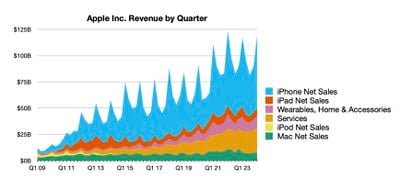

Apple today announced financial results for the first fiscal quarter of 2024, which corresponds to the fourth calendar quarter of 2023.

For the quarter, Apple posted revenue of $119.6 billion and net quarterly profit of $33.9 billion, or $2.18 per diluted share, compared to revenue of $117.2 billion and net quarterly profit of $30.0 billion, or $1.88 per diluted share, in the year-ago quarter.

Gross margin for the quarter was 45.9 percent, compared to 43.0 percent in the year-ago quarter. Apple also declared a quarterly dividend payment of $0.24 per share, payable on February 15 to shareholders of record as of February 12.

"Today Apple is reporting revenue growth for the December quarter fueled by iPhone sales, and an all-time revenue record in Services," said Tim Cook, Apple's CEO. "We are pleased to announce that our installed base of active devices has now surpassed 2.2 billion, reaching an all-time high across all products and geographic segments. And as customers begin to experience the incredible Apple Vision Pro tomorrow, we are committed as ever to the pursuit of groundbreaking innovation — in line with our values and on behalf of our customers."

As has been the case for over three years now, Apple is once again not issuing guidance for the current quarter ending in March.

Apple will provide live streaming of its fiscal Q1 2024 financial results conference call at 2:00 pm Pacific, and MacRumors will update this story with coverage of the conference call highlights.

Conference call recap ahead...

1:38 pm: After rising over 1% in regular trading today and another 1% after hours in advance of the earnings release, Apple shares have given back all of those gains following the release.

1:40 pm: "Our December quarter top-line performance combined with margin expansion drove an all-time record EPS of $2.18, up 16 percent from last year," said Luca Maestri, Apple's CFO. "During the quarter, we generated nearly $40 billion of operating cash flow, and returned almost $27 billion to our shareholders. We are confident in our future, and continue to make significant investments across our business to support our long-term growth plans."

1:41 pm: Apple's fiscal Q1 included the standard 13 weeks, compared to Q1 2023 which had an extra week as happens every few years to reset the calendar.

2:00 pm: Apple's gross margin of 45.9% is its highest in more than a decade, though the 47.4% in Q2 2012 was artificially boosted by one-time items.

2:02 pm: Apple's earnings call with analysts is beginning. Expect Apple CEO Tim Cook and CFO Luca Maestri to make opening remarks and then participate in a Q&A.

2:02 pm: On the stream, we can hear the operator making introductions but there appear to be technical problems on Apple's side.

2:03 pm: In an unusual development, the call has gone back to hold music.

2:05 pm: We're trying again. The operator is on to make introductions.

2:07 pm: It's working. The introduction starts with a note about the 13-week versus 14-week December quarters.

2:08 pm: Tim is starting to report revenue $119.6 billion, up 2% from a year ago, despite one less week in the quarter. Earnings per share was $2.18, up 16%, and an all-time record.

2:08 pm: "We achieved revenue records across more than two dozen countries and regions, including all-time records in Europe and the rest of Asia Pacific. We also continue to see strong double-digit growth in many emerging markets with all-time records in Malaysia, Mexico, the Philippines, Poland, and Turkey, as well as December quarter records in India, Indonesia, Saudi Arabia, and Chile."

2:09 pm: "In services, we set an all-time revenue record with paid subscriptions growing double digits year over year. And I'm pleased to announce today that we have set a new record for our install base, which has now surpassed 2.2 billion active devices."

2:09 pm: "We are announcing these results on the eve of what is sure to be a historic day as we enter the era of spatial computing. Starting tomorrow, Apple Vision Pro, the most advanced personal electronics device ever, will be available in Apple stores for customers in the US with expansion to other countries later this year."

2:10 pm: "Apple Vision Pro is a revolutionary device built on decades of Apple innovation, and it's years ahead of anything else. Apple Vision Pro has a groundbreaking new input system and 1000s of innovations. and it will unlock incredible experiences for users and developers that are simply not possible on any other device."

2:10 pm: "As we look ahead, we will continue to invest in these and other technologies that will shape the future. That includes artificial intelligence, where we continue to spend a tremendous amount of time and effort and we're excited to share the details of our ongoing work in that space later this year."

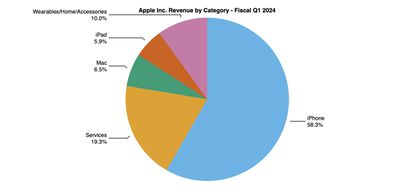

2:11 pm: "Now let's turn to the results for the December quarter. beginning with iPhone. We're proud to report that revenue came in at $69.7 billion, 6% higher than a year ago." Tim is touting the new iPhone 15 and 15 Pro.

2:13 pm: "Turning to Mac, revenue came in at $7.8 billion, up 1% year over year, driven by the strength of our latest M3-powered MacBook Pro models, in spite of having one less week of sales." He mentions the 40th anniversary of the Mac last week, and the speed of innovation in Apple Silicon.

2:14 pm: "In iPad, revenue for the December quarter was $7 billion, down 25% year over year due to a difficult compare with the launch of a new iPad Pro and the 10th generation iPad during the December quarter last year, and one less week of sales."

2:14 pm: "In Wearables, Home and Accessories, revenue came in at $12 billion, down 11% from a year ago due to a difficult compare with the launch timing of several products in this category and the impact of the 14 week last year."

2:15 pm: He touts Apple Watch and AirPods, but does not mention the oxygen sensor lawsuit issues.

2:16 pm: "In services, we set an all-time revenue record of $23.1 billion, an 11% year-over-year increase even with one less week this quarter. This growth represents an acceleration from the September quarter. And we achieved all-time revenue records across advertising cloud services. Payment Services and video, as well as December quarter records in App Store, and AppleCare."

2:17 pm: He's giving an overview of Apple TV+ with all the award nominations, as well as mentions of Major League Soccer streaming and the Apple Music Super Bowl Halftime Show featuring Usher.

2:18 pm: "Turning to retail, in recent months. we opened three stores, including our 100th store in Asia Pacific. Throughout the holidays, our team members pulled out all the stops to help customers find the perfect gift. And I know our US team members are especially excited to begin demoing Apple Vision Pro for our customers tomorrow."

2:18 pm: He's discussing Apple's efforts to honor Black History Month with a new Apple Watch band and backgrounds. He's also discussing the company's Racial Equity and Justice initiatives, as well as its work on environmental issues.

2:19 pm: "We are optimistic about the future, confident in the long term, and as excited as we've ever been to deliver for our users like only Apple can."

2:19 pm: CFO Luca Maestri is on to dive deeper into the financials.

2:20 pm: "Revenue for the December quarter was $119.6 billion, up 2% from last year. In the December quarter a year ago, two unique factors affected our results. First, we had an additional week in the quarter, and second. we had COVID-related factory shutdowns that limited iPhone supply. We estimate that the net impact of these two factors resulted in a two percentage point headwind to our revenue performance this quarter."

2:20 pm: "We set all-time revenue records in Europe and the rest of Asia Pacific and continue to see strong performance across our emerging markets with double-digit growth in the majority of the emerging markets we track."

2:21 pm: "Products revenue was $96.5 billion, flat compared to last year, driven by strength in iPhone, offset by challenging compares for iPad, and wearables home and accessories, and one less week of sales this year across the entire portfolio."

2:21 pm: "Thanks to our unparalleled customer loyalty and very strong levels of customer satisfaction, our total installed base of active devices set a new record across all products and all geographic segments and is now over 2.2 billion active devices."

2:22 pm: "Services revenue set an all time record of $23.1 billion, up 11% year over year when we take into account the extra week last year. This represents a sequential acceleration of growth from the September quarter. We're very pleased with our services performance in both developed and emerging markets."

2:23 pm: "Company gross margin was 45.9%, up 70 basis points sequentially, driven by leverage and favorable mix, partially offset by foreign exchange. Product gross margin was 39.4%, up 280 basis points sequentially, also driven by leveraging mix, partially offset by foreign exchange. Services gross margin was 72.8%, up 190 basis points from last quarter due to a more favorable mix."

2:24 pm: "Operating expenses of $14.5 billion were at the midpoint of the guidance range we provided. Net income was $33.9 billion, up 3.9 billion from last year. Diluted EPS was $2.18, up 16% versus last year and an all time record, and operating cash flow was very strong at $39.9 billion."

2:24 pm: "Our iPhone active installed base grew to a new all time high and we had an all time record number of iPhone upgraders during the quarter. Customers are loving the new iPhone 15 family with the latest reports from 451 Research indicating customer satisfaction of 99% in the US.

In fact, many iPhone models were among the top-selling smartphones around the world during the quarter. According to a survey from Cantar, iPhones were four out of the top five models in the US and Japan, four out of the top six models in urban China and the UK, and all top five models in Australia."

2:26 pm: "Mac generated revenue of $7.8 billion and returned to growth despite one less week of sales this year. This represents a significant acceleration from the September quarter and we faced a challenging compare due to the supply disruptions and subsequent demand recapture we experienced a year ago. Customer response to our latest iMac and MacBook Pro models powered by the M3 chips has been great. And our Mac installed base reached an all time high with almost half of Mac buyers during the quarter being new to the product. Also, 451 Research recently reported customer satisfaction of 97% for Mac in the US."

2:26 pm: "iPad was $7 billion in revenue, down 25% year over year. iPad faced a difficult compare because during the December quarter last year, we launched the new iPad Pro and iPad 10 generation and we had an extra week of sales. However, the iPad install base continues to grow and is at an all time high with over half of the customers who purchased iPads during the quarter being new to the product. Customer satisfaction for iPad was recently measured at 98% in the US."

2:28 pm: "Wearables, Home and Accessories revenue was $12 billion, down 11% year over year due to a challenging compare and the extra week a year ago.

...

We continue to attract new customers to Apple Watch. Nearly two-thirds of customers purchasing an Apple watch during the quarter were new to the product. And the latest reports from 451 research indicate customer satisfaction of 96% in the US and in services. We were very pleased with our double-digit growth, which was driven by the strength of our ecosystem.

Our installed base is now over 2.2 billion active devices and continues to grow nicely establishing a solid foundation for the future expansion of our services business. And we continue to see increased customer engagement with our services; both transacting accounts and paid accounts reached a new all-time high... We had well over 1 billion paid subscriptions across the services on our platform, more than double the number that we had only four years ago."

2:30 pm: He discusses enterprise use of Macs, but also shares interest from companies in the Apple Vision Pro.

"We are seeing strong excitement in enterprise, with leading organizations across many industries such as WalMart, Nike, Vanguard, Stryker, Bloomberg and SAP interested in leveraging and investing in Apple Vision Pro as a new platform to bring innovative spatial computing experiences to the customers and employees.

From everyday productivity to collaborative product design to immersive training, we cannot wait to see the amazing things our enterprise customers will create in the months and years to come."

2:30 pm: "We ended the quarter with $173 billion in cash and marketable securities. We decreased commercial paper by $4 billion, leaving us with total debt of $108 billion. As a result, net cash was $65 billion at the end of the quarter. And our goal of becoming net cash neutral over time remains unchanged. During the quarter, we returned nearly $27 billion to shareholders, including $3.8 billion in dividends and equivalents and $20.5 billion through open market repurchases of 112 million Apple shares."

2:31 pm: "We expect both our March quarter total company revenue and iPhone revenue to be similar to a year ago. For our services business, we expect a similar double digit growth rate to what we reported in the December quarter. We expect gross margin to be between 46 and 47%. We expect our CapEx to be between $14.3 and $14.5 billion we expect OINE to be around $50 million, excluding any potential impact from the mark to market of minority investments and our tax rate to be around 16%."

2:33 pm: Q: Can you unpack some of the services drivers a bit for us? How we should think about services growth for the March quarter, and then speak to some of those underlying drivers in the December quarter, and then the March quarter?

A: Let's start with the December quarter. Up 11% to $23.1 billion is an all-time record for us with all-time records in the Americas, in Europe, and the rest of Asia Pac, so it was pretty broad base geographically and very strong across all the services categories. Obviously, last year we had an extra week, so the 11% is stronger than the underlying performance that we have reported.

2:33 pm: A: Very significant growth there. What I said during the prepared remarks around the the March quarter, I mentioned that we will continue to grow double digits at a percentage that is similar to what we reported for the December quarter; we don't provide guidance around the different services category, so we will provide more color when we report in three months."

2:35 pm: Q: Could you share a bit more detail about the new users you will you were able to onboard over the last 12 months, meaning how might this new cohort look different from past cohorts, either in terms of geographic representation, or skew to certain products or even how their monetization differ from past cohorts?

A: I would say emerging markets have been a very key area of strength for us. India grew in revenue terms by very strong double digits in the December quarter and hit a quarter revenue record. The other emerging markets, like Indonesia, also had a quarterly record, and we had several regions with records from Latin America to the Middle East. And that theme has been pretty consistent across the other quarters of the year as well, so emerging markets very very important. And I feel like we're doing a great job there.

2:37 pm: Q: First on services, just on the outlook for the March quarter for a similar double-digit growth rate as of the December quarter. I'm just wondering, why not? Why wouldn't it be potentially faster given that the December quarter obviously had a headwind from the extra week comp and some of the pricing uplifts on select Apple One services that were implemented last winter should should help in the March quarter.

A: FX was essentially flat in the December quarter so you have a bit of a headwind there, and then when you look at the progression of our services business over the last few quarters, the compares for March are slightly more difficult than compares for December.

2:39 pm: Q: It was very interesting to hear about some of the enterprise customer investments into Vision Pro. Could you talk about some of the efforts to support the Vision Pro developer ecosystem, and it was also good to hear about the potential upcoming announcements on AI.

A: We are incredibly excited about the enterprise opportunities with Apple Vision Pro. I've seen several demos from different companies, Luca mentioned several in his opening remarks, but Walmart has a very cool merchandising app.

There are firms that are doing collaboration, design apps. There are field service applications. Really all over the map. There are applications that for control center / command center kind of things. SAP has really gotten behind it, and of course SAP is in so many companies that I think there will be a great opportunity for us and enterprise. We couldn't be more excited about where things are right now. This has been multiple years of efforts from so many people across apple and really took a whole of company effort to bring it this far.

In terms of generative AI which I would guess is your focus, we have a lot of work going on internally, as I've alluded to before. Our MO, if you will, has always been to to do work and then talk about work and not to get out in front of ourselves. And so we're going to hold that to this as well. but we've got some things that we're incredibly excited about, that we'll be talking about later this year.

2:41 pm: Q: Asking about the iPhone 15 upgrade cycle and what they saw in December.

A: If you look at iPhone 15, since the announcement and shipment in September, and you compare that to iPhone 14 over the same period of time, iPhone 15 is outselling iPhone 14. Upgraders hitting a record is particularly exciting for us.

2:44 pm: Q: How would you measure the success of Vision Pro over time and which Apple product's adoption curve would you look at us potentially the most similar?

A: So each product has its own journey and so I wouldn't want to compare it to any one in particular, I would just say we couldn't be more excited.

Internally, we've gotten a incredible amount of excitement from developers and from customers that can't wait till tomorrow to pick up their units.

And we're incredibly proud to be able to demo the unit in so many of our stores in the US starting tomorrow for people that want to check it out. And so we'll see and report the results of it in the Wearables category that that you're familiar with.

I think that if you look at it from a price point of view, there's an incredible amount of technology that's packed into the product. There's 5000 patents in the product and it's built on many innovations that Apple has spent multiple years on from, from silicon to displays and significant AI and machine learning. All the hand tracking, the room mapping, all this stuff is driven by AI. And so we're incredibly excited about it. I can't wait to be in a store tomorrow and and see the reaction.

2:45 pm: Q: I was hoping to talk a little bit about what are you seeing in China right now? I think from a geographic basis, it's one of the few places that was down double digits while everything else was going up slowly. What do you see now from a competition perspective and a demand perspective in China?

A: If you look at iPhone in China mainland, which I think has been the focus of a lot of interest, and you look at it in constant currency, so more of an operational view, we were down mid-single digits on iPhone. And so it was the other things that drove the larger contraction year over year. On the good news side, we had solid growth on upgraders year over year in mainland China and we had four of the top six smartphone models in urban China.

Also, IDC just put out a note that you may have seen where we were the top brand for the full year and for the December quarter. And so there's some good news.

2:48 pm: Q: Changes in the App Store in Europe. Do you see it having any significant impact financially to your services or the broader Apple P&L statement.

A: We announced a number of changes last week in Europe that would be in effect beginning in March.

So the last month of the calendar quarter, the second fiscal quarter. Some of the things that we announced include alternate billing opportunities, alternate app stores or marketplaces, if you will. We're also opening NFC for new capabilities for banking and wallet apps.

We've really focused on privacy, security and usability. And we've we've tried our best to get as close it in the past in terms of things that people love about our ecosystem, but we're going to fall short of providing the maximum amount that we could supply because we need to comply with the with the regulation. A lot will depend on the choices customers make.

Just to keep it in context, the changes apply to the EU market which represents roughly 7% of our global App Store revenue.

2:50 pm: Q: How are you thinking about the component pricing environment as we think about that gross margin into the March quarter and looking forward?

A: Our gross margins increased sequentially 280 basis points. So a very significant increase. I would say the two primary components of the increase are a favorable mix, we did very well with our high-end models and leverage. It's the biggest quarter of the year for us and so we get the leverage effect.

We had a partial offset on negative impact from foreign exchange, but net obviously, very significant improvement and we had very similar dynamics on the services side where we increased sequentially 190 basis points, also, in this case, due to a more favorable mix. And so the combined effect of the two businesses gave us the 45.9 at the total company level.

We are guiding total company gross margin to 46 to 47%, which is an additional expansion of margins compared to the already very strong results of the December quarter.

2:52 pm: Q: Your capital expenditures have actually come down this last year. As you look to lean in to generative AI, is there something we should consider about the CapEx intensity at Apple to to make investments and set the table for a generative AI platform as we move forward? Just given some of the things that we've seen from some other large tech companies.

A: We've always said we will never under-invest in the business, so we are making all the investments that are necessary throughout our product development, software development, and services development. We will continue to invest in every area of the business and at the appropriate level.

And we're very excited about what's in store for us for the rest of the year.

2:54 pm: Q: Asking about impacts to the March quarter, and the compare to last year.

A: Last year, we had this disruption of supply on iPhone 14 Pro and Pro Max because all the factories shut down due to the COVID 19 situation. And so essentially there was pent up demand as we exited the December quarter they got fulfilled, and we also did the channel fill associated with it during the March quarter, so the close to $5 billion that I mentioned is entirely related to iPhone.

On gross margin, good expansion over the last few quarters and now we are guiding to 46 to 47% and that takes into account everything that is going on in the commodity environment and the foreign exchange situation. Obviously, the product and services mix and the outcome of this is the guidance result.

2:56 pm: Q: It's very interesting to hear your comments on enterprise, and, historically, Apple has been a consumer-centric company. And now Mac, it's penetrating more into the enterprise. I'm kind of curious how to think about Apple of the future. Would it still be consumer-centric or do you think it's going to be more enterprise-focused also, as we get into the future?

A: We've really concluded that we can do both. If you look at it what has happened over the last several years, employees are are in a position in many companies to choose their own technology. And so it sort of took some of the central command from the traditional company and decentralized the decision making. That is a huge advantage for Apple, because there's a lot of people out there that want to use a Mac. They're using a Mac at home. They'd like to use one in the office as well.

Vision Pro, when you look at it, the ton of use cases. I mean, we're starting with a million apps and 600 plus that are have been designed particularly for Vision Pro. When I look at what is coming out of enterprise, it's some of the most innovative things I've seen come out of enterprise in a long time. So I think, like there is for the Mac and iPad, and of course iPhone has been in enterprise since since the early days of iPhone, I think there's a nice opportunity there for Vision Pro as well.

2:59 pm: Q: How do you think about the differences in macro conditions by region? Do you have a sense of are we nearing the trough from a macro demand perspective? Or how long do you think this particular weakness persists?

A: If you look at the US, which obviously drives the vast majority of the revenue, in the Americas, we grew in the December quarter from an iPhone business point of view, and the install base hit an all-time high. If you look at the replacement cycle, it's very difficult to measure the replacement cycle at any given point. And so what we focus on internally a lot is the active installed base. And obviously the sales are usually a cycle. We feel better about about those things.

Keep in mind, the extra week that we had a year ago makes the compare more distorted on the March quarter guide. I would point out to you that the COVID years had a lot of turmoil, a lot of volatility that typically you wouldn't see. If you look at our sequential progression from December to March this year, versus pre-COVID versus a more normal environment, it's actually stronger than those years.

3:00 pm: Q: Just wanted to clarify on China. Are you still upbeat about the opportunity and growth there?

A: We've been in China for 30 years and I remain very optimistic about China over the long term. I feel good about hitting a new install base number, a high watermark, and very good about the growth in upgraders year over year and during the quarter.

3:01 pm: Q: Are you a believer in the thesis that AI and processing on smartphones and devices like yours is going to have a huge role in AI and AI apps, and that's something you guys can take advantage of?

A: Let me just say that I think there's a huge opportunity for Apple with Gen AI, without getting into more details and getting out in front of myself.

3:02 pm: That ends the call.