Electronic payments company Square today announced a new partnership with Apple that will allow small businesses to obtain free processing fees with Apple Pay and compatible Square Readers. Starting today, eligible small businesses across the U.S. will have the chance to process over $12,000 worth of Apple Pay payments for free (based on the 2.75 percent contactless transaction fee charged by Square), totaling $350 worth of savings in Square processing costs.

To receive the free processing discounts, merchants will have to order a discounted $29 Square Reader, which comes with a free Apple Pay marketing kit. The kit includes various stickers and marketing ephemera that promotes the businesses' support of Apple Pay, as well as staff training materials. Once the merchant has their counter set up with all of Square's marketing kit display material, a simple picture sent to Square will then allow the business to start processing Apple Pay transactions for free.

In the press release, Square mentioned that it hopes the new small business-focused effort will continue to educate both business owners and customers about the benefits of Apple Pay. After a focused campaign by Square took place in Portland, contactless payments "tripled over the course of the campaign." On Apple's side, the company is constantly adding new financial institutions and retailers to its Apple Pay "Where to Use" page, encouraging growth of its mobile wallet since its launch in 2014.

Increased awareness for Apple Pay is also driving traction at major festivals and events. Across Kanye West's Life of Pablo pop-up shops in August there was significant usage of contactless transaction in cities across the U.S., from San Francisco (28%), to Dallas and Houston (both 14%). Together with Apple Pay, Square is taking this approach nationwide to help move the payments industry forward through initiatives that educate sellers and customers.

“It’s no secret that chip cards can be slow, which is why we built our reader to also accept contactless payments, a faster and safer way to pay,” said Jesse Dorogusker, Square’s Hardware Lead. “Anything we can do to make a seller’s experience faster and safer, including working with Apple to encourage Apple Pay usage, is an investment worth making.”

For each business taking part, today's offer lasts until the business reaches the $350 cap of free Apple Pay processing fees, or a year passes from the time they enroll in the offer, "whichever occurs earlier." After either of these contingencies is reached, the standard processing fees will begin to apply. Merchants have all year to take advantage of Square's offer, with enrollment deadlines hitting December 31, 2017.

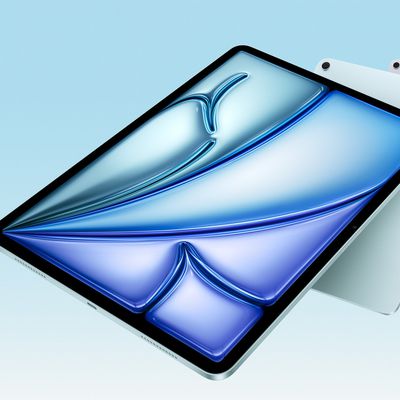

Square updated its line of payment solution devices in 2015 with a reader that supports NFC payments, letting locations which previously could not support Apple Pay -- due to the lack of a required contactless reader -- begin allowing customers to pay with the service. Apple has supported the Square Reader since early 2016, when it began selling the NFC reader both online and in Apple retail stores for $49.