Earnings

By MacRumors Staff

Earnings Articles

Here's How to Listen to Apple's Upcoming Earnings Call With Tim Cook

Apple has announced that it will share earnings results for the third quarter of its 2025 fiscal year on Thursday, July 31. Apple's earnings reports are typically released at 4:30 p.m. Eastern Time, shortly after the stock market has closed in New York.

Apple's CEO Tim Cook and CFO Kevan Parekh will discuss the results on a live-streamed conference call at 5:00 p.m. Eastern Time that day....

Read Full Article 9 comments

Apple's Q2 2025 Earnings Call Takeaways

Apple held its earnings call for the second fiscal quarter of 2025 today (second calendar quarter), announcing revenue of $95.4 billion and net quarterly profit of $24.8 billion. During the call, Apple CEO Tim Cook spoke about tariffs, the App Store changes Apple is facing, device sales, and more.

We've rounded up the most interesting tidbits from the Q2 2025 earnings call below.

U.S....

Tim Cook: Apple is 'Making Progress' on Apple Intelligence Siri Features

During today's earnings call covering the second fiscal quarter of 2025, Apple CEO Tim Cook acknowledged the Apple Intelligence Siri features that have been delayed. Cook said that Apple needs more time to ensure Siri meets its quality bar, but progress is being made.

With regard to the more personal Siri features we announced, we need more time to complete our work on these features, so...

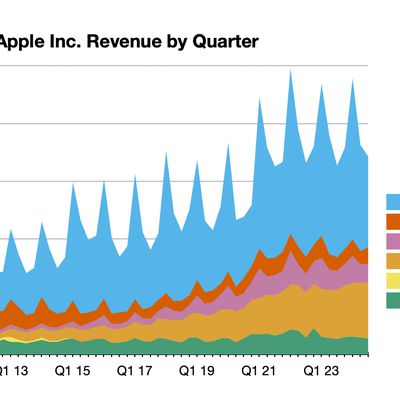

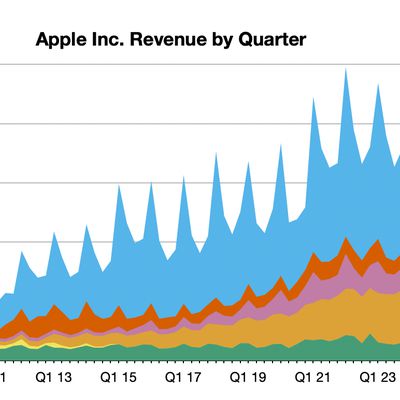

Apple Reports 2Q 2025 Results: $24.8B Profit on $95.4B Revenue

Apple today announced financial results for the second fiscal quarter of 2025, which corresponds to the first calendar quarter of the year.

For the quarter, Apple posted revenue of $95.4 billion and net quarterly profit of $24.8 billion, or $1.65 per diluted share, compared to revenue of $90.8 billion and net quarterly profit of $23.6 billion, or $1.53 per diluted share, in the year-ago...

What to Expect From Apple's Earnings Call on May 1 as Tariffs Loom

Apple will report its earnings results for the second quarter of its 2025 fiscal year on Thursday, May 1 at 1:30 p.m. Pacific Time. Apple's CEO Tim Cook and CFO Kevan Parekh will discuss the results on a conference call with analysts a half hour later.

Keep reading for some key things to know about the quarter, including a recap of new products announced, revenue expectations, and more.

Ne...

Apple's Q1 2025 Earnings Call Takeaways

Apple today held an earnings call to report results for the first fiscal quarter of 2025 (fourth calendar quarter of 2024), with Apple CEO Tim Cook and new Apple CFO Kevan Parekh providing insight into Apple's performance, holiday quarter product sales, and more.

We've highlighted the most interesting takeaways from the Q1 2025 earnings call.

iPhone Sales and Apple Intelligence

Services...

Apple CEO Tim Cook: There's a 'Lot of Innovation' Left for Future iPhone Development

During today's earnings call covering the first fiscal quarter of 2025, Apple CEO Tim Cook was asked about whether he felt there was room for form factor innovation in future iPhone models, with the question hinting perhaps spurred by rumors of the upcoming

"iPhone 17 Air."

Cook often declines to provide insight into future products during earnings calls, but he did give an encouraging...

Apple Now Has More Than 2.35 Billion Active Devices Worldwide

There are more than 2.35 billion active iPhones, iPads, Macs, and other Apple devices worldwide, Apple CEO Tim Cook said today in the earnings call covering the first fiscal quarter of 2025.

2.35 billion active devices is a new record for Apple. Apple last shared its active install base numbers in February 2024, when the company had 2.2 billion active devices worldwide.

Apple did not...

Apple Reports Best Quarter Ever in 1Q 2025 Results: $36.3B Profit on $124.3B Revenue

Apple today announced financial results for the first fiscal quarter of 2025, which corresponds to the fourth calendar quarter of 2024.

For the quarter, Apple posted revenue of $124.3 billion and net quarterly profit of $36.3 billion, or $2.40 per diluted share, compared to revenue of $119.6 billion and net quarterly profit of $33.9 billion, or $2.18 per diluted share, in the year-ago quarter...

Apple to Hold Q1 2025 Earnings Call on January 30

Apple plans to hold its first earnings call of 2025 on Thursday, January 30, according to the company's Investor Relations website.

During the call, Apple CEO Tim Cook and new chief financial officer Kevan Parekh will provide insight into Apple's performance during the 2024 holiday quarter spanning from October to December. Apple's Q4 2024 earnings call was the last for former Apple CFO Luca ...

Apple Reports 4Q 2024 Results: $14.7B Profit on $94.9B Revenue

Apple today announced financial results for the fourth fiscal quarter of 2024, which corresponds to the third calendar quarter of the year.

For the quarter, Apple posted revenue of $94.9 billion and net quarterly profit of $14.7 billion, or $0.97 per diluted share, compared to revenue of $89.5 billion and net quarterly profit of $23.0 billion, or $1.46 per diluted share, in the year-ago...

Trick or Treat? Apple's First Earnings Call Since iPhone 16 Launch Scheduled for Halloween

Apple today announced that its next quarterly earnings conference call will be held on Thursday, October 31 at 2 p.m. Pacific Time/5 p.m. Eastern Time.

On the call, Apple's CEO Tim Cook and CFO Luca Maestri will discuss the company's earnings results for the fourth quarter of its 2024 fiscal year. It will likely be Maestri's final earnings call at Apple, as he will be succeeded by Kevan...

Apple's Q3 2024 Earnings Call Takeaways

Apple today held an earnings call for the third fiscal quarter of 2024 (second calendar quarter), with Apple reporting its best June quarter to date, with revenue higher than expected. Apple CEO Tim Cook and Apple CFO Luca Maestri provided some insight into Apple's performance, iPad sales, services growth, AI plans, and more.

We've highlighted the most interesting tidbits from the Q3 2024...

Apple Reports 3Q 2024 Results: $21.4B Profit on $85.8B Revenue

Apple today announced financial results for its third fiscal quarter of 2024, which corresponds to the second calendar quarter of the year.

For the quarter, Apple posted revenue of $85.8 billion and net quarterly profit of $21.4 billion, or $1.40 per diluted share, compared to revenue of $81.8 billion and net quarterly profit of $19.9 billion, or $1.26 per diluted share, in the year-ago...

What to Expect From Apple's Quarterly Earnings Report This Week

Apple will report its earnings results for the third quarter of its 2024 fiscal year on Thursday, August 1 at 1:30 p.m. Pacific Time. Apple's CEO Tim Cook and CFO Luca Maestri will discuss the results on a conference call with analysts a half hour later.

Keep reading for some key things to know about the quarter, including a recap of new products announced, revenue expectations, and more.

...

Apple to Report Earnings Results on August 1 After Releasing New iPads Last Quarter

Apple recently announced that its next quarterly earnings conference call will be held on Thursday, August 1 at 2 p.m. Pacific Time.

On the call, which anyone can listen to, Apple's CEO Tim Cook and CFO Luca Maestri will discuss the company's earnings results for the third quarter of the 2024 fiscal year. During the quarter, spanning March 31 through June 29, Apple released new iPad Pro...

Apple's Q2 2024 Earnings Call Takeaways

Apple today held its earnings call for the second fiscal quarter of 2024 (first calendar quarter), with Apple CEO Tim Cook and Apple CFO Luca Maestri providing us with some details on Apple's performance, Vision Pro sales, services growth, AI plans, and other topics.

We've highlighted the most interesting takeaways from today's earnings call.

Next Week's Announcements

Apple CEO Tim Cook...

Tim Cook on Generative AI: 'We Have Advantages That Will Differentiate Us'

During today's earnings call covering the second fiscal quarter of 2024, Apple CEO Tim Cook again spoke about Apple's work on generative AI. He said that Apple has "advantages" that will "differentiate" the company in the era of AI, and some "very exciting things" will be shared with customers in the near future.

We continue to feel very bullish about our opportunity in generative AI. We are ...

Apple Reports 2Q 2024 Results: $23.6B Profit on $90.8B Revenue

Apple today announced financial results for the second fiscal quarter of 2024, which corresponds to the first calendar quarter of the year.

For the quarter, Apple posted revenue of $90.8 billion and net quarterly profit of $23.6 billion, or $1.53 per diluted share, compared to revenue of $94.8 billion and net quarterly profit of $24.1 billion, or $1.52 per diluted share, in the year-ago...

What to Expect From Apple's Earnings Report This Week Following Vision Pro Launch

Apple will report its earnings results for the second quarter of its 2024 fiscal year on Thursday, May 2 at 1:30 p.m. Pacific Time. Apple's CEO Tim Cook and CFO Luca Maestri will discuss the results on a conference call with analysts a half hour later.

Keep reading for some key things to know about the quarter, including a recap of new products announced, revenue expectations, and more.

Ne...