Apple Promotes New Apple Pay UK Bank Account Balance Feature

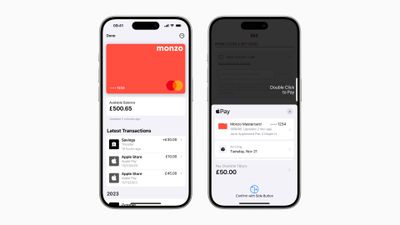

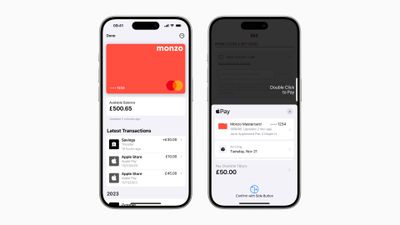

Apple today highlighted the ability in iOS 17.1 for UK users to connect their credit and debit cards in Apple Wallet and easily access information like account balance, spending history, and more.

Users can view their up-to-date bank card balance, payments, deposits, and withdrawals in Wallet and when they're checking out with Apple Pay online or in-apps. Apple says the new feature "empowers users to make more informed purchases, increases their confidence when making a transaction, and allows them to simply view frequent information so that they have more control when it comes to their finances."

From Apple's press release:

"By enabling users to conveniently access their most useful account information within Wallet and at the time of their purchase, they can make informed financial decisions and better understand and manage their spend," said Jennifer Bailey, Apple's vice president of Apple Pay and Apple Wallet. "We look forward to working with U.K. partners under the Open Banking initiative to help users better their financial health, and provide more ways in which banks can deepen their relationships with customers."

Apple added the transaction and card balance functionality to the Wallet app in October's iOS 17.1 update as part of its Connected Cards feature, and several banks have since come on board, including Barclays, Barclaycard, First Direct, Halifax, HSBC, Lloyds, M&S Bank, Monzo Bank, NatWest Bank, and Royal Bank of Scotland.

UK banks support the Open Banking API to integrate with the Wallet app, which has made the feature widely available to UK users, while the Connected Cards rollout in the United States has lagged behind.

Popular Stories

Apple hasn't updated the AirPods Pro since 2022, and the earbuds are due for a refresh. We're counting on a new model this year, and we've seen several hints of new AirPods tucked away in Apple's code. Rumors suggest that Apple has some exciting new features planned that will make it worthwhile to upgrade to the latest model.

Subscribe to the MacRumors YouTube channel for more videos.

Heal...

In 2020, Apple added a digital car key feature to its Wallet app, allowing users to lock, unlock, and start a compatible vehicle with an iPhone or Apple Watch. The feature is currently offered by select automakers, including Audi, BMW, Hyundai, Kia, Genesis, Mercedes-Benz, Volvo, and a handful of others, and it is set to expand further.

During its WWDC 2025 keynote, Apple said that 13...

Popular accessory maker Anker this month launched two separate recalls for its power banks, some of which may be a fire risk.

The first recall affects Anker PowerCore 10000 Power Banks sold between June 1, 2016 and December 31, 2022 in the United States. Anker says that these power banks have a "potential issue" with the battery inside, which can lead to overheating, melting of plastic...

Chase this week announced a series of new perks for its premium Sapphire Reserve credit card, and one of them is for a pair of Apple services.

Specifically, the credit card now offers complimentary annual subscriptions to Apple TV+ and Apple Music, a value of up to $250 per year.

If you are already paying for Apple TV+ and/or Apple Music directly through Apple, those subscriptions will...

Apple's next-generation iPhone 17 Pro and iPhone 17 Pro Max are around three months away, and there are plenty of rumors about the devices.

Apple is expected to launch the iPhone 17, iPhone 17 Air, iPhone 17 Pro, and iPhone 17 Pro Max in September this year.

Below, we recap key changes rumored for the iPhone 17 Pro models:Aluminum frame: iPhone 17 Pro models are rumored to have an...

Apple is developing a MacBook with the A18 Pro chip, according to findings in backend code uncovered by MacRumors.

Earlier today, Apple analyst Ming-Chi Kuo reported that Apple is planning to launch a low-cost MacBook powered by an iPhone chip. The machine is expected to feature a 13-inch display, the A18 Pro chip, and color options that include silver, blue, pink, and yellow.

MacRumors...

Apple is planning to launch a low-cost MacBook powered by an iPhone chip, according to Apple analyst Ming-Chi Kuo.

In an article published on X, Kuo explained that the device will feature a 13-inch display and the A18 Pro chip, making it the first Mac powered by an iPhone chip. The A18 Pro chip debuted in the iPhone 16 Pro last year. To date, all Apple silicon Macs have contained M-series...

Apple last month announced the launch of CarPlay Ultra, the long-awaited next-generation version of its CarPlay software system for vehicles.

There was news this week about which automakers will and won't offer CarPlay Ultra, and we have provided an updated list below.

CarPlay Ultra is currently limited to newer Aston Martin vehicles in the U.S. and Canada. Fortunately, if you cannot...

Apple will finally deliver the Apple Watch Ultra 3 sometime this year, according to analyst Jeff Pu of GF Securities Hong Kong (via @jukanlosreve).

The analyst expects both the Apple Watch Series 11 and Apple Watch Ultra 3 to arrive this year (likely alongside the new iPhone 17 lineup, if previous launches are anything to go by), according to his latest product roadmap shared with...