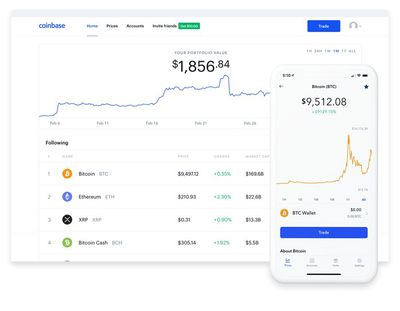

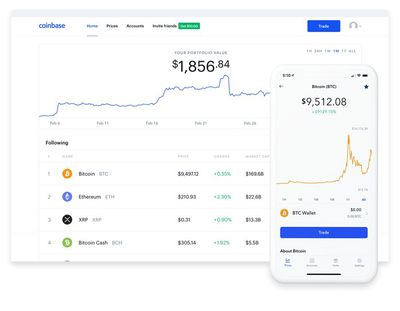

Coinbase Users Can Now Buy Crypto Assets Using Apple Pay

Popular cryptocurrency exchange Coinbase has announced that it is now allowing traders to use bank cards linked to Apple Pay to purchase crypto assets on the platform.

"Today, we're introducing new and seamless ways to enable crypto buys with linked debit cards to Apple Pay and Google Pay, and instant cashouts up to $100,000 per transaction available 24/7," said a Coinbase blog post on Thursday.

"If you already have a Visa or Mastercard debit card linked in your Apple Wallet, Apple Pay will automatically appear as a payment method when you're buying crypto with Coinbase on an Apple Pay-supported iOS device or Safari web browser."

In addition, Coinbase said it is also making it easier and faster for users to access their money by offering instant washouts via Real Time Payments (RTP), allowing customers in the U.S. with linked bank accounts to instantly and securely cash out up to $100,000 per transaction.

In June, Coinbase debit cards gained Apple Pay support, allowing it to be added to the Wallet app on iPhone. The Coinbase Card automatically converts the cryptocurrency that a user wishes to spend to U.S. dollars, and transfers the funds to their Coinbase Card for Apple Pay purchases and ATM withdrawals.

Popular Stories

Apple is planning to launch an all-new "MacBook Ultra" model this year, featuring an OLED display, touchscreen, and a higher price point, Bloomberg's Mark Gurman reports.

Gurman revealed the information in his latest "Power On" newsletter. While Apple has been widely expected to launch new M6-series MacBook Pro models with OLED displays, touchscreen functionality, and a new, thinner design...

Apple this week unveiled seven products, including an iPhone 17e, an iPad Air with the M4 chip, updated MacBook Air and MacBook Pro models, a new Studio Display, a higher-end Studio Display XDR, and an all-new MacBook Neo that starts at just $599.

iPhone 17e features the same overall design as the iPhone 16e, but it gains Apple's A19 chip, MagSafe for magnetic wireless charging and magnetic...

Apple is continuing to test the iOS 26.4 beta, and the latest update is now available for developers and public beta testers. As testing goes on, there are fewer new features in each beta, but today’s release adds new emoji characters and a few other changes.

New Emoji

Apple added new emoji characters, including trombone, treasure chest, distorted face, hairy creature, fight cloud, orca,...