Hedge Funder Lee Cooperman Takes 'Modest Position' in Apple, Drives Stock Price Over $500

Following yesterday's news that investor Carl Icahn has taken a greater than $1 billion position in Apple, believing the company is 'extremely undervalued', today Lee Cooperman of hedge fund Omega Advisors says he agrees with Icahn and that his firm has taken a modest position in Apple, according to CNBC.

The news has driven Apple's stock price over $500 for the first time seven months. Apple first breached the $500 barrier in February of 2012, nearly 18 months ago to the day.

Scott Wapner reporting earlier today on CNBC:

Much is being made of Carl Icahn's big new position in Apple, but from the filings we've learned that Lee Cooperman has taken a new position. He is back in Apple. I just got off the phone with him and he told me the following: he agrees with Carl Icahn that Apple is cheap, said they have a new modest position, said got back in the low $400s.

Lee Cooperman thinking that the new iPhone is going to create some buzz. When talking about the entire space he says he still thinks that Qualcomm is the best play in that overall space. But clearly making it known that he agrees with Carl Icahn that Apple is cheap in his words. They got back in in the low $400s and think the new iPhone which is expected on September 10th is going to create some buzz and you know Apple was right on the cusp of $500. We will see what happens here.

Apple has a long way to go to reach its all-time high of $705 set last year, but both Icahn and Cooperman are betting big on the company and believe it can regain those levels.

Popular Stories

Following nearly two years of rumors about a fourth-generation iPhone SE, The Information today reported that Apple suppliers are finally planning to begin ramping up mass production of the device in October of this year. If accurate, that timeframe would mean that the next iPhone SE would not be announced alongside the iPhone 16 series in September, as expected. Instead, the report...

Key details about the overall specifications of the iPhone 17 lineup have been shared by the leaker known as "Ice Universe," clarifying several important aspects of next year's devices. Reports in recent months have converged in agreement that Apple will discontinue the "Plus" iPhone model in 2025 while introducing an all-new iPhone 17 "Slim" model as an even more high-end option sitting...

Apple supply chain analyst Ming-Chi Kuo today shared alleged specifications for a new ultra-thin iPhone 17 model rumored to launch next year. Kuo expects the device to be equipped with a 6.6-inch display with a current-size Dynamic Island, a standard A19 chip rather than an A19 Pro chip, a single rear camera, and an Apple-designed 5G chip. He also expects the device to have a...

Apple typically releases its new iPhone series around mid-September, which means we are about two months out from the launch of the iPhone 16. Like the iPhone 15 series, this year's lineup is expected to stick with four models – iPhone 16, iPhone 16 Plus, iPhone 16 Pro, and iPhone 16 Pro Max – although there are plenty of design differences and new features to take into account. To bring ...

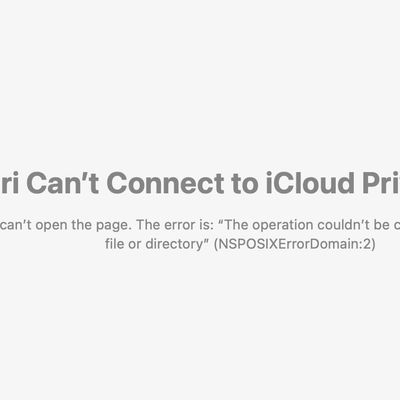

Apple’s iCloud Private Relay service is down for some users, according to Apple’s System Status page. Apple says that the iCloud Private Relay service may be slow or unavailable. The outage started at 2:34 p.m. Eastern Time, but it does not appear to be affecting all iCloud users. Some impacted users are unable to browse the web without turning iCloud Private Relay off, while others are...