, giving Apple a roughly 69 percent gross...

Shipments of Retina iPad Mini Likely to Double in Q1 2014 as Shortages Ease

Shipments of the supply-constrained iPad mini with Retina display are likely to double in Q1 2014, according to market research firm IHS iSuppli (via CNET) and KGI Securities analyst Ming-Chi Kuo, with both stating that the estimated shipment of 2 million Retina iPad mini tablets in the current quarter will grow to a total shipment of about 4.5 million devices in the first three months of next...

iPad Air Component Costs Estimated to Begin at $274, Roughly 13% Cheaper Than iPad 3

IHS Suppli has released its estimate of the component costs involved in building the new iPad Air, performing a virtual teardown based on information revealed by Apple and industry knowledge. According to IHS estimates, the component cost of the iPad Air is between $274 and $361 depending on the model, with the base model's components actually totaling $42 less than that of the entry-level third...

Retina iPad Mini Launch Supplies Set to Be 'Ridiculously Tight' Until Early 2014

Following concerns expressed during the lead-up to this week's Apple media event that the company would be unable to launch the Retina iPad mini in any significant volume before the end of the year, supply chain analysts continue to expect very low supplies of the device when it launches next month.

Shortly after Apple announced the new Retina iPad mini, IHS iSuppli analyst Rhoda Alexander...

Uncertainty Remains Over Whether Retina iPad Mini Will Ship Alongside iPad 5 in 2013

According to market research firm IHS iSuppli (via CNET), production levels for the expected upcoming iPad mini with Retina display indicate that the device may not ship alongside the upcoming iPad 5, which looks to be "on schedule" for an October release. Specifically, it is estimated that Apple's Asia-based supply chain of manufacturers have begun the start of Retina iPad mini display...

iPhone Display Supplier Japan Display Begins Focusing Production Efforts on iPhone 5S

According to market research firm IHS iSuppli (via CNET), primary Apple supplier Japan Display Inc. is gearing up to focus its production efforts on Apple’s next-generation iPhone set to be released next month.

The firm is currently a major supplier of displays for the iPhone 5, joining fellow Japanese company Sharp and South Korean electronics manufacturer LG in handling Apple's production...

Retina iPad Mini Display Production Levels Appear Set to Match Last Year's Model

According to market research firm IHS iSuppli (via CNET), production levels for displays destined for this year’s upcoming iPad mini are set to be on par with those of last year’s model. The firm also believes that this year’s iPad mini will feature a high-resolution Retina display, something that has been highly rumored for the upcoming device.

"Based [what] we are seeing in the [production] ...

iPad Mini Component Costs Estimated to Begin at $188

AllThingsD reports on an iPad mini teardown from research firm IHS iSuppli estimating the component costs for Apple's new iPad mini at $188 for the 16 GB model.The base model, a Wi-Fi-only 16 gigabyte iPad mini, which sells for a starting retail price of $329, costs about $188 to build. Adding additional memory — the options are 32GB and 64GB — adds only incremental cost but a fair amount of...

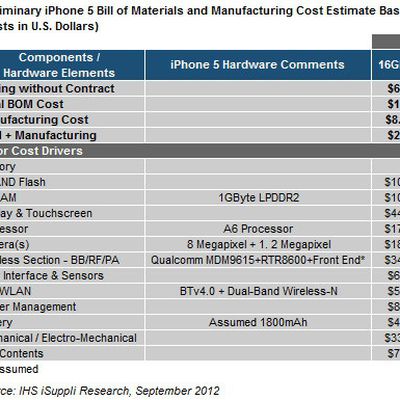

iPhone 5 Component Costs Estimated to Begin at $199

IHS iSuppli has released its estimate of the component costs involved in building the iPhone 5, performing a virtual teardown based on information revealed by Apple and industry knowledge. The estimate, which does not include numerous other costs involved in product development, manufacturing, and sales, such as research and development, software, patent licenses, marketing, and distribution...

Apple Predicted to Expand Lead in Global Semiconductor Purchases in 2012

Research firm IHS iSuppli today released the results of a new study tracking global semiconductor sales in 2012, predicting that Apple will expand its lead on the strength of 15% growth in the face of a stagnant market. Apple first topped the list in 2010 after quickly rising from third place in 2009 and sixth place in 2008.Apple is maintaining its lead in semiconductor purchasing because of...

Samsung Sole Supplier for Retina Display in New iPad?

Bloomberg reports on comments from IHS iSuppli analyst Vinita Jakhanwal claiming that Samsung is currently serving as the sole supplier of the ultra-high resolution Retina display in the new iPad. Previous reports had indicated the Sharp and LG would also be supplying displays for the device.Samsung Electronics Co. (005930) will supply the touch screen for Apple Inc. (AAPL)’s new iPad after LG ...

iPhone 4S Component Costs Once Again Begin at About $188

AllThingsD reports on IHS iSuppli's teardown analysis of the iPhone 4S, with an eye toward estimating the cost of components included in the device. Based on iSuppli's analysis, the 16 GB iPhone 4S carries a bill of materials cost of about $188, in line with that of the GSM iPhone 4 at launch.In the case of the iPhone 4S, [IHS iSuppli analyst Andrew] Rassweiler estimates that the BOM cost...

Apple Reduces Build Cost of CDMA iPhone With Design Tweaks

Research firm IHS iSuppli today announced that it has completed its full teardown of the CDMA iPhone that launched on Verizon this week, estimating that the device carries a bill of materials cost of about $171.35, or approximately 9% less than the original iPhone 4. Despite having nearly the same functionality and a similar bill of materials (BOM) as the previous model, the new code division...