Australian Banks Challenge Apple Over Mobile Payment App Restrictions

Three of Australia's biggest banks have lodged a joint application with anti-trust regulators to negotiate with Apple over gaining access to the NFC-based mobile payment hardware in its smartphones (via Reuters).

Commonwealth Bank, National Australia Bank (NAB), and Westpac have so far resisted signing deals to use the company's Apple Pay mobile payment system, because they want their customers to be able to use digital wallets they have already financed and developed.

However, none of the banks want to be accused of violating anti-competition law by negotiating deals, which is where the application comes in.

If the Australian Competition and Consumer Commission (ACCC) lets the banks collectively negotiate with Apple under the terms of the application, it would enable them to undertake "a limited form of boycott" in which they would all agree not to negotiate with Apple individually while the talks take place.

Apple currently only allows its own mobile payment system to access the NFC-hardware in its iPhone devices, which banks argue is an anti-competitive restriction that hampers consumer choice.

"This is about providing Australians with real choice and better outcomes," said Lance Blockley, a senior advisor at Novantas who spoke to The Sydney Morning Herald on behalf of the banks.

"If successful, the application would have tremendous benefits for the entire Australian mobile payments landscape including for public transport fares, airlines, ticketing, store loyalty and rewards programs and many more applications yet to be developed."

Apple Pay launched in Australia in November, but has since been slow to roll out in the country. The delay was thought to be down to issues Apple was experiencing negotiating fees with the nation's largest banking institutes.

Three months ago it added Apple Pay support for credit and debit cards from the Australia and New Zealand Banking Group (aka ANZ), the only bank in Australia's "Big Four" that played no part in the latest application.

Popular Stories

Wednesday February 11, 2026 10:07 am PST by

Juli CloverApple today released iOS 26.3 and iPadOS 26.3, the latest updates to the iOS 26 and iPadOS 26 operating systems that came out in September. The new software comes almost two months after Apple released iOS 26.2 and iPadOS 26.2.

The new software can be downloaded on eligible iPhones and iPads over-the-air by going to Settings > General > Software Update.

According to Apple's release notes, ...

Apple is planning to launch new MacBook Pro models as soon as early March, but if you can, this is one generation you should skip because there's something much better in the works.

We're waiting on 14-inch and 16-inch MacBook Pro models with M5 Pro and M5 Max chips, with few changes other than the processor upgrade. There won't be any tweaks to the design or the display, but later this...

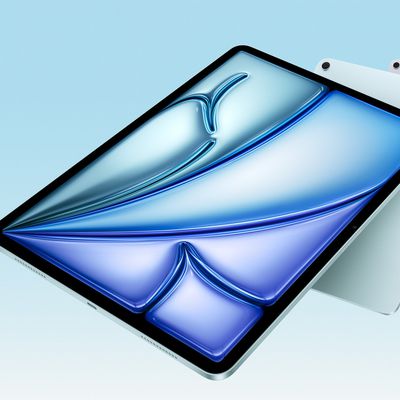

Apple plans to release an iPhone 17e and an iPad Air with an M4 chip "in the coming weeks," according to the latest word from Bloomberg's Mark Gurman.

"Apple retail employees say that inventory of the iPhone 16e has basically dried out and the iPad Air is seeing shortages as well," said Gurman. "I've been expecting new versions of both (iPhone 17e and M4 iPad Air) in the coming weeks."...

Apple acquired Canadian graph database company Kuzu last year, it has emerged.

The acquisition, spotted by AppleInsider, was completed in October 2025 for an undisclosed sum. The company's website was subsequently taken down and its Github repository was archived, as is commonplace for Apple acquisitions.

Kuzu was "an embedded graph database built for query speed, scalability, and easy of ...

Apple plans to announce the iPhone 17e on Thursday, February 19, according to Macwelt, the German equivalent of Macworld.

The report said the iPhone 17e will be announced in a press release on the Apple Newsroom website, so do not expect an event for this device specifically.

The iPhone 17e will be a spec-bumped successor to the iPhone 16e. Rumors claim the device will have four key...