Samsung's Market Cap Takes $10 Billion Hit Amid Rumors of Apple DRAM Deal with Elpida

Digitimes' poor track record has been thrust into the spotlight in recent days, but that hasn't stopped one of the Taiwanese news site's reports from having a major effect on stock prices for Samsung and Hynix. The report from earlier this week claims that Apple has placed "huge" orders for DRAM chips with Elpida, soaking up half of the capacity at the firm's main plant in Hiroshima, Japan.

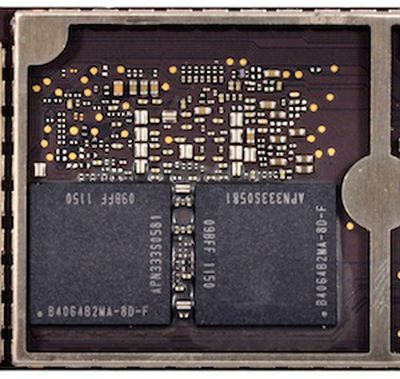

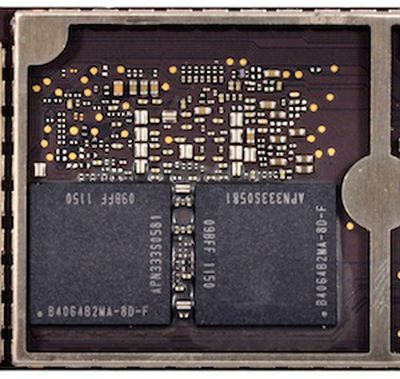

1 GB of Elpida DRAM in third-generation iPad (Source: iFixit)

1 GB of Elpida DRAM in third-generation iPad (Source: iFixit)As

noted by Reuters, the rumor has had a significant effect on fellow DRAM manufacturers Samsung and Hynix, with Samsung losing $10 billion in market value today in a 6% stock decline. The smaller Hynix was down nearly 9%

"It looks like Apple doesn't want to see Samsung and hynix dominate the chip market. Apple wants to maintain its bargaining power by keeping Elpida running," said Choi Do-yeon, an analyst at LIG Investment & Securities.

Elpida filed for bankruptcy in late February, and Micron has emerged as a likely acquirer for the company. The combined Micron-Elpida would be a strong competitor in the DRAM market, sparking concerns for others in the competitive industry.

DRAM, the volatile memory used to hold active applications and other data for use while a device is in operation, is a commodity in the consumer electronics market, with Apple routinely sourcing from multiple suppliers and shifting orders to achieve the best pricing.

Popular Stories

Apple has announced it will be holding a special event on Tuesday, May 7 at 7 a.m. Pacific Time (10 a.m. Eastern Time), with a live stream to be available on Apple.com and on YouTube as usual. The event invitation has a tagline of "Let Loose" and shows an artistic render of an Apple Pencil, suggesting that iPads will be a focus of the event. Subscribe to the MacRumors YouTube channel for more ...

Apple today released several open source large language models (LLMs) that are designed to run on-device rather than through cloud servers. Called OpenELM (Open-source Efficient Language Models), the LLMs are available on the Hugging Face Hub, a community for sharing AI code. As outlined in a white paper [PDF], there are eight total OpenELM models, four of which were pre-trained using the...

Apple has dropped the number of Vision Pro units that it plans to ship in 2024, going from an expected 700 to 800k units to just 400k to 450k units, according to Apple analyst Ming-Chi Kuo. Orders have been scaled back before the Vision Pro has launched in markets outside of the United States, which Kuo says is a sign that demand in the U.S. has "fallen sharply beyond expectations." As a...

Apple is set to unveil iOS 18 during its WWDC keynote on June 10, so the software update is a little over six weeks away from being announced. Below, we recap rumored features and changes planned for the iPhone with iOS 18. iOS 18 will reportedly be the "biggest" update in the iPhone's history, with new ChatGPT-inspired generative AI features, a more customizable Home Screen, and much more....

Apple is finally planning a Calculator app for the iPad, over 14 years after launching the device, according to a source familiar with the matter. iPadOS 18 will include a built-in Calculator app for all iPad models that are compatible with the software update, which is expected to be unveiled during the opening keynote of Apple's annual developers conference WWDC on June 10. AppleInsider...

Top Rated Comments

How is it misleading? It specifically says Samsung's market cap, which is indeed what dropped by $10 billion.

I see what you did there! :D

And screen components! A lot of Samsung's equipment is second to none. It's a pity the relationship between them and Apple has become so sour.

Good for Apple and Elpida. Especially good for Micron if they do acquire Elpida.

In the old days I used to buy all my memory from Micron.

How many times have they gone to other vendors only to come back to Samsung.

Let's face it, Samsung makes some of the finest semiconductor components in the industry.

Apple has always been about delivering a quality finished product.

This means using quality components.

If Elpida cannot provide that same level of quality, Apple will be the one taking the customer satisfaction hit.