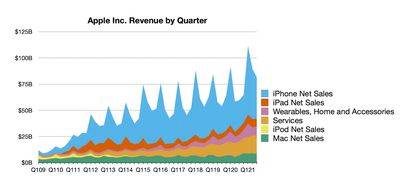

Apple today announced financial results for the third fiscal quarter of 2021, which corresponds to the second calendar quarter of the year.

For the quarter, Apple posted revenue of $81.4 billion and net quarterly profit of $21.7 billion, or $1.30 per diluted share, compared to revenue of $59.7 billion and net quarterly profit of $11.25 billion, or $0.65 per diluted share, in the year-ago quarter. Apple's top-line numbers shattered June quarter records for the company.

Gross margin for the quarter was 43.3 percent, compared to 38.0 percent in the year-ago quarter. Apple also declared a quarterly dividend payment of $0.22 per share, payable on August 12 to shareholders of record as of August 9.

“This quarter, our teams built on a period of unmatched innovation by sharing powerful new products with our users, at a time when using technology to connect people everywhere has never been more important,” said Tim Cook, Apple’s CEO. “We’re continuing to press forward in our work to infuse everything we make with the values that define us — by inspiring a new generation of developers to learn to code, moving closer to our 2030 environment goal, and engaging in the urgent work of building a more equitable future.”

As has been the case for over a year now, Apple is once again not issuing guidance for the current quarter ending in September.

Apple will provide live streaming of its fiscal Q3 2021 financial results conference call at 2:00 pm Pacific, and MacRumors will update this story with coverage of the conference call highlights.

Apple earnings call recap ahead...

1:40 pm: Apple beat analyst estimates across the board in both top-line revenue and earnings numbers, as well as in individual product categories.

1:42 pm: Apple's previous June quarter revenue record was $59.7 billion a year ago, while the previous profit record was $11.5 billion back in 2018.

1:44 pm: After falling about 1.5% during regular trading today ahead of the earnings release, Apple's stock price saw a brief surge right around the release, but is now down about another 0.5%. With Apple still not providing financial guidance for the current quarter, investors and analysts remain unsure about just what to expect going forward.

2:00 pm: The earnings call is about to begin.

2:01 pm: They are beginning with warnings about Covid-19 possibly affecting earnings and revenue in the future.

2:02 pm: Tim Cook is on the call now, saying Apple is reporting a very strong quarter across all product categories and geographic segments.

2:03 pm: Retail sales set a June quarter record, and almost all Apple Retail Stores are open.

2:03 pm: But "progress made is not progress guaranteed."

2:03 pm: The road to recovery will be a winding one. In the midst of that enduring adversity, we are humbled that our technology is playing a key role in keeping our customers connected.

2:04 pm: We are also working towards a healthier and more equitable world and will have more to share there.

2:05 pm: We're in the early innings of 5G, but they have made a significant impact into how people can get the most out of our technology.

2:05 pm: Cook is touting the various features and accessories of the iPhone 12.

2:05 pm: iPad had its best June quarter in nearly a decade. Mac set a new June quarter record.

2:06 pm: Wearables Home and Accessories set a new June quarter record as well.

2:06 pm: AirTag began shipping to an enthusiastic response from customers.

2:06 pm: Services set a new all-time revenue record.

2:06 pm: 35 Emmy nominations for Apple TV+

2:07 pm: Cook is talking up other new features this quarter, like spatial audio for Apple Music.

2:08 pm: The app economy generated $643 billion in 2020.

2:09 pm: Powerful new updates are coming to iOS, iPadOS, macOS, and WatchOS this fall.

2:09 pm: Cook is talking about new features coming, like Focus and Spatial Audio for FaceTime.

2:10 pm: Our new Health Sharing feature will make it easier than ever to share health data with loved ones. Walking Steadiness.

2:10 pm: In the belief that privacy is a fundamental human right, we shared new features in iOS 15 that drive privacy forward.

2:11 pm: Accessibility remains a bedrock principle for us as well.

2:11 pm: The responsibility to be a force for good in the lives of others extends beyond the technology we make. We awarded innovation grants to four historically black colleges and universities to expand coursework in engineering.

2:13 pm: Working to bring more affordable housing to the Bay Area and around California. Contributed $1 billion to help first-time homeowners and build affordable housing.

2:14 pm: I'm greatful for the dedication of our teams to the simple mission of creating technology that improves people's lives. I want to thank everyone at Apple for the purpose and passion they bring to that mission.

2:14 pm: CFO Luca Maestri is taking a deeper dive into the numbers.

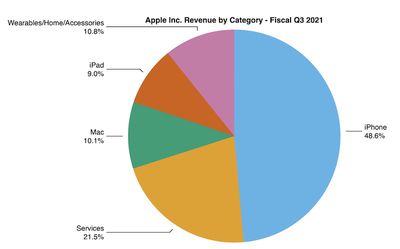

2:14 pm: Double digit growth in each product categories with all-time record for services and June quarter records for iPhone, Mac, and Wearables/Home/Accessories.

2:15 pm: Products revenue was a June revenue, up 37% from a year ago. Unmatched loyalty of our customers drove to new installed base record.

2:15 pm: Company gross margin was 43.3 percent, up 80 basis points from last quarter thanks to cost savings, higher mix of services, and partially offset by seasonal loss of leverage.

2:15 pm: Services gross margin was 69.8 percent.

2:16 pm: iPhone set a June quarter record of $39.6 billion, up 50% year over year, exceeding our expectations. Consistently strong across the world, strong double digits in each geographic segment, setting June quarter records in most markets we track.

2:16 pm: In US, latest survey of consumers from 451 research, shows customer sat for iPhone 12 family of 97%

2:17 pm: Newest service offerings continue to scale across users, content, and features. Key drivers for services all continue to move in the right direction. Installed base of devices hit an all time high across each geographic segment. Transacting and paid accounts on digital content stores reached a new all-time high across each geographic segment. Paid accounts increased by double digits.

2:18 pm: More than 700 million paid subscriptions across Apple's platforms. 4x the number of paid subscriptions we had 4 years ago.

2:18 pm: New services are coming, while growing breadth of existing services.

2:19 pm: Wearables up 36% to $8.8 billion. Product offerings in this category continue to improve, including the new Apple TV 4K and AirTags.

2:19 pm: Apple Watch continues to extend its reach with nearly 75% of customers being new to the product.

2:19 pm: Mac, despite supply constraints, set June record. Remarkable that the last four quarters for Mac have been its best 4 quarters ever.

2:19 pm: Driven by customer response to new Macs powered by the M1 chip.

2:20 pm: iPad growth strong, with new iPad Pro powered by M1 chip. Both iPad and Mac have taken computing to the next level. Performance combined is now the size of a Fortune 50 business.

2:20 pm: Half of customers purchasing Mac and iPad were new to that product. 451 research showed customer sat at 92% for Mac, 95% for iPad.

2:21 pm: MassMutual is offering M1 MacBook Pro to all employees, and equipping all conference rooms with M1 Mac Minis in anticipation of a return to work.

2:21 pm: MacBook Air is seeing corporate adoption as well.

2:22 pm: $194 billion in cash and securities. Total debt of $122 billion. Net cash is $72 billion.

2:22 pm: We are able to return $29 billion to shareholders during June. $3.8 billion in dividends and $17.5 billion of open market purchases.

2:22 pm: 32 million shares retired.

2:23 pm: Given continued uncertainty, we are not providing revenue guidance.

2:24 pm: Expect strong, double-digit year over year revenue growth for September quarter. Lower than June quarter YoY growth: Foreign exchange impact on growth rate to be three points less favorable than June quarter. Services growth rate will return to more typical level. Supply constraints on iPhone and iPad.

2:24 pm: Tax rate around 16 percent.

2:24 pm: Cash dividend of $0.22 per share.

2:28 pm: Q: Commentary on guidance, last year there was a later launch of iPhone than typical, could you talk us through that and the other products, what may be different vs last year?

A: We are expecting to grow very strong double digits. That's the starting point here. Growth rate below 36 percent, first factor is the dollar continues to be favorable to year over year basis (weakened against most currencies). But that benefit will be 3 points less in September quarter than June quarter. Dollar strengthened vs most currencies in recent weeks.

Services growth will likely slow from June quarter. A couple of services categories like Advertising and AppleCare that were significantly impacted a year ago because of Covid lockdowns. We don't expect that to continue into September quarter.

Supply constraints that we've seen in June quarter will be higher during September quarter. When we talked here 3 months ago, we said we were expecting supply constraints between $3 and $4 billion to affect iPad and Mac. We mitigated some of those constraints, so slightly below the low end of that range. Expect that number to be higher for September quarter.

Put all that together, very strong double digit growth for September with those caveats.

2:30 pm: Q: Do you expect supply constraints to persist through December quarter and holiday selling season? What additional costs are you absorbing because of supply constraints? Is that having an effect on margins?

A: In terms of cost, we're paying more for freight than I would like to pay. But component costs continue in the aggregate to decline. In terms of supply constraints and how long they last, I don't want to predict that. We're taking it one quarter at a time. We'll do whatever we can to mitigate whatever set of circumstances we're dealt.

Our results for gross margin, we really saw some nice cost savings in the quarter. Providing guidance of 41.5-42.5 for September, which is a level we're very pleased with.

2:32 pm: Q: World of unprecedented things, for R&D and innovation, is it being impacted by that where a normal cadence is unfair, or can you empower people to work remotely and still have the same innovations that you've had in the past?

A: Employees are really doing double duty and the company is very resilient. Can not be more pleased with the cadence that we're coming out with new things. Software announcements that we've made at WWDC and corresponding launches for software that we're planning on for fall, all of the products from the last 12-18 months, it's amazing. I'm very pleased with it.

2:33 pm: Q: What have you learned from this iPhone cycle from customer preferences and things like that, and geographic basis too?

A: Look at results in Q3, strong double digit growth for switchers and upgraders. Largest upgrade quarter for Q3 ever. Feel really great about both categories and as Luca said during the preamble, our results are really strong for iPhone around the world. Very strong cycle and yet the penetration on 5G is still very low. Feel really good about the future of the iPhone.

2:34 pm: Q: China up 58%, what are you seeing from customers and where are you seeing growth?

A: Incredibly strong quarter, June quarter revenue record for greater China. Very proud of that and doing the best job we can to serve customers there. Strong response to 12 Pro and 12 Pro Max. Balance of our products, we also set June quarter records for Wearables/Home/Accessories, Mac, and Services. It was an across-the-board strength. Seeing plenty of new customers come to the market. Mac and iPad, two-thirds of customers who bought in the last quarter were new to that product. Apple Watch it was 85%. We could not be happier with the results.

2:36 pm: Q: Historically, September tends to be flat or up gross margin. Can you talk more about it?

A: Q3 results, 43.3% gross margin. In addition to getting really good cost savings on a sequential basis, we had a high mix of services as part of the total. Rebound from covid lockdowns in September a year ago. As we move forward sequentially, we expect a different mix. Significantly higher than even a year ago, a year ago we were at 38.2 percent. Almost 400 basis points of expansion on a year over year basis. Just a different mix.

2:38 pm: Q: Is it higher ARPU or install base, and how does that stack up?

A: Installed base continues to grow, larger opportunity from that. More people engaged in our ecosystem. People for free, or willing to pay for services. Continues to grow nicely. That obviously helps on the revenue side. Continue to increase both the quality and the quantity of the services. Launched a lot of new services. These are businesses that we are scaling right now. That revenue helps and flows through growth rates. It's very nice for us to see.

2:41 pm: Q: Debate in the market on how much Apple benefitted from the pandemic. Spend on App Store, etc. Other areas limited by the pandemic and stores closed. Was your business helped or hindered by the pandemic?

A: We don't have the crystal ball to tell us what the variables would be and how they impacted our business. On the positive side of the ledger, during extreme lockdowns, digital services did very well because entertainment options were limited. Services did really well. With more people working from home, studying from home, iPad and Mac demand was very strong.

On the other side, services like AppleCare and Advertising were affected negatively. Certain products, like iPhone or Watch are more complex types of sales, they were also affected because so many points of sale were closed around the world. Not just our stores, but partner stores. Now, some of these businesses are rebounding. Ads and AppleCare... iPad and Mac, it's difficult for us to gauge because it's been constrained for a long period of time. Maybe the new normal exiting Covid may be different from the past. Maybe more hybrid models around work.

So it's difficult to say on a net basis what that is. It's very fluid and tends to change over time. We're all looking forward to a Covid-free world for us and for our customers as well.

2:44 pm: Q: On iPhones, after strong product cycle, iPhone revenues come under pressure because upgrade rate slows, mix shifts to lower end of portfolio. Is it fair to assume a similar trend will play out over the next year and if not what's different this time?

A: We're not predicting the next cycle, but I would point out a few things: We have a very large and growing installed base. With iPhones past a billion active devices earlier this year, we have loyal and satisfied customers. Geographic response is pervasive across the world. Top 3 selling models in US, UK 4 out of top 5, Australia top 2, Japan top 3, Urban China top 2. The response from customers all around has been great. The product itself is amazing. The 12 lineup was a huge leap that introduced 5G, A14 Bionic and a number of other fantastic features that customers love. We're in the very early innings of 5G. Look at 5G penetration around the world, there's only a couple of countries that are in double digits yet. That's an amazing thing, 9 months or so into this. We're going to continue to deliver great products. Integrate hardware, software and services together into an amazing experience. Those are the things that I would consider if I were coming up with the forecast.

2:46 pm: Q: How old is the installed base? How are upgrades happening and how old is that iPhone base?

A: It's difficult to answer the question precisely. On both switchers and upgraders, we did well in Q3. Geographic representation of iPhone, year over year comps, looks extremely well. We're really pleased with it. I would remind you that the billion number that I quoted was just iPhone. We quoted a number in the January call of 1.65 billion devices. Total active devices. The net is, very strong switchers and upgraders, best upgrade quarter for June that we've seen. We feel really great about the momentum.

But we recognize that 5G penetration is quite low around the world and we're at the front end of this.

2:48 pm: Q: How does Apple determine what you want to make yourself vs not-strategic and outsource. Is ARM getting acquired by Nvidia beneficial or neutral or negative?

A: I'll leave questions about the acquisition to everyone else. How we decide to make silicon, can we do something better? Can we deliver a better product? If we can buy something in the market and it's great, as good as what we can do, we're going to buy it. We'll only enter where we have the ability to do something better and make a better product for the user. M1, we have ability within silicon team to make a product that's appreciably better than we could buy. We've taken our great hardware and software expertise and combined those and brought the M1 out. Response has been unbelievable. Powering Mac sales that are constrained. iPad also has constraints. That's how we look at that and how we should enter a market or not.

2:50 pm: Q: Services growth normalizing in the quarter, so what is a normalized growth rate for Services business as folks return to the office in post-Covid world?

A: Go back several quarters to get a bit of an average. A bit of variability around the results, but certainly we haven't done 33 percent in years. That was a bit of an anomaly and business has a good compare in June quarter. Services growth has been for many quarters strong double digits. We're confident around that level.

2:51 pm: Q: In September, there will be supply constraints on iPhone and iPad. First time on component shortages impacting iPhone. Display or something else? What is the choke point?

A: Majority of constraints are of the variety that others are seeing. Industry shortage. We do have some shortages in addition to that that are where the demand has been so great and beyond our own expectations that it's difficult to get the entire set of parts within the lead times that we try to get those. It's a little bit of that as well. As I said before, the latest nodes which we use in several of our products have not been as much of an issue. Legacy nodes are where the supply constraints have been on silicon.

2:54 pm: Q: Based on the data and the comments about upgrades and switchers being strong, as well as geographic areas, what's that specific set of datapoints mean for the iPhone? SE2 driving price down, is there less of a need for a lower priced product going forward and will current portfolio and new generation be higher end in nature?

A: We had incredible quarter for emerging markets. June quarter records in Mexico, Brazil, Chile, Turkey, UAE, Poland, Czech Republic, India. Obviously in China as I talked about before. Thailand, Malaysia, Vietname, Cambodia, Indonesia. It's a very long list. Those results are for the entire line of products and we still do have SE in the line. Launched it a year ago but it's still in the line today. It's sort of our entry price point. I'm pleased with how all of them are doing and I think we need that range of price points to accomodate the types of people that we want to accomodate. For entry buyer who wants to get in, then something for pro buyer who wants the very best iPhone they can buy.

That's true in emerging markets as good as its true in the US or other developed markets.

2:54 pm: Q: Is the emerging market buyer who wants to get into the iPhone, are they looking for 5G over the intermediate or longer term if available from infrastructure?

A: In most markets that I read, it's really, really, really early on 5G. Really early. Top end buyer is buying for the future as well. They may hold their phone for two years or longer. 5G becomes an important part of their buying decision.

2:57 pm: Q: How will Apple One bundles influence trajectory of services re economics, and how do you think IDFA is developing and influencing the trajectory of advertising within services?

A: Apple One, we're offering Apple One because it makes enjoying our subscription services easier than ever before. Apple Music, Apple TV+, Apple Arcade and iCloud. We put the customer at the center of that and have recently begun to remind people about Apple One in a way that we probably waited a few months before doing that. I'm very pleased with what we're seeing with Apple One right now. I think it's a great ramp for the future of services. It's a great customer benefit because many of our customers like trying out more than one of these services. It's one easy bundle and subscription services.

In terms of IDFA or advertising in general, I take it your question is about ATT — with ATT we've been getting quite a bit of customer reaction, positive reaction to being able to make the decision on a transparent decision on whether to be tracked or not. It seems to be going very well from a user point of view.

3:00 pm: Q: Can you go more into gross margin?

A: On the freight side we're seeing some level of cost pressure that is out of the norm. Components getting good cost savings on sequential basis, very good from level of gross margin on product side. Up 600 basis points year over year. It feels like something that we've been able to accomplish and maintain at least in the near term. Nothing that was abnormal during the quarter or one-off in nature. Pretty structural.

On services, on a year over year basis, sequential decline was small. Very large margin profile across many services, any change in mix can drive a lot of changes. AppleCare has rebounded, so the relative success of services in the marketplace can drive some changes in gross margin. 69.8% we're very very happy with where we are with services margin trajectory.

3:01 pm: Q: Regulatory focus in China on Chinese companies, not a direct impact on Apple but how should investors handicap indirect impact given that some of these companies are large contributors to App Store revenues. Are you seeing any impact on these and is the limiting of the usage of these apps influencing how people are interacting with your devices? Any ancillary impact?

A: For the quarter, as you can see, we grew 58% in Greater China so embedded in that was a quarterly record for services which includes the App Store. The economy has really bounced back there from Covid. In terms of regulatory focus, what we are focusing on from our angle is to serve users there and make sure that they're very satisfied with products and services that we're showing. We work with a lot of different companies to ensure that. That's our focus.

3:01 pm: The call has ended.