Ireland

By MacRumors Staff

Ireland Articles

Apple Expands Emergency SOS via Satellite to UK, France, Germany, and Ireland

Apple today announced the expansion of Emergency SOS via Satellite and Find My via satellite functionality to the United Kingdom, France, Germany, and Ireland. iPhone 14 users can now connect with emergency services when cellular and Wi-Fi coverage are not available, and calls from the Emergency SOS via Satellite feature will be routed to local emergency services facilities. Apple's...

Read Full Article 49 comments

iPhone 14's Emergency SOS via Satellite Feature to Expand to France, Germany, Ireland, and the UK Next Month

The iPhone 14 lineup's Emergency SOS via satellite and Find My via satellite features will launch in four additional countries next month, Apple today announced. In its press release announcing that Emergency SOS and Find My via satellite for the iPhone 14 and iPhone 14 Pro models will roll out later today, Apple mentioned that the feature will be coming to France, Germany, Ireland,...

Apple to Expand Presence in Ireland and North Carolina

Apple is expanding its presence in Ireland with a new product testing center, the Irish Examiner reports, alongside opening a new office in North Carolina. Apple will open a new product testing center in Cork, Ireland, in what will be the first facility of its kind to test Apple devices in Europe. At the site, Apple engineers and technicians will use a range of equipment, including electron...

Apple TV+ Could Face Ban in Europe Unless It Meets Proposed Requirement of 30% European Content

Irish lawmakers implementing European Union directives are proposing new legislation that would require streaming services, including Apple TV+, Amazon Prime Video, and Netflix, to host at least 30 percent European content or face being shut down across the EU. These clauses of the "General Scheme of the Online Safety and Media Regulation Bill" come in response to the overwhelming amount...

Apple Celebrates 40 Years of Community At Its Cork Campus in Ireland

Apple has published an article on its website celebrating 40 years of community at its Cork campus in Ireland. The story of Apple in Ireland began in 1980 with a single manufacturing facility and 60 employees. Fast-forward to today, and Ireland is home to more than 6,000 Apple employees and a sprawling campus in the city of Cork. As Apple celebrates its 40th anniversary in Ireland, the...

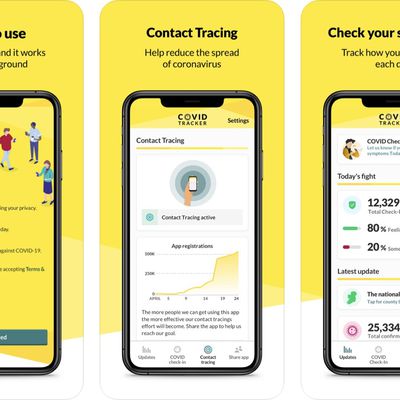

Ireland Launches COVID-19 App That Uses Apple/Google Exposure Notification API

Ireland today released "COVID Tracker Ireland," a COVID-19 contact tracing app that takes advantage of Apple and Google's Exposure Notification API. The app, which is opt in, says that users will be alerted if they come in close contact with someone who has tested positive for coronavirus. Those exposed will be able to track their symptoms, get advice on what to do, and choose to anonymously ...

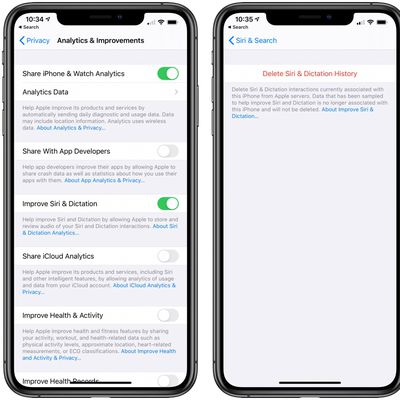

Irish Regulators 'in Contact' With Apple Over Siri Quality Control Program

Ireland's Data Protection Commissioner (DPC) is "in contact" with Apple after a former Apple contractor asked the DPC to investigate Apple's practice of allowing employees to listen to Siri recordings, reports Reuters. The contractor, Thomas Le Bonniec, requested the assistance of the DPC in May and called for greater protection under the EU's privacy laws. DPC Deputy Commissioner Graham...

Tim Cook Visits Ireland, Calls for Global Corporate Tax Reform [Updated]

Tim Cook visited Ireland today to collect an award from Taoiseach Leo Varadkar for Apple's 40 years of investment in the country. Apple's CEO also met with Irish musician Hozier and Dublin-based game studio WarDucks. In 2016, the European Commission found that Apple received illegal state aid from Ireland and forced the company to repay 13 billion euros in back taxes. Apple and Ireland are...

Tim Cook to Receive Award From Irish Prime Minister Celebrating 40 Years of Apple Investment

Apple CEO Tim Cook is set to receive an award from the Irish Prime Minister Leo Varadkar this month, reports Bloomberg. Cook is scheduled to meet with the Irish Taoiseach in Dublin on January 20 to receive the award, "in recognition of the iPhone maker’s 40 years of investment in Ireland," according to IDA Ireland, the country's investment agency. Apple's business relationship with...

Apple Finishes Paying $15.3B in Back Taxes to Ireland, Prompting EU Regulators to Drop Lawsuit

Just over two years after the European Commission ruled that Apple was receiving illegal state aid from Ireland -- where it had reportedly paid less than 2 percent in taxes compared to the country's headline 12.5 percent corporate tax rate -- Apple has now paid back the entire 13.1 billion euros ($15.3 billion) it owed in back taxes (via Reuters). The European Commission confirmed the...

Tim Cook Reaffirms Apple's Commitment to Ireland After Tax Dispute and Abandoned Data Center Plans

Just weeks after Apple abandoned its plans to build a $1 billion data center in Ireland, and amid a major Irish tax dispute with the European Commission, Apple CEO Tim Cook ensures his company remains committed to the country. In a recent interview with The Irish Times, Cook said Apple appreciated the support it received from the community who wanted the data center to be there, and...

Tim Cook Visits Ireland as Apple Promotes Its Support of Over 1.7 Million Jobs in Europe

Apple CEO Tim Cook has arrived in Ireland, the latest destination on his European tour, which has included stops in Italy and the Netherlands. Apple CEO Tim Cook and Ireland's Taoiseach Leo Varadkar Leo Varadkar, the Taoiseach or Prime Minister of Ireland, tweeted that he had a "good meeting" with Cook in the capital of Dublin on Monday. It's unclear what was discussed, but it appears to have ...

Apple Ditches Plans for $1 Billion Irish Data Center, Citing Approval Delays

Apple has ditched its plans to build a $1 billion data center in Ireland because of continual delays in the approval process chiefly brought about by planning appeals by local residents (via Reuters). Apple had been trying to get its $1 billion data center in County Galway, Ireland built for over three years, but has experienced pushback from individuals and organizations highlighting environm...

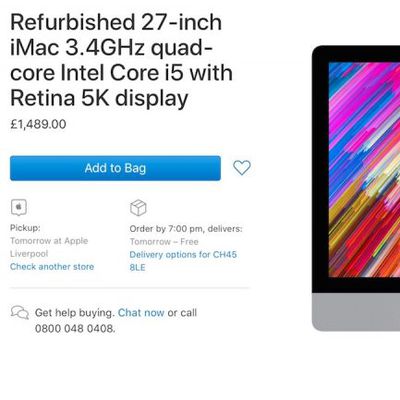

Apple Now Selling Refurbished 2017 27-inch iMac Models in Europe

Apple quietly updated several of its European online stores for refurbished products over the last couple of days, and has added its latest 27-inch 5K iMac models to the discounted listings for the first time. The iMacs were first released in June of 2017 and feature Kaby Lake processors, faster SSDs, and AMD discrete graphics. Online stores in France, Germany, Ireland, Italy, and Spain have...

Apple Will Start Paying Ireland Billions Owed in Back Taxes 'Early Next Year'

In August 2016 the European Commission ruled that Apple must repay 13 billion euros ($15.46 billion) in back taxes dating between 2003 and 2014. According to the EU, the taxes were avoided with the help of sweetheart tax deals from Ireland, and today The Wall Street Journal reports that Apple will now begin paying these back taxes "as soon as early next year." Ireland's Finance Minister,...

Apple's Irish Data Center Faces New Challenge as Residents Plan to Fight Back Against Court Approval [Updated]

Apple has been trying to get its $1 billion data center in County Galway, Ireland built for well over two years now, and last week the company finally won approval for construction by the Irish High Court. While it was expected that Apple would now move forward and begin planning for construction, two local residents have brought up a new legal challenge for the company. As reported by The...

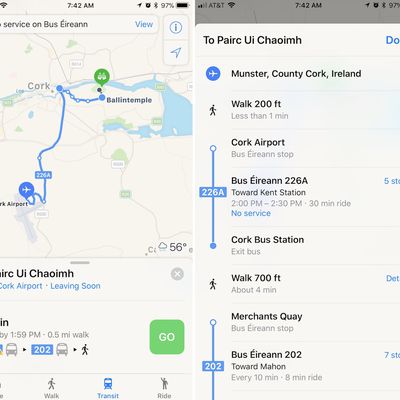

Apple Maps Transit Directions Expand to Ireland

Apple Maps has added public transit directions for Ireland, as pointed out by developer Steven Troughton-Smith on Twitter. With the updated directions, users in Ireland can now choose from a few different public transportation routes when traveling around Ireland. Transit directions are available in a few cities like Dublin and Cork, including transportation provided by Bus Éirann, Aircoach,...

Apple Wins Approval for $1 Billion Data Center in Ireland

Apple has won approval to build a $1 billion data center in the west of Ireland, successfully fending off an environmental legal challenge brought by local residents (via Reuters). Ireland's High Court on Thursday ruled that the proposed data center in Galway county, planned by Apple since February 2015, could proceed despite locals' various environmental concerns for the area if Apple...

E.U. to Take Ireland to Court For Failing to Claim Apple Tax

The European Commission said on Wednesday it will take Ireland to court for its failure to recover up to 13 billion euros ($15.3 billion) of tax due from Apple (via Reuters). Apple was ordered to pay the unpaid taxes in August 2016 after the Commission ruled that the company had received illegal state aid. The Commission argued that Irish revenue commissioners gave Apple unfair advantage...

Some Supporters of Apple's Irish Data Center Have 'Totally Lost Hope' as Final Verdict Again Delayed

One year ago, Apple began a staunch defense of its proposed data center in Galway County, Ireland, as a group of locals attempted to derail construction by reciting various environmental concerns for the area if Apple successfully built the facility. The delayed data center was supposed to be met with a decision this week, but now The Irish Times is reporting that a final verdict has been...