PayPal

By MacRumors Staff

PayPal Articles

PayPal Brings Contactless Payments to German iPhones Under New EU Rules

Earlier this month, PayPal said that it would debut contactless iPhone payments in Germany, and German iPhone users now appear to be able to use the feature. According to German site iPhone Ticker, some PayPal customers in Germany have access to PayPal as an alternative to Apple Pay.

PayPal can be used for NFC tap to pay functionality just like Apple Pay, with payments initiated in the...

Read Full Article 110 comments

PayPal Launching Contactless iPhone Payments in Germany to Compete With Apple Pay

PayPal today announced that it is planning to debut contactless payments in Germany, allowing German iPhone users to make tap-to-pay purchases in stores using their PayPal accounts.

PayPal is able to offer this feature because Europe's Digital Markets Act has forced Apple to open up the NFC chip in its devices to third-party apps. NFC payments are available in apps without the need for Apple ...

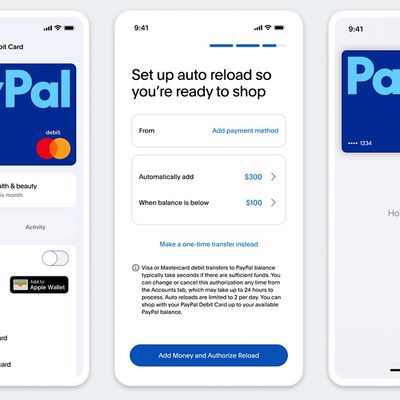

Apple Wallet Gets Deeper Integration With PayPal's Debit Card This Year

It would have been really easy to miss it, but Apple last year briefly mentioned a new PayPal feature coming to the Wallet app on the iPhone.

In the final sentence of an October 2024 press release, celebrating the 10-year anniversary of Apple Pay, Apple said iPhone users in the U.S. would be able to see their PayPal balance when using their PayPal debit card in the Wallet app. Apple said...

PayPal Debit Card Now Supports Apple Wallet With Up to 5% Cash Back

PayPal today announced that the PayPal Debit Card can now be added to the Apple Wallet app and used with Apple Pay in stores and online.

"Whether in-store, online or in-apps, PayPal debit card cardholders will be able to enjoy the convenience and security that Apple Pay brings to their everyday lives," said Apple's services chief Eddy Cue, in PayPal's press release.

PayPal Debit Card...

PayPal and Venmo Debit and Credit Cards Gain Apple Wallet Support

PayPal has announced that users can now add their PayPal and Venmo credit and debit cards to Apple Wallet, while still earning the same cashback and rewards on eligible purchases.

The new integration means users can use the cards to make contactless payments in-store, and use iPhones, iPads, and Macs to make purchases in apps and on the web using Apple Pay.

To get started, users should...

Apple Tap to Pay Integration Coming to PayPal and Venmo iOS Apps

The PayPal and Venmo iOS apps will soon offer Apple's Tap to Pay on iPhone functionality, allowing merchants that use PayPal or Venmo to accept contactless debit or credit cards and mobile wallet payments, including Apple Pay.

PayPal shared the news in its latest earnings report, which was released today.Leveraging Apple's Tap to Pay on iPhone technology, U.S. merchant customers will soon be ...

PayPal Announces Support for Safari Passkeys Feature

Popular payments service PayPal today announced that it is introducing support for passkeys, providing an easier and more secure login method for PayPal accounts. Apple integrated passkeys into iOS with the launch of iOS 16, and it is also available in iPadOS 16.1 and macOS Ventura, coming today.

Passkeys are an industry standard developed by the FIDO Alliance and the World Wide Web...

PayPal Acquiring iZettle to Compete With Square for In-Store Payments Processing

PayPal this week announced plans to acquire the Swedish-based payments hardware company iZettle for $2.2 billion, with a plan to expand its presence in brick and mortar stores thanks to iZettle's technology. The acquisition will also help PayPal bolster its business across iZettle's main markets of Europe and Latin America (via Bloomberg).

Notably, the purchasing deal marks PayPal's biggest...

Visa, Mastercard, Amex, and Discover Plan Combo Checkout Button to Compete With PayPal

Visa, Mastercard, American Express, and Discover are planning to combine their online payment options into "a single button," hoping to make customers' shopping easier and reduce friction in the checkout process. The button will be a major competitor to PayPal, and combat what's called "the NASCAR effect," where multiple payment logos and options dot the purchasing interface on online...

eBay Details Plans to Replace PayPal as Main Payments Processor With New Partner Adyen

eBay this week announced major changes coming for both buyers and sellers on its online marketplace, with a plan to phase out its 15-year-long partnership with PayPal and eventually integrate Amsterdam-based payments company Adyen as its "primary partner for payments processing globally" (via Recode). This will eventually affect all eBay customers on every version of the site, including desktop...

PayPal Offering $100 iTunes Gift Card for $85 on eBay While Supplies Last

If you're looking to start stocking up on iTunes gift cards for the holidays, PayPal's Digital Gifts storefront on eBay today has the $100 iTunes gift card at $85 for customers in the United States. You'll need to be logged into a PayPal account, and once you complete the purchase the digital gift card will be emailed to you with a code to add the credit to your iTunes account.

Discounts on...

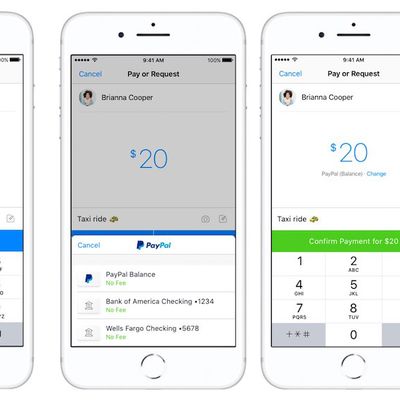

You Can Now Pay Friends Through Facebook Messenger Using PayPal

Last year, PayPal launched within Facebook Messenger as a way for users to shop and complete payments directly through the messaging app. Today, the two companies are expanding the focus of this feature and opening up peer-to-peer payments for Facebook Messenger users who have linked their PayPal account to the app.

With a rollout starting today, Facebook Messenger users will be able to tap on ...

PayPal Announces Over 2M U.S. Retailers Will Begin Accepting Venmo Payments Online

PayPal today announced that "more than two million" retailers in the United States will now accept online payments from the PayPal-owned, peer-to-peer payments platform Venmo. Users with Venmo accounts will be able to pay on retailer apps like Forever 21, Foot Locker, and Lululemon starting this week (via Reuters).

With the addition of Venmo into the checkout process of these apps, Venmo...

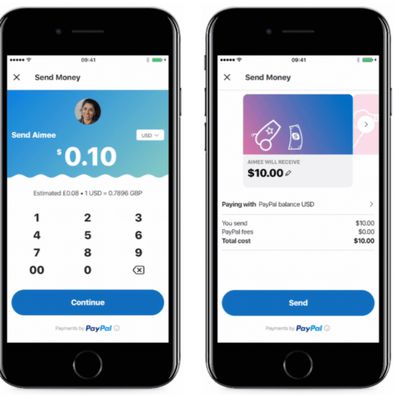

You Can Now Send Money With PayPal in Skype App on iPhone and iPad

Skype today announced that users across 22 countries can now send money with PayPal in its mobile app for iOS and Android.

Skype said the person-to-person payments feature is rolling out today in the United States, United Kingdom, Austria, Belgium, Canada, Cyprus, Estonia, Finland, France, Germany, Greece, Ireland, Italy, Latvia, Luxembourg, Malta, Netherlands, Portugal, San Marino,...

Apple Adds PayPal as Payment Option for iTunes, App Store, and Apple Music

From today, PayPal customers in the U.K., Australia, Canada, Mexico, and the Netherlands can use their PayPal account to pay for App Store, Apple Music, iTunes, and iBooks purchases made on their Apple devices. PayPal said on Wednesday the option would be rolling out to other countries including the U.S. soon after.

Previously, Apple users were only able to pay for transactions using a...

PayPal CEO Doesn't Think Apple Pay's Peer-to-Peer Payments Update Will Hurt Venmo

In a new interview with The Telegraph, PayPal CEO Dan Schulman discusses a wide range of topics covering the origins of the company, its history with eBay, and potential competition with Apple in the peer-to-peer payments space. PayPal owns Venmo, one of the most popular P2P payments apps available today across iOS, Android, and the web, and Schulman cited this availability across various...

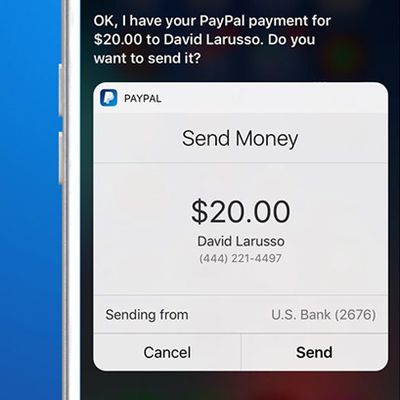

PayPal iOS App Update Brings Siri Integration to Send and Receive Money

PayPal has updated its iOS app to include Siri integration with support for a variety of languages across 30 countries.

In a post on its official blog, PayPal announced that users of the digital payment service will be able to use Apple's voice-activated AI personal assistant to send and request money among friends and family.

With so many P2P transactions happening during such a busy...

PayPal to Discontinue Apps for Windows Phone, BlackBerry, and Kindle

PayPal recently announced that it plans to pull support for its apps on the Windows Phone, BlackBerry, and Amazon Kindle Fire mobile platforms, as the company doubles down on its new and updated apps for iOS and Android (via CNET). Users on the three operating systems in question have until June 30 to access the PayPal app.

In the blog post announcing the impending sunset of PayPal's app on...

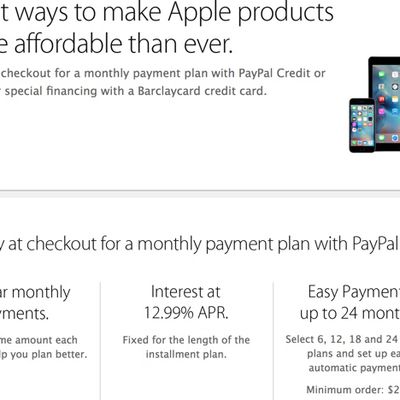

Apple Drops Support for PayPal Credit Payment Plans in U.S. Online Store

Apple yesterday quietly removed all mentions of PayPal Credit from its U.S. Online Store, signaling its decision to stop allowing customers to use PayPal Credit payment plans for purchases in the United States.

On the financing section of its website, where customers can get information about their payment options, Apple is now only offering financing through Barclaycard Visa, which allows...

Apple, Google and Others Form Coalition to Push Technology in Financial Sector

A handful of technology giants -- including Apple, Amazon, Google, PayPal, and Intuit -- have announced a partnership in the formation of the Financial Innovation Now coalition (via Re/code). The group aims to promote tech-friendly policies and changes within the financial services sector in Washington, D.C. Those behind the group will work to alter the political debate on relevant issues like...