Canalys

By MacRumors Staff

Canalys Articles

Apple's Mac Shipments Are Soaring, Here's Why

Apple recorded the highest year-over-year growth among major computer vendors in the United States during the first quarter of 2025, with Mac shipments increasing 28.7% and market share rising from 14.2% to 16.0%, according to newly published data from Canalys.

Shipments of desktops and notebooks to the United States reached 16.9 million units in the first quarter of 2025, representing a 15% ...

Read Full Article 117 comments

AirPods Are Still Untouchable as Apple Crushes the Competition in 2025

Apple maintained its position as the global leader in the wireless headphone market in the first quarter of 2025, achieving 18.2 million shipments and capturing a 23.3% market share, according to new data from Canalys.

The data suggests that Apple, including its Beats subsidiary, continues to leverage its hardware-software ecosystem to dominate the true wireless stereo (TWS) market. Although ...

iPad Demand Soars as Apple Widens Lead Over Samsung and Xiaomi

Apple led the global tablet market in the first quarter of 2025, achieving 14% year-over-year shipment growth amid heightened demand for iPads, according to new data from Canalys.

Worldwide tablet shipments reached 36.8 million units in the first quarter 2025, representing an 8.5% year-over-year increase. Apple shipped 13.7 million iPads during the quarter, up from 12.1 million in the first...

iPhone Shipments Up 13% Amid Global Smartphone Market Slowdown

Apple achieved impressive 13% year-over-year growth in Q1 2025, shipping 55 million iPhones worldwide and increasing its global market share to 19%, up from 16% a year ago, according to the latest Canalys research.

Apple's performance is in stark contrast to the broader smartphone market, which recorded just 0.2% growth with 296.9 million units shipped globally.

Samsung maintained its...

Apple's iPad Continues to Dominate Tablet Market

Apple continues to have no close competition in the tablet market, earning 42.3 percent of the global tablet market share in the fourth quarter of 2024, according to a new report from Canalys.

Apple shipped an estimated 16.9 million iPads during the quarter, up from 14.8 million in Q4 2023. The company's closest competitor was Samsung, with 7 million tablets shipped in Q4 2024 for 17.8...

Apple Drops to Sixth Place in China's Smartphone Market

For the first time in years, Apple has fallen out of the top five smartphone vendors in China, ranking sixth in the second quarter of 2024.

Data from Canalys, a market research firm, shows that Apple's iPhone shipments in China declined by 6.7% year-on-year. This drop has been attributed to fierce competition from domestic brands such as Huawei, Vivo, Oppo, Honor, and Xiaomi. Huawei, in...

Apple Leads Global PC Growth With 21% Shipment Increase

Apple is believed to have seen a significant 21% increase in Mac shipments for the second quarter of 2024, the largest growth among global PC manufacturers during this period, as part of an industry-wide recovery.

According to a report by IDC, an industry research firm, worldwide shipments of desktops and laptops increased by 3% year-over-year for the quarter ending in June 2024. Apple and...

Apple Sinks From First to Fifth Place in Chinese Smartphone Market

Analytics company Canalys has released its latest report on China's smartphone market for the first quarter of 2024, and Apple has come off worst among the top five brands jostling for supremacy in Asia's largest economy.

Huawei returned to the top spot after 13 quarters with a 17% market share. The local vendor shipped 11.7 million smartphones, thanks to its popular Mate and nova series,...

Analysts Have No Idea How Many Macs Apple Shipped Last Quarter

For the last several years, Apple has not provided breakdowns of the number of iPhones, Macs, and iPads sold, keeping analysts, customers, investors, and others in the dark on exact device sales. This has led analysts to attempt to estimate product shipments, and as the Q3 quarterly Mac numbers confirm, it's a very inexact process.

Companies like Gartner, IDC, and Canalys in fact appear to...

iPhone Shipments Up Nearly 20% in Q1 2022 in North America

Apple shipped an estimated 20 million iPhones in North America in the first calendar quarter of 2022, marking notable growth, according to shipment estimates that were shared today by Canalys.

iPhone shipments were up nearly 20 percent from the 17 million iPhones shipped in the year-ago quarter, and Apple's market share hit 51 percent, up from 45 percent.

Apple was the number one...

Apple Was the Only Top Smartphone Vendor to Increase Shipments Year-Over-Year Last Quarter

Apple was the only top smartphone maker that saw a year-over-year increase in shipments in the last quarter, while Samsung, Oppo, Xiaomi, and others saw steep declines in their respective mobile smartphones.

Apple yesterday announced record earnings for the March quarter, with more than $97 billion in revenue, beating expectations. Following the results, Strategy Analytics, Canalys, and IDC...

iPhone Was the Most Popular Smartphone in Q4 2021

iPhones accounted for around one-fifth of all smartphone shipments in the fourth quarter of 2021, allowing Apple to reclaim first place as the biggest smartphone vendor, according to a report from Canalys.

Canalys estimates that the iPhone accounted for 22 percent of worldwide smartphone shipments in the fourth quarter of 2021. The scale of Apple's shipments is thanks to strong demand for...

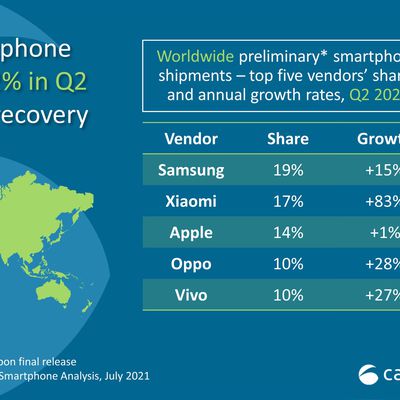

Xiaomi Surpasses Apple to Become Number Two Worldwide Smartphone Vendor in Q2 2021

Apple was the number three worldwide smartphone vendor in the second quarter of 2021, according to smartphone shipment estimates shared today by Canalys.

Apple's iPhone sales were surpassed by smartphone sales from Samsung and Chinese smartphone maker Xiaomi, with Xiaomi surpassing Apple and taking the number two spot for the first time.

Samsung was the most popular smartphone vendor with ...

Mac Shipments Continue to Rise Amid Surge in Demand for PCs [Updated]

Shipments of Macs increased by almost 10 percent in the second quarter of 2021 compared to the same time last year, as the surge in demand for computers continued, according to IDC data.

The IDC Worldwide Quarterly Personal Computing Device Tracker shows that worldwide shipments of personal computers, including desktops, notebooks, and workstations, reached 83.6 million units in the second...

Apple Dominated Audio Device Shipments in 2020 With AirPods and Beats

Apple shipped an estimated 108.9 million "smart personal audio" devices, which includes the AirPods and Beats headphones in 2020, according to new data shared today by Canalys.

That's up close to 30 percent from the 84 million device shipments in 2019, with Apple holding 25.2 percent market share. Apple dominated the competition, with Samsung, the next closest audio device manufacturer,...

Apple Continues to Dominate Tablet Market With an Estimated 19.2 Million Shipments in Q4 2020

Apple continues to hold a dominant position in the tablet market thanks to continued iPad sales growth throughout 2020, according to new data shared today by Canalys.

Apple shipped an estimated 19.2 million iPads during the fourth quarter of 2020 (which corresponds to Apple's first fiscal quarter of 2021), marking a 40 percent increase over the estimated 13.7 million tablets that it shipped...

Apple Takes Top Spot in Global Smartphones Market With Record 82 Million iPhone Shipments in Q4 2020

Apple has taken the spot in the global smartphone market thanks to record iPhone shipments, while Samsung and Huawei have lost significant ground, according to the latest market research firm data.

Canalys research found that Apple shipped more iPhones than ever in the fourth quarter of 2020, at 81.8 million units. Samsung meanwhile took second place shipping 62 million units – a 12%...

Canalys: Apple Shipped 16% More PCs in 2020, but Still Lags Behind Dell, HP, and Lenovo

Apple shipped 22.6 million PCs in 2020, an increase of 16 percent over 2019's 19.4 million, but the company remains well behind rivals, according to a new report by Canalys.

The report, which excludes tablet computers, shows that worldwide PC market growth accelerated significantly in the final quarter of 2020. Shipments of desktops, notebooks, and workstations increased by 25 percent...

Canalys: Apple 'Still Has Much to Prove' With HomePod Mini in Crowded Smart Speaker Market

A new report from Canalys has forecasted the global smart speaker market for next year, projecting that it will reach 163 million units, a growth of 21 percent.

Mainland China is expected to be the main market for smart speakers next year with a growth of 16 percent. The rest of the market is expected to grow by just three percent. In spite of this, 2021 is believed to be a much stronger...

Apple Continues to Dominate North American Wearables Market

Apple continued to dominate the North American wearables market in the second quarter of 2020, with a growth of nine percent year-on-year, according to a new report by Canalys.

The shipments of wearables in the North American market grew 10 percent in the second quarter of 2020, but the value of the market remained flat year-on-year. A boom in low-end activity trackers meant that the...