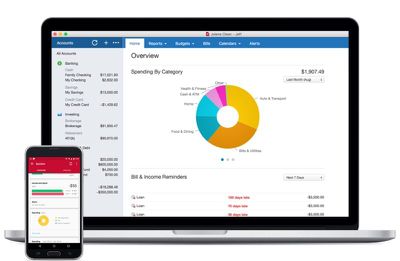

Finance and budgeting software Quicken for Mac was updated to version 4.4 this week, adding a handful of useful new features ranging from auto backup to improvements to summary reports.

With Auto-Backup, Quicken will back up five files at a time to a user-set location whenever someone logs out of the app, preventing data from being accidentally lost. A new Transaction Sidebar indicator has been added, which highlights all accounts that have new transactions when connected accounts are refreshed.

Comparison and summary reports can be exported or copied to a spreadsheet for printing or data analysis, and there's a new Total column in the summary report. New report comparison customization options make it easier to compare the current period with previous periods on a quarterly or monthly basis.

First released in October, Quicken 2017 features a new interface, a range of custom report options, and Quicken Bill Pay for paying for bills directly within the app.

Quicken for Mac 2017 can be downloaded from the Quicken website or from the Mac App Store for $74.99. [Direct Link]

Top Rated Comments

Sure, it's may not be "perfect" in every way (and what personal finance app truly is?) but unlike with Quicken for the Mac, I can at least trust Banktivity to not ditch the platform for a decade, then come back with some weak-sauce port of their PC version and claim like "all is good for Mac users" while charging a premium for a half-featured product. Sooooo, I'll pass...