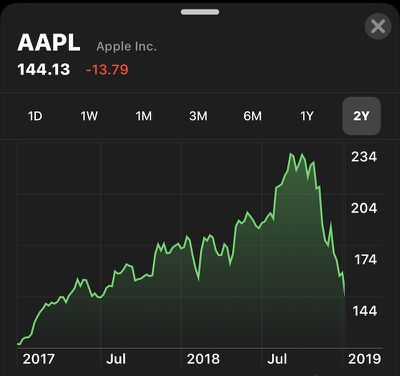

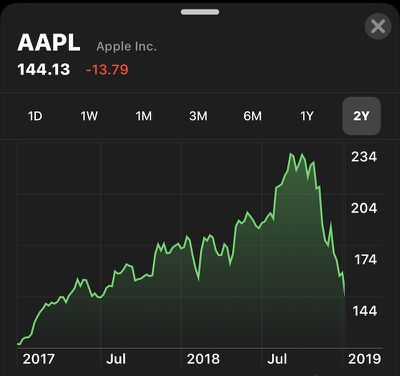

AAPL Opens at $144, Sliding Nearly 10% After Major Revenue Cut and Down 35% Since Early November

AAPL has opened at $144 today on the stock market, with share prices sliding roughly nine percent after Apple lowered its revenue guidance by up to $9 billion for the first quarter of its 2019 fiscal year.

AAPL is down just over 35 percent since closing at $222.22 on November 1, just prior to its last earnings report.

In a letter to shareholders on Wednesday, Apple disclosed that its revenue will be lower than its original guidance for the first quarter of its 2019 fiscal year, coming in at approximately $84 billion. Apple originally guided for revenue of $89 billion to $93 billion in the quarter on November 1.

The letter said lower than anticipated iPhone revenue, primarily in Greater China, accounts for the entire revenue shortfall.

In an internal memo, Apple CEO Tim Cook said he will host an all-hands meeting with employees today at 9:30 a.m. Pacific Time at Apple's Town Hall auditorium on its Infinite Loop campus to answer questions about the shortfall.

AAPL was already dragged down by Apple's recent announcement that it will no longer disclose iPhone, iPad, and Mac unit sales starting with its next quarterly earnings report. The move sparked fears among some investors and analysts that Apple had something to hide, particularly regarding slowing iPhone sales.

Apple yesterday announced that it will report its earnings for the first quarter of its 2019 fiscal year on January 29.

Popular Stories

Since the iPhone X in 2017, all of Apple's highest-end iPhone models have featured either stainless steel or titanium frames, but it has now been rumored that this design decision will be coming to an end with the iPhone 17 Pro models later this year.

In a post on Chinese social media platform Weibo today, the account Instant Digital said that the iPhone 17 Pro models will have an aluminum...

Apple is continuing to refine and update iOS 26, and beta three features smaller changes than we saw in beta 2, plus further tweaks to the Liquid Glass design. Apple is gearing up for the next phase of beta testing, and the company has promised that a public beta is set to come out in July.

Transparency

In some apps like Apple Music, Podcasts, and the App Store, Apple has toned down the...

In select U.S. states, residents can add their driver's license or state ID to the Wallet app on the iPhone and Apple Watch, providing a convenient and contactless way to display proof of identity or age at select airports and businesses, and in select apps.

Unfortunately, this feature continues to roll out very slowly since it was announced in 2021, with only nine U.S. states, Puerto Rico,...

Apple will launch its new iPhone 17 series in two months, and the iPhone 17 Pro models are expected to get a new design for the rear casing and the camera area. But more significant changes to the lineup are not expected until next year, when the iPhone 18 models arrive.

If you're thinking of trading in your iPhone for this year's latest, consider the following features rumored to be coming...

Apple is expanding the ability to add an Apple Account Card to the Wallet app to more countries, according to backend Apple Pay changes.

With iOS 15.5, Apple updated the Wallet app to allow users to add an Apple Account Card, which displays the Apple credit balance associated with an Apple ID.

If you receive an Apple gift card, for example, it is added to an Apple Account that is also...

Three out of four iPhone 17 models will feature more RAM than the equivalent iPhone 16 models, according to a new leak that aligns with previous rumors.

The all-new iPhone 17 Air, the iPhone 17 Pro, and the iPhone 17 Pro Max will each be equipped with 12GB of RAM, according to Fixed Focus Digital, an account with more than two million followers on Chinese social media platform Weibo. The...

Apple should unveil the iPhone 17 series in September, and there might be one bigger difference between the Pro and Pro Max models this year.

As always, the Pro Max model will be larger than the Pro model:iPhone 17 Pro: 6.3-inch display

iPhone 17 Pro Max: 6.9-inch displayGiven the Pro Max is physically larger than the Pro, it has more internal space, allowing for a larger battery and...

The calendar has turned to July, meaning that 2025 is now more than half over. And while the summer months are often quiet for Apple, the company still has more than a dozen products coming later this year, according to rumors.

Below, we have outlined at least 15 new Apple products that are expected to launch later this year, along with key rumored features for each.

iPhone 17 Series

iPho...