Goldman Sachs this week updated its Apple Card customer agreement to reflect the credit card's upcoming Daily Cash savings account feature, which was expected to launch with iOS 16.1 but appears to have been delayed.

"To enable new ways to use Daily Cash like the upcoming Savings account feature, we are updating the Daily Cash Program section of your Apple Card Customer Agreement," reads an email sent to Apple Card holders this week.

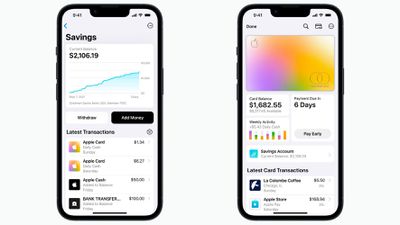

In October, Apple announced that Apple Card users would soon be able to open a new high-yield savings account from Goldman Sachs and have their Daily Cash cashback rewards automatically deposited into it, with no fees, no minimum deposits, and no minimum balance requirements. The account will be managed through the Wallet app on the iPhone.

The savings account was listed in the release notes for the iOS 16.1 Release Candidate, but it did not end up launching with that update. The savings account has not been present in any iOS 16.2 betas, so it's unclear when it will become available, but Goldman Sachs evidently continues to lay the groundwork for the feature's launch.

Once the account is set up, all Daily Cash received from that point on will be automatically deposited into it and start earning interest, unless a user opts to continue having Daily Cash added to their Apple Cash balance. Apple Card provides 2-3% Daily Cash on purchases made with Apple Pay and 1% on purchases made with the physical card.

Launched in 2019, Apple's credit card remains exclusive to the United States. Customers who sign up for an Apple Card and use it to purchase Apple products through December 25 will receive 5% Daily Cash as part of a limited-time promotion.