Apple is set to report its earnings results for the fourth quarter of its 2017 fiscal year at 1:30 p.m. Pacific Time today.

Apple is set to report its earnings results for the fourth quarter of its 2017 fiscal year at 1:30 p.m. Pacific Time today.

The fiscal quarter reflects Apple's sales between July 2 and September 30 of 2017.

Apple provided the following guidance for its fourth quarter back on August 1:

• revenue between $49 billion and $52 billion

• gross margin between 37.5 and 38 percent

• operating expenses between $6.7 billion and $6.8 billion

• other income/expense of $500 million

• tax rate of 25.5 percent

Apple's guidance suggests the company will report at least its second best fourth quarter earnings results in its history.

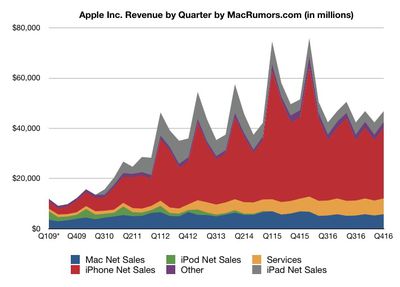

A quarter-by-quarter look at Apple's revenue since the 2009 fiscal year:

• 2013: $37.5B

• 2014: $42.1B

• 2015: $51.5B

• 2016: $46.9B

• 2017: $49B+

MacRumors.com compiled fourth quarter estimates from several financial institutions and analysts tracking Apple and the company's stock. The figures are listed below, ranked from highest to lowest in quarterly revenue.

Apple's fourth quarter earnings results will provide the first official indication of how well the iPhone 8 and iPhone 8 are selling. The devices became available to pre-order on September 15, just over two weeks before the quarter ended, and launched in stores one week later on September 22.

Multiple reports have suggested that demand for the iPhone 8 and iPhone 8 Plus has been tepid, but that could be a side effect of pent up demand for the iPhone X. Apple staggered the release of its high-end smartphone, for which pre-orders began October 27, nearly six weeks after the iPhone 8 and iPhone 8 Plus.

The most interesting takeaway will be Apple's guidance for the quarter we're in right now, which encompasses the launch of the iPhone X and the busy holiday shopping season. Over the past year, analysts have repeatedly predicted the highly-anticipated device will drive a significant "supercycle" of upgrades.

A high guidance range would suggest that Apple expects the iPhone X to sell very well, while a lower one would suggest that either demand is lower than thought or that Apple continues to face issues with ramping up supply of the device.

In addition to iPhone sales, investors will be looking for continued growth of Apple's services category, which includes the likes of the App Store, iTunes Store, Apple Music, Apple Pay, AppleCare, and licensing fees. Apple's services revenue grew 22 percent to an all-time record of $7.3 billion last quarter.

Apple's services category has become the size of a Fortune 100 company, according to chief executive Tim Cook.

Cook and Apple's financial chief Luca Maestri will discuss the company's earnings results on a conference call at 2:00 p.m. Pacific Time. MacRumors.com will transcribe the call as it unfolds for those unable to listen.