Coinbase Users Can Now Buy Crypto Assets Using Apple Pay

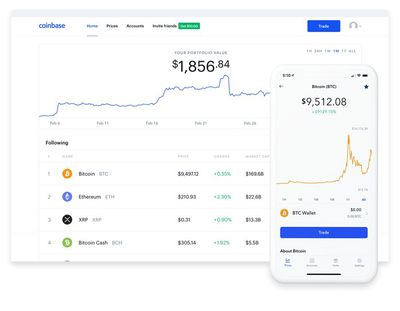

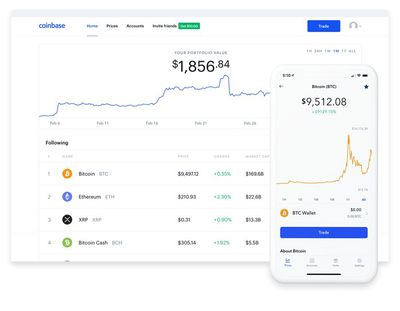

Popular cryptocurrency exchange Coinbase has announced that it is now allowing traders to use bank cards linked to Apple Pay to purchase crypto assets on the platform.

"Today, we're introducing new and seamless ways to enable crypto buys with linked debit cards to Apple Pay and Google Pay, and instant cashouts up to $100,000 per transaction available 24/7," said a Coinbase blog post on Thursday.

"If you already have a Visa or Mastercard debit card linked in your Apple Wallet, Apple Pay will automatically appear as a payment method when you're buying crypto with Coinbase on an Apple Pay-supported iOS device or Safari web browser."

In addition, Coinbase said it is also making it easier and faster for users to access their money by offering instant washouts via Real Time Payments (RTP), allowing customers in the U.S. with linked bank accounts to instantly and securely cash out up to $100,000 per transaction.

In June, Coinbase debit cards gained Apple Pay support, allowing it to be added to the Wallet app on iPhone. The Coinbase Card automatically converts the cryptocurrency that a user wishes to spend to U.S. dollars, and transfers the funds to their Coinbase Card for Apple Pay purchases and ATM withdrawals.

Popular Stories

In his Power On newsletter today, Bloomberg's Mark Gurman said Apple will have a three-day stretch of product announcements from Monday, March 2 through Wednesday, March 4. In total, he expects Apple to introduce "at least five products."

Subscribe to the MacRumors YouTube channel for more videos.

A week ago, Apple invited selected journalists and content creators to an "Apple Experience" in...

Apple's software engineers are testing iOS 26.3.1, according to the MacRumors visitor logs, which have been a reliable indicator of upcoming iOS versions.

iOS 26.3.1 should be a minor update that fixes bugs and/or security vulnerabilities, and it will likely be released within the next two weeks.

Last month, Apple released iOS 26.2.1 with bug fixes and support for the second-generation...

The special new color that Apple is considering for the iPhone 18 Pro and iPhone 18 Pro Max this year is red, according to Bloomberg's Mark Gurman.

Specifically, he said that Apple is testing a "deep red" finish for the two devices.

If this rumor materializes, it would be the first time that the Pro and Pro Max models ever come in red, and the iPhone 18 Pro models would be the first...