SEC Charges Former Apple Lawyer Gene Levoff With Insider Trading [Updated]

The U.S. Securities and Exchange Commission has charged Apple's former vice president of corporate law Gene Levoff with insider trading, according to a lawsuit filed in the U.S. District Court for New Jersey on Wednesday.

The complaint alleges that Levoff had access to Apple's earnings results before they were publicly announced and used this information to buy Apple shares in advance of better-than-expected earnings results and to sell shares ahead of weaker-than-expected earnings results between 2011 and 2016.

Through his illegal insider trading in 2015-2016, the complaint alleges that Levoff profited and avoided losses of approximately $382,000:

For example, in July 2015 Levoff received material nonpublic financial data that showed Apple would miss analysts' third quarter estimates for iPhone unit sales. Between July 17 and the public release of Apple's quarterly earnings information on July 21, Levoff sold approximately $10 million dollars of Apple stock – virtually all of his Apple holdings – from his personal brokerage accounts. Apple's stock dropped more than four percent when it publicly disclosed its quarterly financial data.

Levoff also served on Apple's Disclosure Committee from September 2008 to July 2018. In this position, he was ironically responsible for ensuring that other Apple employees were compliant with Apple's insider trading policies, including enforcement of "blackout periods" around the time of Apple's earnings reports.

Levoff was also tasked with signing off on some Apple acquisitions in his role. He was terminated in September 2018, according to the lawsuit.

Read the full complaint here. The news was first reported by CNBC.

Update: Apple issued the following statement per Bloomberg's Mark Gurman: "After being contacted by authorities last summer we conducted a thorough investigation with the help of outside legal experts, which resulted in termination."

Popular Stories

Following nearly two years of rumors about a fourth-generation iPhone SE, The Information today reported that Apple suppliers are finally planning to begin ramping up mass production of the device in October of this year. If accurate, that timeframe would mean that the next iPhone SE would not be announced alongside the iPhone 16 series in September, as expected. Instead, the report...

Key details about the overall specifications of the iPhone 17 lineup have been shared by the leaker known as "Ice Universe," clarifying several important aspects of next year's devices. Reports in recent months have converged in agreement that Apple will discontinue the "Plus" iPhone model in 2025 while introducing an all-new iPhone 17 "Slim" model as an even more high-end option sitting...

Apple supply chain analyst Ming-Chi Kuo today shared alleged specifications for a new ultra-thin iPhone 17 model rumored to launch next year. Kuo expects the device to be equipped with a 6.6-inch display with a current-size Dynamic Island, a standard A19 chip rather than an A19 Pro chip, a single rear camera, and an Apple-designed 5G chip. He also expects the device to have a...

Apple typically releases its new iPhone series around mid-September, which means we are about two months out from the launch of the iPhone 16. Like the iPhone 15 series, this year's lineup is expected to stick with four models – iPhone 16, iPhone 16 Plus, iPhone 16 Pro, and iPhone 16 Pro Max – although there are plenty of design differences and new features to take into account. To bring ...

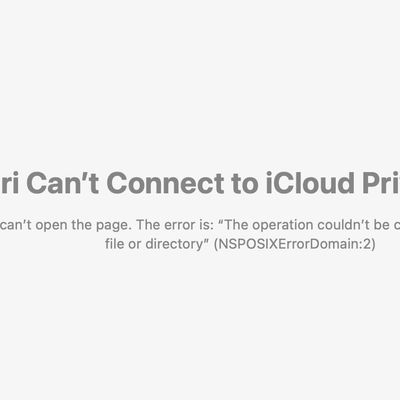

Apple’s iCloud Private Relay service is down for some users, according to Apple’s System Status page. Apple says that the iCloud Private Relay service may be slow or unavailable. The outage started at 2:34 p.m. Eastern Time, but it does not appear to be affecting all iCloud users. Some impacted users are unable to browse the web without turning iCloud Private Relay off, while others are...

Apple is planning to release at least one iPhone 17 model next year with mechanical aperture, according to a report published today by The Information. The mechanical system would allow users to adjust the size of the iPhone 17's aperture, which refers to the opening of the camera lens through which light enters. All existing iPhone camera lenses have fixed apertures, but some Android...