Earnings

By MacRumors Staff

Earnings Articles

Apple to Report Earnings on May 2 Following Vision Pro Launch

Apple today announced that its next quarterly earnings conference call will be held on Thursday, May 2 at 2 p.m. Pacific Time. On the call, which will be streamed live on Apple's investor website, Apple's CEO Tim Cook and CFO Luca Maestri will discuss the company's earnings results for the second quarter of the 2024 fiscal year. During the quarter, which ran from December 31, 2023 through...

Read Full Article 79 comments

Apple's Q1 2024 Earnings Call Takeaways

Apple today held its earnings call for the first fiscal quarter of 2024 (fourth calendar quarter of 2023), with Apple CEO Tim Cook and Apple CFO Luca Maestri sharing details on Apple's performance, recent product sales, services growth, and more. We've highlighted the most interesting takeaways from the earnings call. EU App Ecosystem Changes Maestri and Cook were asked about possible...

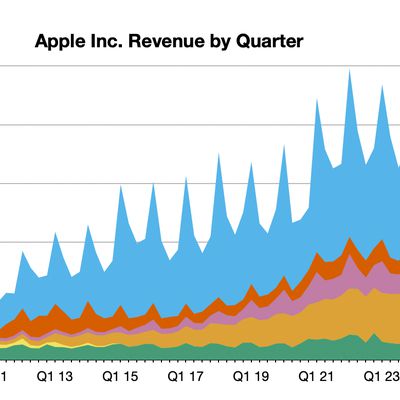

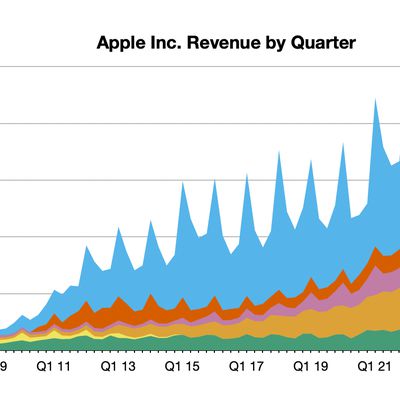

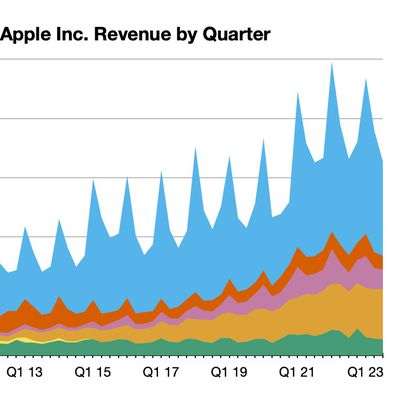

Apple Reports 1Q 2024 Results: $33.9B Profit on $119.6B Revenue

Apple today announced financial results for the first fiscal quarter of 2024, which corresponds to the fourth calendar quarter of 2023. For the quarter, Apple posted revenue of $119.6 billion and net quarterly profit of $33.9 billion, or $2.18 per diluted share, compared to revenue of $117.2 billion and net quarterly profit of $30.0 billion, or $1.88 per diluted share, in the year-ago quarter...

Apple to Hold February 1 Earnings Call Just Ahead of Vision Pro Launch

Apple has announced that its first earnings call of 2024 will be held on February 1, one day before the Vision Pro launches in the United States. On the call, Apple's CEO Tim Cook and CFO Luca Maestri will discuss the company's earnings results for the first quarter of the 2024 fiscal year. The executives will almost certainly provide some additional commentary about the Vision Pro. A...

Apple CEO Tim Cook on Generative AI: 'We're Investing Quite a Bit'

During today's earnings call covering the fourth fiscal quarter of 2023, Apple executives held a Q&A session with analysts and investors. Apple CEO Tim Cook was questioned about how Apple might be able to monetize generative AI, which he of course declined to comment on, but he said that Apple is "investing quite a bit" in AI and that there are going to be product advancements that involve...

Mac Revenue Down 34% Year-Over-Year, But Tim Cook Expects 'Significant' Improvement With M3 Macs

Apple today shared its earnings results for the fourth fiscal quarter of 2023 (third calendar quarter), and Mac revenue saw a major drop compared to last year. Mac sales came in at $7.6 billion in Q4 2023, down 34 percent from $11.5 billion in the year-ago quarter. Mac revenue for all of 2023 was $29.4 billion, down from $40.2 billion in 2022. Apple CFO Luca Maestri attributed the drop to ...

Apple Reports 4Q 2023 Results: $23B Profit on $89.5B Revenue

Apple today announced financial results for the fourth fiscal quarter of 2023, which corresponds to the third calendar quarter of the year. For the quarter, Apple posted revenue of $89.5 billion and net quarterly profit of $23.0 billion, or $1.46 per diluted share, compared to revenue of $90.1 billion and net quarterly profit of $20.7 billion, or $1.29 per diluted share, in the year-ago...

M3 Max Chip Around as Fast as M2 Ultra in Early Benchmark Results

The first benchmark results for Apple's M3 Max chip surfaced in the Geekbench 6 database today, providing a look at CPU performance. Based on the "Mac15,9" model identifier shown, the results appear to be for the new 16-inch MacBook Pro. The highest multi-core score for the M3 Max with a 16-core CPU is currently 21,084 as of writing. If this early result is accurate, this means the M3 Max is ...

What to Expect From Apple's Earnings Report Tomorrow Following iPhone 15 Launch

Apple will report its earnings results for the fourth quarter of its 2023 fiscal year on Thursday, November 2 at 1:30 p.m. Pacific Time. Apple's CEO Tim Cook and CFO Luca Maestri will discuss the results on a conference call with analysts a half hour later. Keep reading for some key things to know about the quarter, including a recap of new products announced, revenue expectations, and more. ...

Apple to Report Earnings on November 2 Following iPhone 15 Launch

Apple has announced that it will report its earnings results for the fourth quarter of the 2023 fiscal year on Thursday, November 2. The report will be available at 1:30 p.m. Pacific Time on that day, and Apple's CEO Tim Cook and CFO Luca Maestri will discuss the results on a conference call with analysts at 2:00 p.m. Pacific Time. A live audio stream of the call will be available on Apple's ...

Apple Reports 3Q 2023 Results: $19.9B Profit on $81.8B Revenue

Apple today announced financial results for its third fiscal quarter of 2023, which corresponds to the second calendar quarter of the year. For the quarter, Apple posted revenue of $81.8 billion and net quarterly profit of $19.9 billion, or $1.26 per diluted share, compared to revenue of $83.0 billion and net quarterly profit of $19.4 billion, or $1.20 per diluted share, in the year-ago...

What to Expect From Apple's Earnings Next Week Following New Macs

Apple will report its earnings results for the third quarter of its 2023 fiscal year on Thursday, August 3 at 1:30 p.m. Pacific Time. Apple's CEO Tim Cook and CFO Luca Maestri will discuss the results on a conference call with analysts a half hour later. Keep reading for some key things to know about the quarter, including a recap of new products announced, revenue expectations, and more. ...

Apple to Announce Q3 2023 Earnings on August 3 Following New Macs

Apple has announced that it will report its earnings results for the third quarter of the 2023 fiscal year on Thursday, August 3. The report will be available at 1:30 p.m. Pacific Time, and Apple's CEO Tim Cook and CFO Luca Maestri will discuss the results on a conference call with analysts at 2:00 p.m. Pacific Time. A live audio stream of the call will be available on Apple's Investor...

Tim Cook Responds to Rise of ChatGPT, Says AI's Potential is 'Very Interesting'

Apple CEO Tim Cook today provided some commentary surrounding artificial intelligence amid the surging popularity of ChatGPT and other chatbots. Speaking on Apple's quarterly earnings call today, Cook said artificial intelligence's potential is "very interesting," but noted that there are a "number of issues that need to be sorted" out with the technology and that it is "very important to be ...

Tim Cook Says Apple Still Not Considering 'Mass Layoffs'

Apple CEO Tim Cook today said he still views mass layoffs as a "last resort," and ensured this is not something the company is considering right now. "I view that as a last resort and, so, mass layoffs is not something that we're talking about at this moment," said Cook, in an interview with CNBC. Major tech companies like Google and Facebook parent Meta have laid off tens of thousands of ...

Apple Reports 2Q 2023 Results: $24.1B Profit on $94.8B Revenue, New March Quarter Record for iPhone Revenue

Apple today announced financial results for its second fiscal quarter of 2023, which corresponds to the first calendar quarter of the year. For the quarter, Apple posted revenue of $94.8 billion and net quarterly profit of $24.1 billion, or $1.52 per diluted share, compared to revenue of $97.3 billion and net quarterly profit of $25.0 billion, or $1.52 per diluted share, in the year-ago quarter...

What to Expect From Apple's Earnings Results Following New Macs and HomePod

Apple will report its earnings results for the second quarter of its 2023 fiscal year on Thursday, May 4 at 1:30 p.m. Pacific Time. Apple's CEO Tim Cook and CFO Luca Maestri will discuss the results on a conference call for investors a half hour later. Keep reading for some key things to know about the quarter, including a recap of new products announced, revenue expectations, and more. Ne...

Apple to Announce Q2 2023 Earnings Results on May 4

Apple today announced plans to report its earnings results for the second fiscal quarter (first calendar quarter) of 2023 on Thursday, May 4. The earnings report and investor call afterward will provide insight into the period between late December and March, which is often a slow quarter for Apple following the holiday quarter. Apple in January introduced new M2 Pro and M2 Max MacBook Pro ...

What We Learned About Apple During Today's First Quarter Earnings Call

Apple today held its first earnings call of 2023, which covers the fourth calendar quarter of 2022. During the call, Apple CEO Tim Cook and Apple CFO Luca Maestri shared several interesting tidbits about recent product sales, services results, and more, and we've highlighted the most interesting parts of the call below. AI On the topic of artificial intelligence, particularly in services,...

Apple Now Has More Than Two Billion Active Devices Worldwide

There are more than two billion active iPhones, iPads, Macs, and other Apple devices worldwide, Apple said today in the earnings report covering the first fiscal quarter of 2023. During the December quarter, we achieved a major milestone and are excited to report that we now have more than 2 billion active devices as part of our growing installed base," said Apple CEO Tim Cook. Two billion...