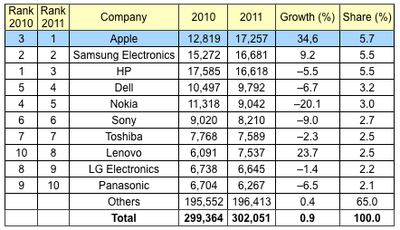

Apple Ranked as World's Top Semiconductor Customer in 2011

Back in June of last year, IHS iSuppli reported that Apple had become the world's largest buyer of semiconductors in 2010, jumping past HP and Samsung to top the list with $17.5 billion in spending. Apple's lead was expected to grow in 2011 on continued strength of the iPhone, iPad, and MacBook Air, all of which contain substantial NAND flash memory, which has become a primary driver of semiconductor markets due to the booming mobile device landscape.

Research firm Gartner is out today with a new report that appears to utilize a somewhat different methodology in calculating semiconductor expenditures but which now comes to the same conclusion as IHS Suppli's earlier report. According to Gartner, Apple became the world's largest semiconductor customer in 2011 as measured by total silicon content in all products designed by Apple and its competitors, known as Design TAM.

Gartner pegs Apple's year-over-year growth for 2011 at 34.6%, easily topping the growth of other top semiconductor customers and allowing it to leapfrog Samsung and a sliding HP for the top spot in the rankings. According to the report, semiconductor purchases for Apple's products came in at $17.3 billion in 2011, ahead of Samsung's $16.7 billion and HP's $16.6 billion purchases.

iSuppli's report from last year highlighted the vast differences in Apple's and HP's markets, with Apple's semiconductor usage being driven by mobile devices and HP's by traditional computer products. Gartner notes that mobile devices and solid-state drives are indeed now the major drivers of semiconductor usage.

"The major growth drivers in 2011 were smartphones, media tablets and solid-state drives (SSDs)," said Masatsune Yamaji, principal research analyst at Gartner. "Those companies that gained share in the smartphone market, such as Apple, Samsung Electronics and HTC, increased their semiconductor demand, while those who lost market share in this segment, such as Nokia and LG Electronics, decreased their semiconductor demand.

Gartner distinguishes Design TAM from Purchasing TAM, which would attribute to a given company only the amount actually purchased by the company. As an example of the difference between the two metrics, semiconductors purchased by a third-party manufacturing partner would generally count toward the primary company's Design TAM but not its Purchasing TAM.

Popular Stories

Apple today updated its trade-in values for select iPhone, iPad, Mac, and Apple Watch models. Trade-ins can be completed on Apple's website, or at an Apple Store.

The charts below provide an overview of Apple's current and previous trade-in values in the U.S., according to its website. Maximum values for most devices either decreased or saw no change, but the iPad Air received a slight bump.

...

Apple is promoting the new Liquid Glass design in iOS 26, showing off the ways that third-party developers are embracing the aesthetic in their apps. On its developer website, Apple is featuring a visual gallery that demonstrates how "teams of all sizes" are creating Liquid Glass experiences.

The gallery features examples of Liquid Glass in apps for iPhone, iPad, Apple Watch, and Mac. Apple...

Apple's online store in the U.S. is suddenly offering a pack of four AirTags for just $29, which is the same price as a single AirTag.

This is likely a pricing error, and it is unclear if orders will be fulfilled. Apple has not discounted the AirTag four-pack in any other countries that we checked.

Delivery estimates are already pushing into late November to early December, suggesting...

Following more than a month of beta testing, Apple released iOS 26.1 on Monday, November 3. The update includes a handful of new features and changes, including the ability to adjust the look of Liquid Glass and more.

Below, we outline iOS 26.1's key new features.

Liquid Glass Toggle

iOS 26.1 lets you choose your preferred look for Liquid Glass.

In the Settings app, under Display...

IKEA today announced the upcoming launch of 21 new Matter-compatible smart home products that will be able to interface with HomeKit and the Apple Home app. There are sensors, lights, and control options, all of which will be reasonably priced. Some of the products are new, while some are updates to existing lines that IKEA previously offered.

There are a series of new smart bulbs that are...

We're officially in the month of Black Friday, which will take place on Friday, November 28 in 2025. As always, this will be the best time of the year to shop for great deals, including popular Apple products like AirPods, iPad, Apple Watch, and more. In this article, the majority of the discounts will be found on Amazon.

Note: MacRumors is an affiliate partner with some of these vendors. When ...

The future of Apple Fitness+ is "under review" amid a reorganization of the service, according to Bloomberg's Mark Gurman.

In the latest edition of his "Power On" newsletter, Gurman said that Apple Fitness+ remains one of the company's "weakest digital offerings." The service apparently suffers from high churn and little revenue.

Nevertheless, Fitness+ has a small, loyal fanbase that...

HTX Studio this week shared the results from a six-month battery test that compared how fast charging and slow charging can affect battery life over time.

Using six iPhone 12 models, the channel set up a system to drain the batteries from five percent and charge them to 100 percent over and over again. Three were fast charged, and three were slow charged.

Another set of iPhones underwent...

Apple in iOS 26.2 will disable automatic Wi-Fi network syncing between iPhone and Apple Watch in the European Union to comply with the bloc's regulations, suggests a new report.

Normally, when an iPhone connects to a new Wi-Fi network, it automatically shares the network credentials with the paired Apple Watch. This allows the watch to connect to the same network independently – for...

![]()