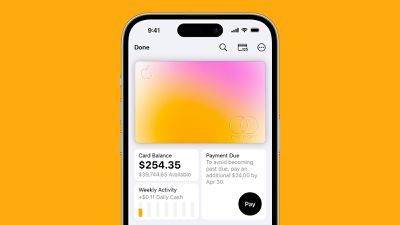

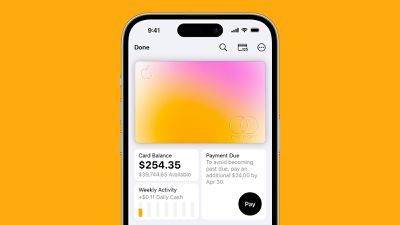

Apple Talking With JPMorgan Chase About Potential Apple Card Partnership

Amid long-running reports that Apple and Goldman Sachs are working toward ending their Apple Card partnership, JPMorgan Chase is now in talks with Apple about taking over the credit card program, reports The Wall Street Journal.

A deal could still be months away, according to the report, but talks have accelerated in recent weeks as the two sides negotiate details of a potential agreement.

Chase is looking for certain concessions in order for a deal to be reached, including paying less than the $17 billion face value of outstanding balances of Apple Card holders and doing away with the synchronized Apple Card billing cycles that match the calendar months but have created customer service issues.

Apple has also spoken with Synchrony Financial and Capital One about the Apple Card program, while Goldman Sachs spoke with American Express last year as the two current partners on Apple Card have been exploring how to end their partnership, but it appears Chase is the current leader.

Update: CNBC and the Financial Times also reported about the talks between Apple and JPMorgan.

Popular Stories

Apple turns 50 this year, and its CEO Tim Cook has promised to celebrate the milestone. The big day falls on April 1, 2026.

"I've been unusually reflective lately about Apple because we have been working on what do we do to mark this moment," Cook told employees today, according to Bloomberg's Mark Gurman. "When you really stop and pause and think about the last 50 years, it makes your heart ...

While the iOS 26.3 Release Candidate is now available ahead of a public release, the first iOS 26.4 beta is likely still at least a week away. Following beta testing, iOS 26.4 will likely be released to the general public in March or April.

Below, we have recapped known or rumored iOS 26.3 and iOS 26.4 features so far.

iOS 26.3

iPhone to Android Transfer Tool

iOS 26.3 makes it easier...

Apple recently acquired Israeli startup Q.ai for close to $2 billion, according to Financial Times sources. That would make this Apple's second-biggest acquisition ever, after it paid $3 billion for the popular headphone maker Beats in 2014.

This is also the largest known Apple acquisition since the company purchased Intel's smartphone modem business and patents for $1 billion in 2019....

Apple plans to announce the iPhone 17e on Thursday, February 19, according to Macwelt, the German equivalent of Macworld.

The report, citing industry sources, is available in English on Macworld.

Apple announced the iPhone 16e on Wednesday, February 19 last year, so the iPhone 17e would be unveiled exactly one year later if this rumor is accurate. It is quite uncommon for Apple to unveil...

In the iOS 26.4 update that's coming this spring, Apple will introduce a new version of Siri that's going to overhaul how we interact with the personal assistant and what it's able to do.

The iOS 26.4 version of Siri won't work like ChatGPT or Claude, but it will rely on large language models (LLMs) and has been updated from the ground up.

Upgraded Architecture

The next-generation...