Apple Promotes New Apple Pay UK Bank Account Balance Feature

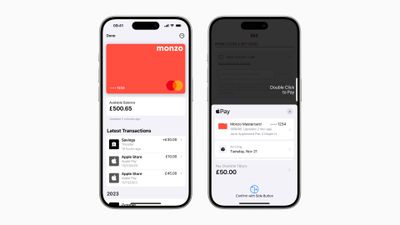

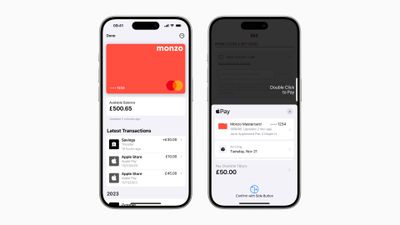

Apple today highlighted the ability in iOS 17.1 for UK users to connect their credit and debit cards in Apple Wallet and easily access information like account balance, spending history, and more.

Users can view their up-to-date bank card balance, payments, deposits, and withdrawals in Wallet and when they're checking out with Apple Pay online or in-apps. Apple says the new feature "empowers users to make more informed purchases, increases their confidence when making a transaction, and allows them to simply view frequent information so that they have more control when it comes to their finances."

From Apple's press release:

"By enabling users to conveniently access their most useful account information within Wallet and at the time of their purchase, they can make informed financial decisions and better understand and manage their spend," said Jennifer Bailey, Apple's vice president of Apple Pay and Apple Wallet. "We look forward to working with U.K. partners under the Open Banking initiative to help users better their financial health, and provide more ways in which banks can deepen their relationships with customers."

Apple added the transaction and card balance functionality to the Wallet app in October's iOS 17.1 update as part of its Connected Cards feature, and several banks have since come on board, including Barclays, Barclaycard, First Direct, Halifax, HSBC, Lloyds, M&S Bank, Monzo Bank, NatWest Bank, and Royal Bank of Scotland.

UK banks support the Open Banking API to integrate with the Wallet app, which has made the feature widely available to UK users, while the Connected Cards rollout in the United States has lagged behind.

Popular Stories

Apple today released new firmware designed for the AirPods Pro 3, the AirPods 4, and the prior-generation AirPods Pro 2. The AirPods Pro 3 firmware is 8B25, while the AirPods Pro 2 and AirPods 4 firmware is 8B21, all up from the prior 8A358 firmware released in October.

There's no word on what's include in the updated firmware, but the AirPods Pro 2, AirPods 4 with ANC, and AirPods Pro 3...

iOS 26 extended pinned conversations in the Messages app to CarPlay, for quick access to your most frequent chats. However, some drivers may prefer the classic view with a list of individual conversations only, and Apple now lets users choose.

Apple released the second beta of iOS 26.2 this week, and it introduces a new CarPlay setting for turning off pinned conversations in the Messages...

Apple recently teamed up with Japanese fashion brand ISSEY MIYAKE to create the iPhone Pocket, a limited-edition knitted accessory designed to carry an iPhone.

iPhone Pocket is available to order on Apple's online store starting today, in the United States, France, China, Italy, Japan, Singapore, South Korea, and the United Kingdom. However, it is already completely sold out in the United...

Starting with the upcoming tvOS 26.2 update, currently in beta, additional profiles created on the Apple TV no longer require their own Apple Account.

In the Settings app on the Apple TV, under Profiles and Accounts, anyone can create a new profile by simply entering a name and indicating whether the profile is for a kid. The profile will be associated with the primary user's Apple Account,...

Apple is preparing for Tim Cook to step down as CEO of the company "as soon as next year," according to the Financial Times.

The company's board of directors and senior executives "recently intensified preparations for Cook to hand over the reins," the report said.

While the report said that Apple is unlikely to name a new CEO before its next earnings report in late January, it went on to ...

Most of Apple's Macs are slated to get M5 chips across 2026, and there's a possibility we'll even see the first M6 chips toward the end of the year. Updates are planned for everything from the MacBook Air to the Mac Studio.

MacBook Air (Early 2026)

The MacBook Air will be one of the first Macs to get a 2026 refresh, with an update planned for the first few months of the year. The MacBook...

Walmart's Black Friday sale has officially kicked off today, with an online shopping event that's also seeing some matching deals in retail locations. There are quite a few major discounts in this sale, including savings on headphones, TVs, and more.

Note: MacRumors is an affiliate partner with Walmart. When you click a link and make a purchase, we may receive a small payment, which helps us...

We're officially in the month of Black Friday, which will take place on Friday, November 28 in 2025. As always, this will be the best time of the year to shop for great deals, including popular Apple products like AirPods, iPad, Apple Watch, and more. In this article, the majority of the discounts will be found on Amazon.

Note: MacRumors is an affiliate partner with some of these vendors. When ...

Apple released the first iOS 26.2 beta last week. The upcoming update includes a handful of new features and changes on the iPhone, including a new Liquid Glass slider for the Lock Screen's clock, offline lyrics in Apple Music, and more.

In a recent press release, Apple confirmed that iOS 26.2 will be released to all users in December, but it did not provide a specific release date....

While it was rumored that Apple planned to release new versions of the HomePod mini, Apple TV, and AirTag this year, it is no longer clear if that will still happen.

Back in January, Bloomberg's Mark Gurman said Apple planned to release new HomePod mini and Apple TV models "toward the end of the year," while he at one point expected a new AirTag to launch "around the middle of 2025." Yet,...