Apple Card, Apple's credit card that began rolling out to some beta testers and members of the media this week, uses Mastercard for processing payments.

Since it uses Mastercard's network, the Apple Card is able to take advantage of benefits offered to Mastercard card holders, as pointed out by TechCrunch's Matthew Panzarino, one of the early testers.

Mastercard's website offers a list of benefits available to Apple Card users, including fraud protection, identity theft protection, and a free ShopRunner membership that offers free two-day shipping from some websites.

Other benefits include Mastercard's travel discounts and upgrades, Mastercard's exclusive "special events," Mastercard golf offerings, and home rental discounts via Onefinestay, all of which are available to all Mastercard users.

Purchase protection and extended warranties offered by some credit cards as benefits are not available with the Apple Card. Apple Card's main benefit is its Daily Cash program, which offers between 1 and 3 percent cash back on purchases, with money sent out each day shortly after a purchase is made.

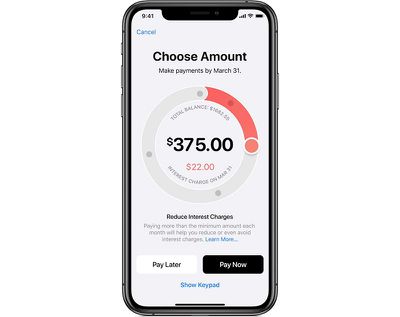

Also of interest to potential Apple Card customers is a new base annual percentage rate (APR). When Apple Card was announced, Apple said that it would offer an APR between 13.24 percent and 24.24 percent based on credit score. Following the Federal Reserve's decision to cut interest rates last Wednesday, the APR for Apple card has changed.

As noted by The Verge's Nilay Patel, the base APR for purchases is now 12.99%, while the maximum APR is 23.99%.

Btw, the lowest APR for Apple Card is 12.99 percent after Fed rate cut, seeing a few stories quoting a higher rate. But I just signed up and it is indeed 12.99. pic.twitter.com/mYbDpXskUw — nilay patel (@reckless) August 6, 2019

For those who are applying to Apple Card and who may have frozen their credit, Goldman Sachs handles card approvals and uses TransUnion for credit checks. You'll need to unfreeze your TransUnion credit to be approved for Apple Card.

Apple Card customers should be aware that the Apple Card must be managed using an iPhone or iPad as there is no web component to the card.

A random selection of people who signed up to be notified about Apple Card are being invited to sign up for the Apple Card today, with a full rollout coming later this month. For more on how Apple Card works, make sure to check out our Apple Card guide.