Kantar Worldpanel

By MacRumors Staff

Kantar Worldpanel Articles

Amazon Surpasses Apple and Google to Become World's Most Valuable Brand

Apple surpassed Google but Amazon usurped both tech giants to become the world's most valuable brand in market research firm Kantar's annual BrandZ brand value report.

According to the BrandZ Top 100 Most Valuable Global Brand ranking 2019 [PDF], the ecommerce giant saw its brand value rise to $315.5 billion, beating second-placed Apple's $309.5 billion evaluation and Google's $309 billion...

Read Full Article 119 comments

iOS Grew U.S. Market Share This Spring Thanks to 'Unprecedented Depth' of Price Options as Android 'Felt the Heat'

In the United States, iOS saw significant growth in the three months ending June 2018, with market share up 5.9 percentage points to 38.7 percent as tracked in the newest data from Kantar Worldpanel ComTech. Helping to boost iOS performance were sales for the iPhone 8 and iPhone 8 Plus, together accounting for nearly one in five smartphones sold in the time period.

Apple's other flagship...

iPhone X Was One of the Top Three Best-Selling Smartphones in December 2017 Across Five Markets

Apple's iPhone X made it into the top three best-selling smartphones in December 2017 "across all key regions," according to new data tracked by Kantar Worldpanel. Specifically, Apple's new iPhone X climbed best-selling charts in Europe, Japan, Australia, the United States, and China, where it was the top selling model during the holiday season this year.

Although iOS market share fell 0.5...

iPhone X Sales Were 'Stellar' in Several Countries During First Month of Availability

Kantar Worldpanel's newest smartphone OS data details the "stellar" performance of the iPhone X in multiple markets around the world during November, amid an overall "mixed performance" for iOS devices from September to November 2017. While Apple's piece of the smartphone ecosystem fell in Great Britain, the United States, Japan, and Australia, the company saw ongoing growth in urban China during ...

iOS Lost Market Share in Numerous Countries From August to October 2017 as People Waited for iPhone X

Apple's piece of the smartphone ecosystem market fell in eight total territories during the August-October 2017 timeframe, according to new data tracked by Kantar Worldpanel. Echoing numerous stories from earlier this fall that reported people were waiting for the iPhone X and not purchasing an iPhone 8 or iPhone 8 Plus, Kantar's data showed a 7.6 percentage point drop for iOS in the United...

iOS Gained Market Share in Most Countries This Summer, Although Samsung Drove Gains for Android in UK

Apple's portion of the mobile ecosystem market increased in eight major territories in the three months ending August 2017, according to new data collected and shared by Kantar Worldpanel. Over the summer of 2017, iOS saw growth in the following territories compared to the same year-ago period: Spain (4.4 percentage point increase), followed by China (4.3), the United States (3.7), Germany (2.3), ...

iOS Drops to Lowest Share of China Smartphone Market in Nearly Three Years

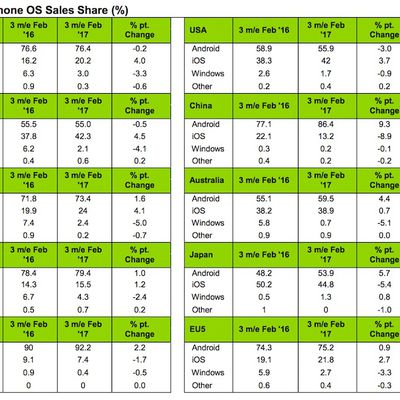

Apple's iOS has dropped to its lowest share of the smartphone market in urban China since July 2014, according to new data collected and shared by Kantar Worldpanel. Today's report specifically details smartphone shares around the world for the three months ending in February 2017. In total, devices running iOS dropped 8.9 percentage points from the same year-ago quarter, receding from 22.1...

iOS Grew to Capture 42% of U.S. Smartphone Market Over Holidays

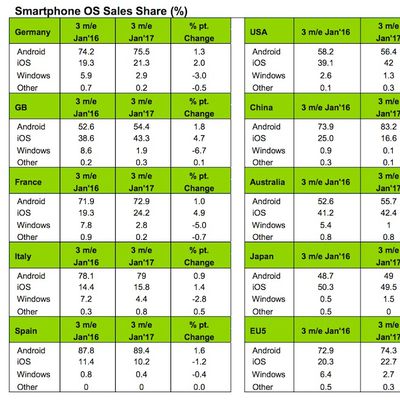

From November 2016 through January 2017, iOS devices accounted for 42 percent of smartphone sales in the United States, growing 2.9 percentage points year-over-year thanks to iPhone sales over the holidays. According to new data released by Kantar Worldpanel, the same period saw a decline for Android smartphones, which still captured the largest share of the market at 56.4 percent in the United...

iPhone Captured 31% of Smartphone Sales in the U.S. Ahead of Holiday Season

The iPhone 7, iPhone 7 Plus, and iPhone 6s were the "three most popular smartphones" in the United States in the three month period ending November 2016, when users were purchasing early holiday gifts for friends and family members. According to new data collected by Kantar Worldpanel, the three Apple iPhones captured a total 31.3 percent of smartphone sales in the U.S., while Samsung accounted...

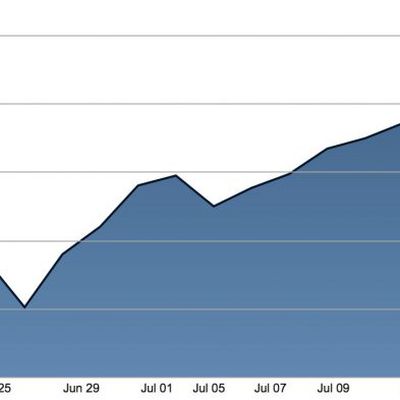

Apple Stock Nears Quarterly High as Investors Prepare for Q3 Earnings Report

Apple stock enjoyed its biggest one-day rise since May on Thursday, following a brief dip as investors speculated on the company's prospects in the run-up to its Q3 earnings call and the release of the iPhone 7 later this year.

Shares closed at $98.78, almost hitting their previous high since Apple reported its fiscal Q2 earnings, when the company's stock fell below $100. Shares remain down...

Kantar: iOS Adoption Rises in China as Android Grows in U.S. and Europe

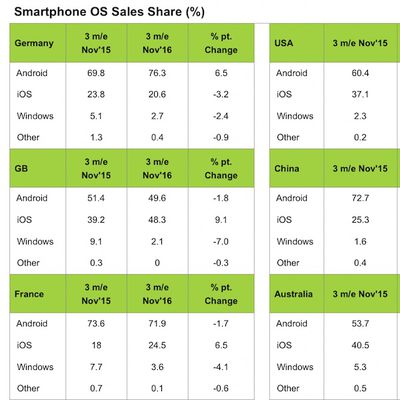

Kantar Worldpanel has released new smartphone operating system market share data for the third calendar quarter of 2015, providing a regional breakdown of Android, iOS, BlackBerry, Windows Phone and other mobile platform adoption in the U.S., Europe, China, Japan and elsewhere during the three-month period ending October.

In the U.S. market, Android led the third quarter with 62.8% market...

Android Switchers Drive iOS Adoption in Europe During First Quarter

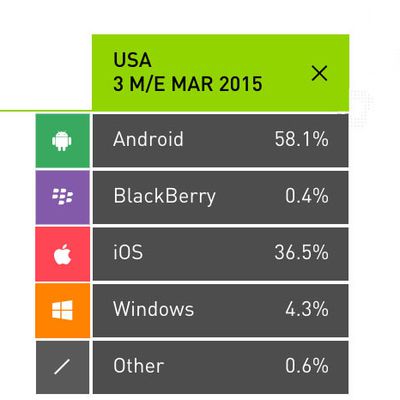

Kantar Worldpanel has released new smartphone operating system market share data for the first quarter of 2015, providing a regional breakdown of Android, iOS, BlackBerry, Windows Phone and other mobile platform adoption in the United States, Australia, United Kingdom, France, Germany, Spain, Italy, China, Japan, Argentina, Brazil and Mexico during the three-month period ending March....