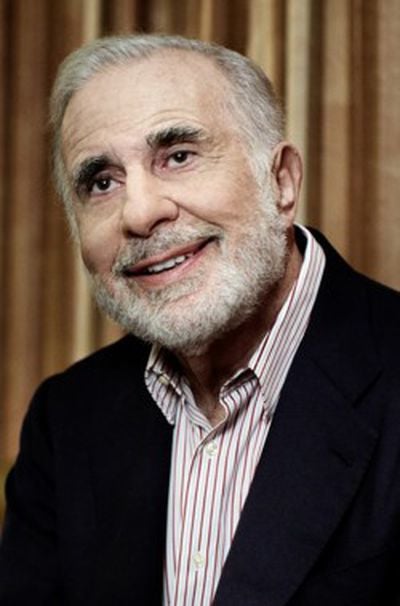

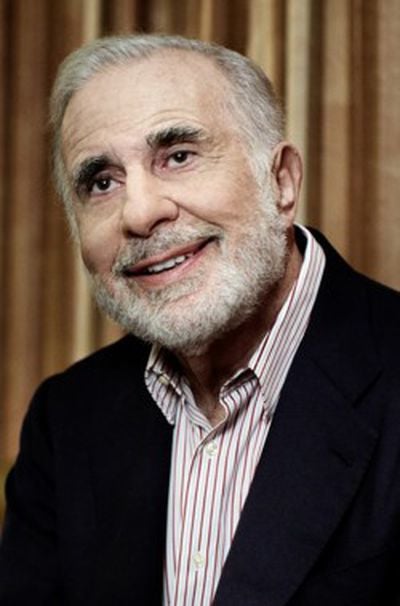

Carl Icahn Posts Response to Apple On Proxy Proposal for Share Buyback, Buys $500 Million More in Stock

Several weeks ago, Apple filed a statement with the SEC advising shareholders to vote against activist investor Carl Icahn's non-binding "advisory" share buyback proposal from early December.

Several weeks ago, Apple filed a statement with the SEC advising shareholders to vote against activist investor Carl Icahn's non-binding "advisory" share buyback proposal from early December.

The proposal will be voted on by shareholders at Apple's stockholder's meeting, to be held at Apple's headquarters at some point in the next couple of months. Today, Icahn published a seven-page letter to shareholders advocating for a yes vote on its proposal.

He also announced that he purchased another $500 million in Apple stock today, bringing his cumulative total to $3.6 billion. Just yesterday, Icahn revealed that he had surpassed $3 billion in AAPL ownership. He also stated on CNBC that his criticism was reserved for Apple's board of directors, not its management.

In the letter, Icahn explains his belief that Apple's stock is a "no brainer" to purchase, and that Apple's board should be supportive of a significant increase in Apple's share repurchase program. He argues that Apple's stock -- currently priced at $555 -- would be priced at $840 if its price to earnings ratio was the same as the average P/E across the S&P 500.

We believe, however, that this share repurchase authorization can and should be even larger, and effectuating that for the benefit of all of the company’s shareholders is the sole intention of our proposal. The company has recommended voting against our proposal for various reasons. It seems to us that the basis of its argument against our proposal is that the company believes, because of the “dynamic competitive landscape” and because its “rapid pace of innovation require[s] unprecedented investment, flexibility and access to resources”, it does not currently have enough excess liquidity to increase the size of its repurchase program. Assuming this indeed is the basis for the company’s argument, we find its position overly conservative (almost to the point of being irrational), when we consider that the company had $130 billion of net cash as of September 28, 2013 and that consensus earnings are expected to be almost $40 billion next year. Given this massive net cash position and robust earnings generation, Apple is perhaps the most overcapitalized company in corporate history, from our perspective.

The full letter is

available from the SEC and comes ahead of Apple's

first quarter earnings report, scheduled for Monday afternoon. The company is expected to report the strongest results for any quarter in its history.

Popular Stories

Apple's next-generation iPhone 17 Pro and iPhone 17 Pro Max are just over two months away, and there are plenty of rumors about the devices.

Below, we recap key changes rumored for the iPhone 17 Pro models.

Latest Rumors

These rumors surfaced in June and July:Apple logo repositioned: Apple's logo may have a lower position on the back of the iPhone 17 Pro models, compared to previous...

Apple should unveil the iPhone 17 series in September, and there might be one bigger difference between the Pro and Pro Max models this year.

As always, the Pro Max model will be larger than the Pro model:iPhone 17 Pro: 6.3-inch display

iPhone 17 Pro Max: 6.9-inch displayGiven the Pro Max is physically larger than the Pro, it has more internal space, allowing for a larger battery and...

In 2020, Apple added a digital car key feature to its Wallet app, allowing users to lock, unlock, and start a compatible vehicle with an iPhone or Apple Watch. The feature is currently offered by select automakers, including Audi, BMW, Hyundai, Kia, Genesis, Mercedes-Benz, Volvo, and a handful of others, and it is set to expand further.

Apple has a web page with a list of vehicle models that ...

The calendar has turned to July, meaning that 2025 is now more than half over. And while the summer months are often quiet for Apple, the company still has more than a dozen products coming later this year, according to rumors.

Below, we have outlined at least 15 new Apple products that are expected to launch later this year, along with key rumored features for each.

iPhone 17 Series

iPho...

Apple is continuing to refine and update iOS 26, and beta three features smaller changes than we saw in beta 2, plus further tweaks to the Liquid Glass design. Apple is gearing up for the next phase of beta testing, and the company has promised that a public beta is set to come out in July.

Transparency

In some apps like Apple Music, Podcasts, and the App Store, Apple has toned down the...

New renders today provide the best look yet relocated Apple logo and redesigned MagSafe magnet array of the iPhone 17 Pro and iPhone 17 Pro Max.

Image via Majin Bu.

Several of the design changes coming to the iPhone 17 Pro model have been rumored for some time, such as the elongated camera bump that spans the full width of the device, with the LiDAR Scanner and flash moving to the right side.

...

Since the iPhone X in 2017, all of Apple's highest-end iPhone models have featured either stainless steel or titanium frames, but it has now been rumored that this design decision will be coming to an end with the iPhone 17 Pro models later this year.

In a post on Chinese social media platform Weibo today, the account Instant Digital said that the iPhone 17 Pro models will have an aluminum...

Amazon is soon to be back with its annual summertime Prime Day event, lasting for four days from July 8-11, the longest Prime Day yet. As it does every year, Prime Day offers shoppers a huge selection of deals across Amazon's storefront, and there are already many deals you can get on sale ahead of the event.

Note: MacRumors is an affiliate partner with Amazon. When you click a link and make a ...

Apple's position as the dominant force in the global true wireless stereo (TWS) earbud market is expected to continue through 2025, according to Counterpoint Research.

The forecast outlines a 3% year-over-year increase in global TWS unit shipments for 2025, signaling a transition from rapid growth to a more mature phase for the category. While Apple is set to remain the leading brand by...

Several weeks ago, Apple filed a statement with the SEC advising shareholders to vote against activist investor Carl Icahn's non-binding "advisory" share buyback proposal from early December.

Several weeks ago, Apple filed a statement with the SEC advising shareholders to vote against activist investor Carl Icahn's non-binding "advisory" share buyback proposal from early December.