Gartner

By MacRumors Staff

Gartner Articles

Analysts Have No Idea How Many Macs Apple Shipped Last Quarter

For the last several years, Apple has not provided breakdowns of the number of iPhones, Macs, and iPads sold, keeping analysts, customers, investors, and others in the dark on exact device sales. This has led analysts to attempt to estimate product shipments, and as the Q3 quarterly Mac numbers confirm, it's a very inexact process.

Companies like Gartner, IDC, and Canalys in fact appear to...

Read Full Article 124 comments

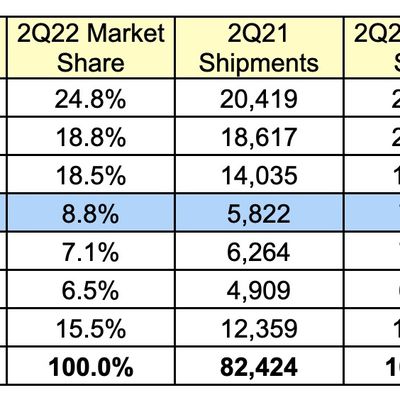

Apple's Mac Shipments Grew in Q2 2022 Amid Continued Worldwide PC Shipment Decline

Apple's worldwide Mac shipments were up in the second quarter of 2022, according to new PC shipping estimates shared today by Gartner. Apple shipped an estimated 6.4 million Macs during the quarter, up from 5.8 million in the year-ago quarter, marking 9.3 percent year-over-year growth.

Gartner's Preliminary Worldwide PC Vendor Unit Shipment Estimates for 2Q22 (Thousands of Units)

Apple...

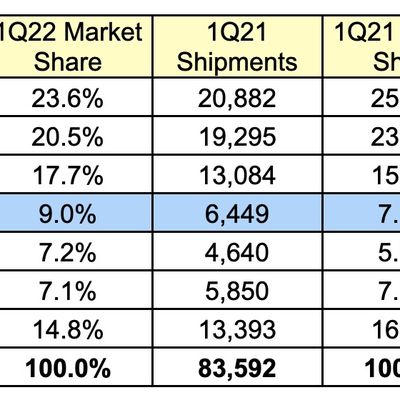

Mac Shipments Up in Q1 2022 Amid Worldwide PC Shipment Decline

Apple's worldwide Mac shipments were slightly up in the first quarter of 2022, according to new PC shipping estimates shared this afternoon by Gartner. Apple shipped an estimated 7 million Macs during the quarter, up from 6.5 million in the year-ago quarter, marking 8.6 percent growth.

Gartner's Preliminary Worldwide PC Vendor Unit Shipment Estimates for 1Q22 (Thousands of Units)

Apple was...

Apple Surpassed Samsung as World's Largest Smartphone Maker in Fourth Quarter

Apple overtook Samsung to become the largest smartphone vendor worldwide in the fourth quarter of 2020, a feat not achieved by Apple since 2016, according to market data by Gartner.

In the final quarter of 2020, Apple sold 80 million new iPhones, largely driven by the launch of the first 5G-enabled iPhone series. Anshul Gupta, Senior Research Director at Gartner, says that 5G and improved...

Apple Extends Lead Over Samsung As Biggest Buyer of Semiconductor Chips in 2020

Apple was easily the largest buyer of semiconductor chips in 2020, according to the latest data collected by Gartner. Apple spent $53.6 billion and took 11.9% of the global market share, representing 24% growth year-on-year, while Samsung was the second biggest buyer, spending $36.4 billion and taking 8.1% of the market, representing 20.4% growth year-on-year.

Together, the two companies...

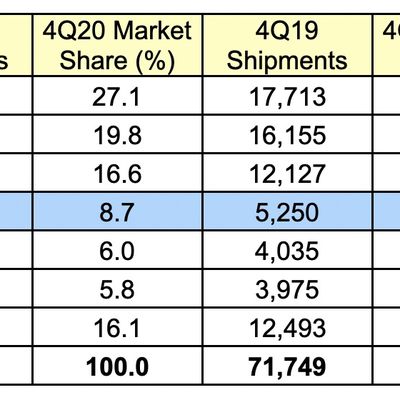

Mac Shipments Rise Significantly in Q4 2020 Amid Overall PC Market Growth

Apple's worldwide Mac shipments were up in the fourth quarter of 2020, according to new PC shipping estimates shared this afternoon by Gartner. Apple shipped an estimated 6.9 million Macs during the quarter, up from the 5.25 million it shipped in the year-ago quarter, marking growth of 31.3 percent.

Gartner's Preliminary Worldwide PC Vendor Unit Shipment Estimates for 4Q20 (Thousands of Units)

...

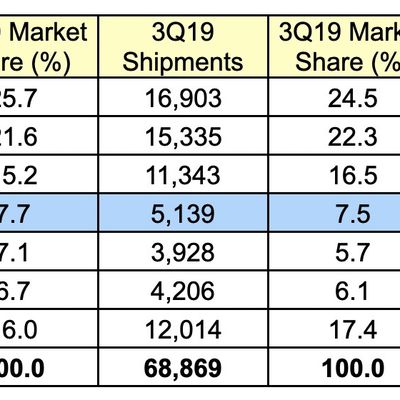

Mac Shipments Up in Q3 2020 Amid Worldwide PC Market Growth

Apple's worldwide Mac shipments saw decent growth in the third quarter of 2020, according to new preliminary PC shipping estimates shared this afternoon by Gartner.

Gartner's Preliminary Worldwide PC Vendor Unit Shipment Estimates for 3Q20 (Thousands of Units)

Apple shipped an estimated 5.5 million Macs during the quarter, up 7.3 percent from the 5.1 million that it shipped in the third...

Apple's Worldwide Mac Shipments Up in Q2 2020 Amid Overall PC Market Growth

Apple's worldwide Mac shipments were up 5.1 percent during the second quarter of 2020, according to new PC shipping estimates shared this afternoon by Gartner.

Gartner's Preliminary Worldwide PC Vendor Unit Shipment Estimates for 2Q20 (Thousands of Units)

Apple shipped an estimated 4.4 million Macs in Q2 2020, up from the 4.2 million shipped in Q2 2019, with shipments growing even amid the...

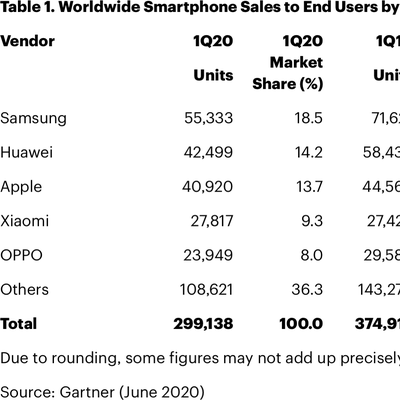

Global iPhone Sales Dropped an Estimated 8% in Q1 2020, Overall Smartphone Sales Down 20%

Apple's iPhone sales dropped eight percent in the first quarter of 2020, according to new data shared today by Gartner.

Apple sold an estimated 40.92 million smartphones during the quarter, a 3.7 million drop from the 44.57 million that it sold in the first quarter of 2019.

Other smartphone manufacturers saw much steeper drops in sales. Samsung's sales, for example, were down 22.7...

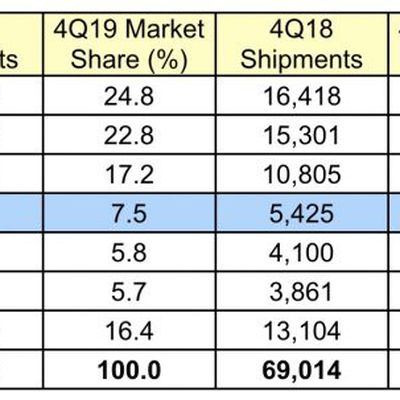

Mac Shipments Down in Q4 2019 Amid Overall PC Market Growth

Apple's worldwide Mac shipments were down in the fourth quarter of 2019, according to new PC shipping estimates shared this afternoon by Gartner.

Apple shipped an estimated 5.26 million Macs during the quarter, down from 5.43 million in the year-ago quarter, a decline of three percent.

Gartner's Preliminary Worldwide PC Vendor Unit Shipment Estimates for 4Q19 (Thousands of Units)

Apple's...

Mac Shipments Down in Q3 2019 Amid Overall Worldwide PC Market Growth

Apple's worldwide Mac shipments were down in the third quarter of 2019, according to new preliminary Pc shipping estimates shared this afternoon by Gartner.

During the quarter, Apple shipped an estimated 5.1 million Macs, down from 5.3 million in the third quarter of 2018, marking a 3.7 percent drop in shipments. Apple's marketshare also declined slightly, dropping from 7.9 percent to 7.5...

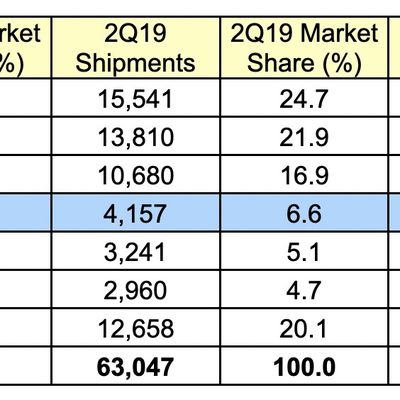

Research Firms Paint Contrasting Pictures of Apple's Mac Shipments in Q2 2019

Prominent research firms Gartner and IDC attempt to estimate shipments of computers around the world on a quarterly basis, and both firms today released their estimates for the second calendar quarter.

Gartner's and IDC's estimates are just that — estimates – and with Apple no longer reporting unit sales of Macs and other products, we won't know how accurate these estimates end up being....

Mac Shipments Down in Q1 2019 Amid Worldwide PC Decline

Amid a decline of 4.6 percent in worldwide PC sales, Apple's Mac sales were also down 2.5 percent in the first quarter of 2019, according to new PC shipment estimates shared this afternoon by Gartner.

Apple shipped an estimated 3.98 million Macs during the quarter, down from 4.08 million in the year-ago quarter. Apple's market share grew year-over-year though, coming in at 6.8 percent, up from ...

Gartner: iPhone Sales Suffered Worst Quarterly Decline for Three Years Over 2018 Holiday Period

Apple recorded its biggest decline in iPhone sales for almost three years over the holiday quarter, according to new market research data by Gartner.

Apple sold 64 million iPhones in the fourth quarter of 2018, down from 73 million in Q4 2017. Those numbers followed a pattern of declining smartphone sales globally in Q4 2018, with growth of just 0.1 percent over the period and 408.4...

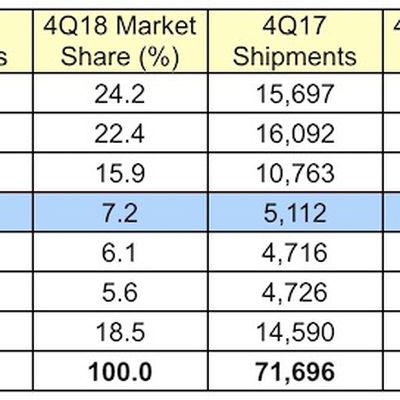

Apple's Mac Sales Drop in Q4 2018 Amid Worldwide PC Shipment Decline

Apple's worldwide Mac shipments fell in the fourth quarter of 2018, according to new preliminary PC shipping estimates shared this afternoon by Gartner.

During the quarter, Apple shipped an estimated 4.9 million Macs, down from 5.1 million in the year-ago quarter. Apple's share of the market grew, however, from 7.1 percent in 3Q18 to 7.2 percent.

Gartner's Preliminary Worldwide PC Vendor ...

Apple's Mac Sales Down in Q3 2018 Amid a Lack of Updates

Apple's worldwide Mac shipments were down in the third quarter of 2018, according to new preliminary PC shipping estimates shared this afternoon by Gartner.

During the quarter, Apple shipped an estimated 4.9 million Macs, compared to 5.4 million in the third quarter of 2017 for an 8.5 percent drop. Apple's market share also declined, dropping from 8 percent in 3Q17 to 7.3 percent in 3Q18.

Ga ...

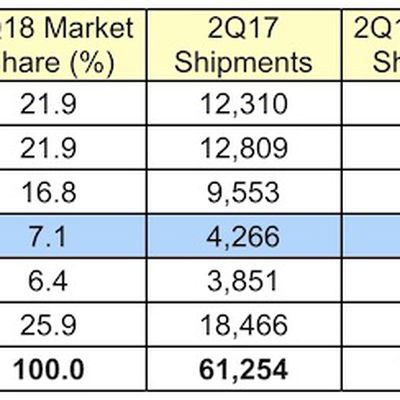

Apple's Mac Shipments Increase in Q2 2018 as PC Market Sees First Growth in 6 Years [Updated]

Apple's worldwide Mac shipments grew 3 percent in the second quarter of 2018 compared to the year-ago quarter, according to new preliminary PC shipping estimates shared today by Gartner.

During the quarter, Apple shipped an estimated 4.4 million Macs, compared to 4.26 million in the second quarter of 2017. Apple's market share also saw slight growth, improving from 7 percent in Q2 2017 to 7.1...

Mac Shipments Remain Steady in Q1 2018 Amid Continuing Worldwide PC Decline

Amid a continuing decline in worldwide PC shipments, Apple's Mac sales have remained steady in the first quarter of 2018, according to new PC shipping estimates shared this afternoon by Gartner.

Apple shipped an estimated 4.26 million Macs during the first quarter of 2018, up from 4.2 million Macs in the year-ago quarter, marking 1.5 percent growth.

Apple's market share for the quarter...

iPhone and Android Duopoly Nears Peak With Estimated 99.9% Market Share Last Year

A record 99.9 percent of smartphones sold worldwide last year were based on either Android or iOS, as all competing platforms have effectively been squeezed out, according to data shared today by research firm Gartner.

Android remains more widely adopted than iOS by a significant margin, with a roughly 86-14 percent split between the respective operating systems last year. Android's...

Apple Rises to Become World's Fourth-Largest PC Maker With Around 20M Macs Sold Last Year

Apple rose to become the world's fourth-largest PC maker in 2017, as Mac sales increased to nearly 20 million during the year, according to the latest estimates shared by research firms IDC and Gartner.

The roughly 19.6 million total is based on Apple's reported Mac sales of 13.9 million units in the first three calendar quarters of the year, while IDC and Gartner estimate Apple sold another ...