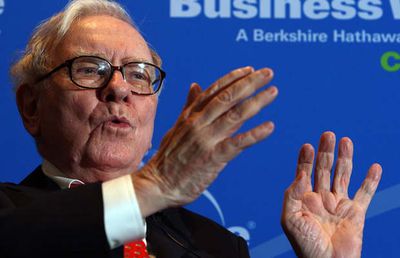

Apple shares have soared 9 percent since American business magnate Warren Buffett revealed his company's $1.2 billion stake in the company on May 16 (via Fortune).

Apple stock looked to be on the wane following Apple's earnings call at the end of April, when the company announced its first ever drop in iPhone sales and its first year-over-year revenue drop in 13 years.

Shares of Apple subsequently fell below $90 for the first time in nearly two years amid investors' concerns over the slump. Later it was revealed that Apple investor Carl Icahn had earlier decided to sell his stake in the company due to concern over China's attitude towards Apple, while a second Apple investor, David Tepper, had also dumped shares as its value continued to lessen.

However, just over two weeks ago, a regulatory filing by multinational conglomerate Berkshire Hathaway - which is run by Warren Buffett - revealed that as of March 31, the company owned 9,811,747 shares in Apple stock. Since then, shares of Apple have risen by 9 percent and breached the $100 mark, its highest point in a month.

Buffett has something of a reputation for being able to affect stocks, according to Fortune, which points to a dramatic 11 percent upturn of Kinder Morgan shares in February, shortly after Berkshire Hathaway disclosed its stake in the company.

However, Apple has also enjoyed a reversal of fortune in recently reported production targets for its next-generation iPhone 7, which is expected to launch this September.

Contradicting previous claims of projected weak demand for the upcoming device, Apple has reportedly asked its Asian suppliers to prepare for the highest iPhone production target in "about two years".

Apple investors also appeared unperturbed by news this week that the company's retail expansion in India may fall through, following a ruling from the Indian government that Apple must sell locally sourced goods if it wants to open stores in the country.

Apple remains eager to expand its business in India, where last quarter the company saw its revenue grow 56 percent, surpassing $1 billion. CEO Tim Cook's recent weeklong visit to the country garnered significant media attention and Apple will have regarded it as a positive step towards its global expansion goals.

Top Rated Comments

But this reason is often completely fabricated. For example, it was very well known that Apple would have reported a non-record quarter and shares moved accordingly in the last months, pushing the stock to an unbelievable P/E of less than 9 (implying a loss of about 90% revenues in 10 years).

When the widely expected data was released, the stock moved sharply down, again, with doomsday stories and, guess what?, very well timed news about Icahn and other investors dropping the stock. The perfect storm.

As a consequence, retail investors panicked, igniting a downward spiral.

The stock is up 9% not because of Buffett, but because it was irrationally taken down by FUD created by speculators, the same people who are feasting today on mom & pop lost money.

Makes total sense. I guess it's all about one person and not about the actual performance and potential of the company.

Not saying this didn't have some level of impact, but to call it THE reason is irrational.