IDC

By MacRumors Staff

IDC Articles

iPhone Shipments Down 9% in China's Q1 Smartphone Boom

Apple's iPhone shipments in China declined by 9 percent in the first quarter compared to the year earlier, and it was the only major smartphone vendor to see a decline, according to data from research firm IDC.

Shipments of iPhones fell to 9.8 million units, giving Apple a market share of 13.7 percent, down from 17.4 percent in the previous quarter. Apple has now had seven straight quarters...

Read Full Article 188 comments

iPhone Sales Stall Despite Global Smartphone Market Recovery

Apple experienced minimal iPhone growth in 2024 despite a significant rebound in the global smartphone market, according to new data published by IDC. Worldwide smartphone shipments increased 6.2% to reach 1.24 billion units, but iPhone shipments grew by just 0.4% during the same period.

The tepid performance underlines Apple's challenges in key markets like China, where domestic rivals are...

Apple Leads Global PC Growth With 21% Shipment Increase

Apple is believed to have seen a significant 21% increase in Mac shipments for the second quarter of 2024, the largest growth among global PC manufacturers during this period, as part of an industry-wide recovery.

According to a report by IDC, an industry research firm, worldwide shipments of desktops and laptops increased by 3% year-over-year for the quarter ending in June 2024. Apple and...

Samsung Regains Top Spot as Apple's iPhone Shipments Fall in Q1 2024

Apple's iPhone shipments decreased by nearly 10% globally in the first quarter of 2024, hit by rapid growth in shipments by rival Chinese vendors, based on data provided by the International Data Corporation (IDC).

According to the IDC report, Apple's shipments fell 9.6% to 50.1 million units in the first quarter, down from 55.4 million units in the same quarter the previous year. Apple...

Apple Ships More Smartphones Annually Than Samsung for First Time

Apple overtook Samsung as the top global smartphone manufacturer in 2023, according to preliminary data from market research firm IDC. If the data is accurate, it is the first time Samsung has lost the top spot to another company in 13 years. In 2013, Nokia held the number one spot, Samsung was second, and Apple didn't even feature in the top five.

IDC bases its analyses on market share of...

iPhone Shipments Suffered Double-Digit Drop Over Holiday Quarter, Says IDC

Worldwide smartphone shipments suffered their worst quarterly drop on record over the holiday period, according to IDC, and Apple was not immune to the cooling consumer demand amid the global economic downturn.

The research firm estimates that Apple shipped 72.3 million iPhones in the December quarter, down year-on-year from 85 million units, representing a 14.9% drop in shipments compared...

Analysts Have No Idea How Many Macs Apple Shipped Last Quarter

For the last several years, Apple has not provided breakdowns of the number of iPhones, Macs, and iPads sold, keeping analysts, customers, investors, and others in the dark on exact device sales. This has led analysts to attempt to estimate product shipments, and as the Q3 quarterly Mac numbers confirm, it's a very inexact process.

Companies like Gartner, IDC, and Canalys in fact appear to...

Global Smartphone Shipments to Decline 3.5% in 2022, Apple to Be Least Impacted

Global smartphone shipments are expected to decline 3.5 percent to 1.31 billion units in 2022, according to IDC's latest Worldwide Quarterly Mobile Phone Tracker forecast. Because of increasing challenges with supply and demand, IDC is significantly reducing its forecast for 2022, which previously predicted 1.6 percent growth.

IDC believes Apple will be the "least impacted vendor" because of ...

Apple Was the Only Top Smartphone Vendor to Increase Shipments Year-Over-Year Last Quarter

Apple was the only top smartphone maker that saw a year-over-year increase in shipments in the last quarter, while Samsung, Oppo, Xiaomi, and others saw steep declines in their respective mobile smartphones.

Apple yesterday announced record earnings for the March quarter, with more than $97 billion in revenue, beating expectations. Following the results, Strategy Analytics, Canalys, and IDC...

Apple Shipped More Tablets Than Samsung and Amazon Did Combined Last Quarter

While the iPad has long been the world's most popular tablet, newly published market research helps put Apple's lead into perspective.

According to estimates shared by research firm IDC, Apple shipped 12.9 million iPads in the second quarter of 2021. By comparison, IDC estimated that Samsung and Amazon shipped a combined 12.3 million tablets in the quarter, suggesting that Apple shipped more...

Mac Shipments Continue to Rise Amid Surge in Demand for PCs [Updated]

Shipments of Macs increased by almost 10 percent in the second quarter of 2021 compared to the same time last year, as the surge in demand for computers continued, according to IDC data.

The IDC Worldwide Quarterly Personal Computing Device Tracker shows that worldwide shipments of personal computers, including desktops, notebooks, and workstations, reached 83.6 million units in the second...

Apple's Wearables Shipments Increasing, but Losing Market Share to Smaller Competitors

Apple's shipments of wearables continued to grow year-on-year in the first quarter of 2021, but the company lost overall market share to smaller rivals, according to newly-published IDC data.

Companies shipped a total of 104.6 million units in the first quarter of this year, marking a 34.4 percent increase from the 77.8 million units shipped at the same time last year. This is also the first ...

Mac Shipments More Than Doubled in First Three Months of 2021 Compared to Same Period in 2020 [Updated]

The Mac experienced momentous growth in the first quarter of this year, with shipments growing by 111.5% compared to the same time period last year, according to market data from IDC.

The data shows that the whole PC industry grew year-over-year, despite the global health crisis and component shortages. In Q1 of the year, Apple shipped roughly 6.7 million Macs, representing 8% of the whole...

iPhone Shipments to Gulf Countries Saw Double-Digit Growth in Q4 2020

In the fourth quarter of 2020, Apple saw its iPhone shipments in Gulf countries increase by 55% compared to the quarter prior, thanks to the launch of the 5G enabled iPhone 12 and last year's iPhone 11 lineup, according to market research by IDC.

In total, the region saw smartphone shipments grow by 2.3% in the last quarter of the year compared to Q3, to a total of 2.26 million units....

Apple Continued to Dominate Wearables Market Across 2020

Apple continued to have a dominant hold on the wearables market in the fourth quarter of 2020, according to new shipment estimates shared today by IDC. Apple shipped 55.6 million wearable devices during the quarter for 36.2 percent market share.

That's the same market share Apple held in the fourth quarter of 2019, but overall device shipments were up from 43.7 million in Q4 2019. Apple's...

Apple Dominated Japan's Smartphone Market in 2020

According to research firm IDC (via GizChina), Apple dominated the smartphone market in Japan over the fourth quarter of 2020, with the iPhone brand accounting for over half of all phone sales in the country.

As per the report, the mobile market reached 11.432 million shipments in Q4 2020, and 52.6% of all smartphone sales in Japan were iPhones, substantially contributing to a 10.6%...

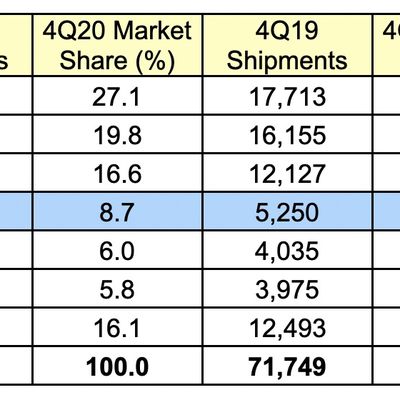

Mac Shipments Rise Significantly in Q4 2020 Amid Overall PC Market Growth

Apple's worldwide Mac shipments were up in the fourth quarter of 2020, according to new PC shipping estimates shared this afternoon by Gartner. Apple shipped an estimated 6.9 million Macs during the quarter, up from the 5.25 million it shipped in the year-ago quarter, marking growth of 31.3 percent.

Gartner's Preliminary Worldwide PC Vendor Unit Shipment Estimates for 4Q20 (Thousands of Units)

...

Apple Watch Sets New Record With Estimated 11.8 Million Shipments Last Quarter

Apple Watch shipments totaled an impressive 11.8 million units in the third quarter of 2020, up nearly 75% from 6.8 million units shipped in the third quarter of 2019, according to figures shared today by research firm IDC.

11.8 million units appears to be a new quarterly record for the Apple Watch, as Statista shows that shipments of the device have never exceeded 9.2 million in any prior...

Apple Slips to Fourth Place for Smartphone Market Share, Overtaken by Xiaomi

Apple has shipped 10.6 percent fewer iPhones year-on-year in the third quarter of 2020, meaning that it has been overtaken by Xiaomi for the first time, according to new data shared by IDC.

The report details how Apple is now ranked as the fourth-largest smartphone manufacturer by market share. This is the first time that Apple has ranked fourth, with Xiaomi, Huawei, and Samsung exceeding...

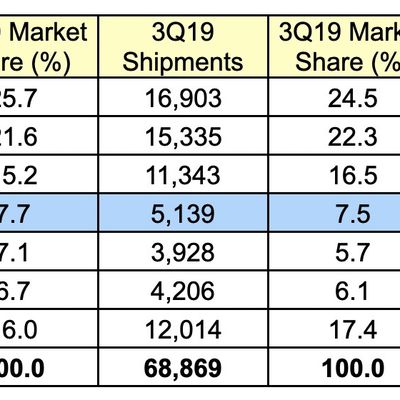

Mac Shipments Up in Q3 2020 Amid Worldwide PC Market Growth

Apple's worldwide Mac shipments saw decent growth in the third quarter of 2020, according to new preliminary PC shipping estimates shared this afternoon by Gartner.

Gartner's Preliminary Worldwide PC Vendor Unit Shipment Estimates for 3Q20 (Thousands of Units)

Apple shipped an estimated 5.5 million Macs during the quarter, up 7.3 percent from the 5.1 million that it shipped in the third...