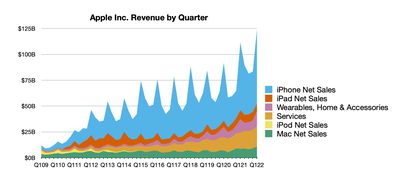

Apple today announced financial results for the first fiscal quarter of 2022, which corresponds to the fourth calendar quarter of 2021.

For the quarter, Apple posted revenue of $123.9 billion and net quarterly profit of $34.6 billion, or $2.10 per diluted share, compared to revenue of $111.4 billion and net quarterly profit of $28.8 billion, or $1.68 per diluted share, in the year-ago quarter.

Despite headwinds from chip shortages and other supply chain issues that Apple had previously said would hamper its ability to meet customer demand during the quarter, Apple's revenue and earnings for the quarter were all-time records. Apple's iPhone, Mac, Wearables, and Services segments also recorded all-time highs for revenue.

Gross margin for the quarter was 43.8 percent, compared to 39.8 percent in the year-ago quarter. Apple also declared a quarterly dividend payment of $0.22 per share, payable on February 10 to shareholders of record as of February 7.

“This quarter’s record results were made possible by our most innovative lineup of products and services ever,” said Tim Cook, Apple’s CEO. “We are gratified to see the response from customers around the world at a time when staying connected has never been more important. We are doing all we can to help build a better world — making progress toward our goal of becoming carbon neutral across our supply chain and products by 2030, and pushing forward with our work in education and racial equity and justice.”

As has been the case for well over a year now, Apple is once again not issuing guidance for the current quarter ending in March.

Apple will provide live streaming of its fiscal Q1 2022 financial results conference call at 2:00 pm Pacific, and MacRumors will update this story with coverage of the conference call highlights.

Conference call recap follows below...

1:37 pm: Apple's share price is currently up over 2% in after-hours trading.

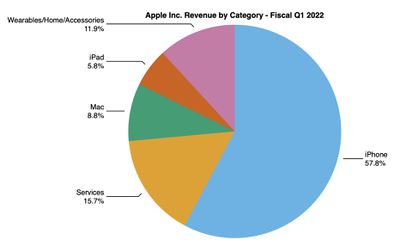

1:40 pm: With $10.85 billion in revenue, Apple's Mac sales broke through the $10 billion mark for the first time ever. Services are also approaching a milestone with a record $19.5 billion in revenue. iPad had $7.25 billion was the only segment to not set an all-time record, which isn't too surprising given a lack of recent updates for the iPad Pro and iPad Air lines.

1:42 pm: Even with the after-hours bump, the share price is still well off the all-time high of earlier in the month when the price touched $182.94. It's currently just above $165.

2:01 pm: The earnings call with analysts is beginning.

2:03 pm: Tim Cook is proud to announce Apple's biggest quarter ever, noting an all-time revenue record up 11 percent from last year and better than expected at the beginning of the quarter. There are more than 1.8 billion active devices, another record. Revenue growth across all product categories except iPad, which was supply constrained. Supply constraints were higher than the prior quarter.

2:04 pm: Tim is expressing gratitude to medical workers and others fighting COVID-19. Tim notes this is the 8th quarter dealing with the COVID pandemic.

2:04 pm: He is now reflecting on the 15th anniversary of Steve Jobs' unveiling of the iPhone earlier this month.

2:05 pm: Each of our major products leads the industry in customer satisfaction in their categories. iPhone set an all-time revenue record, thanks to the strength of the iPhone 13 lineup.

2:05 pm: An all-time revenue record was set for the Mac, thanks to M1-powered devices. M1 Pro and M1 Max is blowing users away with power, performance, and efficiency.

2:05 pm: The iPad continues to be indispensable to millions of teachers, students, artists, creatives, and more.

2:07 pm: Wearables, Homes, and Accessories set an all-time record as well, thanks to the Apple Watch 7 and other devices. Tim is talking about receiving emails from Apple Watch owners who have received heart-related alerts or were able to call 911 from their watch in an emergency.

2:08 pm: Services set an all-time revenue record, performing even better than Apple anticipated. Tim calls the App Store an economic miracle for developers, noting that it's safe for users. $260 billion transferred to developers. 200 award wins for Apple TV+ shows and movies, with 890 nominations.

2:09 pm: Our retail business saw its highest revenue in Apple history, and earned its highest ever customer satisfaction stores.

2:10 pm: Last year, celebrated 10 years of the Employee Giving program. We pledged to match contributions to organizations doing important work at every level. This program has contributed nearly $725 million to charitable organizations. We also celebrated 15 years of Apple's partnership with Project (RED). Raised $270 million for Project (RED).

2:11 pm: We also launched a new partnership with the Boys & Girls Club of America. The initiative will help youngsters learn to code on iPads. Apple is climate-neutral across the company's operations and is working intensely to reach a 2030 goal of carbon neutrality across the supply chain and throughout the lifetime of its products.

2:12 pm: Tim also mentioned the company's work on diversity and its Black History Month recognition, including a new Apple Watch band and a watch face.

2:13 pm: Now Apple CFO Luca Maestri is on to discuss the performance in more detail. The company set records in many geographies. Revenue was $101.4 billion on products, despite significant supply constraints. Grew in each product category except iPad, "where supply constraints were particularly pronounced."

2:14 pm: The current installed base of active devices is 1.8 billion devices. Growth was broad-based, with all-time records in each product category and geographic segment (except iPad). $19.5 billion in services revenue, and records across every geographic segment. 43.8% gross margin due to volume leverage and favorable mix, partially offset by higher cost structures. 38.4% product gross margin and 72.4% services gross margin.

2:16 pm: Latest survey shows iPhone customer satisfaction at 98%. Mac saw strong demand for MacBook Pro. The vast majority of Mac sales are from M1-powered devices. Record number of upgraders, and the last 6 quarters have been the best 6 quarters ever for Mac.

2:16 pm: iPad saw "very significant" supply constraints though customer demand was very strong across all models. Half of customers purchasing an iPad during the quarter were new to the product.

2:17 pm: $14.7 billlion for Wearables, Home, and Accessories, and records in each geographic segment. Apple Watch saw 2/3 of customers new to the product.

2:17 pm: New records for Services, with positive momentum on many fronts. December quarter record for the App Store.

2:18 pm: Increased customer engagement with services. Double-digit growth of paid accounts and hit an all-time high, and paid subscriptions reached 785 million in the quarter, up 165 million in the last 12 months. New content came to Apple TV+, Fitness+, and Apple Arcade.

2:19 pm: M1-powered Macs are the preferred machine for enterprise customers. Shopify is upgrading its entire global workforce to M1 Macs.

2:20 pm: Deloitte Consulting is expanding the Mac Employee Choice program, including the new M1-powered MacBook Pro.

2:21 pm: Cash position: We ended the quarter with $203 billion in cash and marketable securities. Total debt of $123 billion. Net cash of $80 billion. Business continues to generate strong cash flow, and $27 billion was returned to shareholders. $3.7 billion in dividends and $14.4 billion in open market purchases of 93 million Apple shares.

2:21 pm: $6 billion accelerated share repurchase began in November, retiring 30 million shares.

2:23 pm: Apple is not providing revenue guidance once again but is sharing some insights assuming COVID doesn't change too much. The company expects an all-time March company revenue record despite supply constraints. The revenue growth rate will decelerate from December, after explosive March 2021 growth. There was a different iPhone launch last year. FX will be a 3-point headwind vs December quarter growth rate. 2 point affect of FX in the March quarter, while it had a 1 point benefit in December.

2:24 pm: Strong double-digit growth in Services, but decelerated from December quarter. Higher rate of lockdowns last year led to extra use of digital services. OpEx to be between $12.5 billion and $12.7 billion. Tax rate should be around 16%.

2:24 pm: The call is being opened to questions from analysts.

2:25 pm: Q: Your margins have been impressive. On product, it's clearly benefitting from a strong mix. How sustainable do you think these mix trends are? Any thoughts on how Pro and Pro Max mix compared to prior cycles?

When you look at gross margin on Services, where within services are you seeing trends and how should investors think about these margins?

2:26 pm: A: In terms of the mix, we don't comment directly on mix, but we saw strong demand across the iPhone 13 family. In fact, we had several of the top-selling models in various markets including the top 5 in the US and Australia, top 4 in Urban China, 3 of top 4 in France and Germany, 4 of top 6 in Japan. Based on external data, it seems to say we are gaining share as well. We feel quite good on the momentum of iPhone.

We were constrained during the quarter.

2:28 pm: On the services side, our services business in aggregate is accretive to overall company margin. Services portfolio is very broad and contains businesses with different margin profiles. Due to nature of businesses and also how we account for them (net vs gross). Services gross margin percentage will be influenced by the rate of growth of businesses within the portfolio. We do not guide at product or services level, but the guidance that we provided for the march quarter, 42.5-43.5, very strong compared to recent history. We're very pleased with that.

2:29 pm: Q: Similar components used for iPhone and iPad? Should we see in a recovery in iPad as we see a slowing of iPhone sales?

A: In Q1, the December quarter, we said we would have constraints. For March, where we will have less constraints than the December quarter. Commonality between different products, there is some but generally the challenge is on legacy nodes and these legacy nodes are by supplier. It's much more focused on the supplier than anything else versus us behind the curtain finding a place to take it. There is some of that, but largely we take it where the shortages are.

2:30 pm: Q: Any guidance on iPad and where it should go?

A: Very significant constraint in December, very much on legacy nodes. Virtually all of the problem was in that area. Overall, we're not guiding constraint by product level, but overall we do see an improvement in the March quarter in terms of constraints going down versus December.

2:33 pm: Q: Can you talk about Mac business? Up about 50% from calendar 2019, almost $11 billion and still working through M1 transition. Where do you see opportunity to gain share? Target markets to grow this?

A: Mac set an all-time revenue record at $10.9 billion, up 25 percent. The last 6 quarters have been the top 6 revenue quarters of all time. Further very good about this, we set all-time revenue records in Americas, Europe, and Asia Pac, and December quarter record in Greater China. It's not narrowed to a particular geographic area that we're doing well in. It's almost across the board. The response is very much because of M1, and we got even more response with MacBook Pro that we launched during Q1. The upgraders (record number in December) and also markets like China, 6/10 sales are people new to the Mac. Upgraders and Switchers. Customer sat is off the charts. What I see this as is, a product that will be very successful in a number of different markets from education to business to creative, and in all geographies. We aren't limiting ourselves.

2:34 pm: Q: Services outperformed expectations. What trends are you seeing that are driving the extra revenue?

A: It was great on all fronts, December quarter records in every geography. Records for cloud, video, music, payments, App Store. Better than we were expecting at the beginning of the quarter. Overperformance was spread around the world and around services categories. The installed base is growing, we continue to have more engagement from customers on our services. Paid subscriptions is a phenomenal story, 785 million paid subs with 165 million increased in last 12 months. All these things combined are really powering the business.

2:36 pm: Q: As it relates to disruption you've seen on the component side for manufacturing, are you rethinking your broader supply chain strategy or manufacturing footprint on the back of the disruptions or are you happy with the overall geographic exposure that you see in the supply chain today?

A: If you step back and look at how we've done, our largest issue by far has been the chip shortage that is industry-wide and on these legacy nodes. I think our supply chain actually does very good considering the shortages because it's a fast-moving supply chain, the cycle times are very short, there's little distance between a chip being fabricated and packaged and a product going out of the factory. I don't see that it makes a fundamental change in the supply chain.

2:37 pm: Q: How are you thinking about the metaverse opportunity and APple's role in that market?

A: That's a big question. We're a company in a business of innovation. We're always exploring new and emerging technologies and this area is very interesting to us. We have 14,000 ARKit apps on the App Store, incredible AR experiences for millions of people today. We see a lot of potential in this space and are investing accordingly.

2:39 pm: Q: Any idea how much revenue was left on the table in December and how does that shake out in March?

A: In terms of December to March, it's hard to estimate with great precision but we said it would be more than September quarter for last quarter, and March will be less than December quarter. That's the verbiage that we placed around it. Yes, it is still challenging, but for us, we pride ourselves on getting products to customers who really want them and do that on a fast basis and it's frustrating that we can't always do that at the speed that we would like. However, March is better than December and there's some encouraging signs there. We aren't predicting overall because of the number of variables that go into such a prediction.

2:41 pm: Q: Visibility around the product roadmap. $23 billion in R&D in 2021, without telling us the roadmap, how do you think about where to focus R&D resources and how much should we think about spend on evolutions of products out there versus new offerings?

A: We have a little different model, we try to announce things when they're ready or close to ready and try to maintain an element of surprise. Hopefully that explains our roadmap and that has proven successful for us and other people can do it differently. We're going to continue to do that. In terms of deciding where to invest in, we look at areas that are at the intersection of hardware, software, and services. We think that's where the magic really happens and it brings out the best in Apple. There are areas that have more than piqued our interest and you can tell over time that we've ramped our R&D spend even more than we were before. There's quite a bit of investment going into things that are not on the market at this point, as there always are.

2:43 pm: Q: Can we get perspective on China and the macro climate and how that pertains to business. We heard concerns that current policies might have caused a pause in smartphone inventory and local vendors elevated into Chinese New Year. Sell-in vs sell-through in that market?

A: I can only comment for us, our sales grew 21% there in the last quarter and we're very proud of that. I'll stay away and let other people be the economists and make the macro determinations, but what we're seeing there was super impressive with all-time revenue records and a record number of upgraders and strong double-digit growth in switchers on iPhone. We had the top 4 selling phones in Urban China, there's a lot of good there and I would remind you that iPhone was constrained in the quarter. I'm not sure where the statements are coming around about inventory and I can't comment about how other people have more or not.

2:44 pm: Q: On supply chain you've been managing it very well and gross margins have grown relatively well across products and services. Can you shed light on costs attributed to supply chain that might abate later?

A: We're seeing inflation and it's factored into gross margin and OpEx that Luca reviewed. Logistics as I mentioned previously is very elevated in terms of cost of moving things around. I would hope that at least a portion of that is transitory but the world has changed so we'll see.

2:46 pm: Q: On Apple TV+, other players have talked about slowing subscriber growth as we move through the pandemic. Can you talk about that?

A: We don't give out subscriber numbers for Apple TV+, what we do do is give out a subscriber number for our subscription numbers that we have. We ended at 785 million, incredibly pleased with that. Huge growth on year over year. Accounts both Apple-branded and third-party, in terms of how we're doing, we've been honored with 200 wins and 890 nominations, doing exactly like we wanted to with giving storytellers a place to tell original stories and we feel really good with where we are competitively and the position of the product.

2:47 pm: Q: Any customer segments you aren't tapping into currently?

A: Putting aside anything on our roadmap, we wouldn't talk about, I think Apple Card has a great runway ahead of it. It was rated the number-one midsize credit card in customer sat by JD Power. It's fast-becoming people's main credit card for many people. The growth of Apple Pay has been stunning. There's still a lot more there to go, and a lot of cash in the environment. I think that both of these and whatever else we might do have a great future ahead.

2:49 pm: Q: If you can speak to the March quarter in terms of seasonality and performance, because of the later launch of the phone some of that came into the March quarter, should we interpret, because supply constraints are easing somewhat into the quarter, should we see similar March quarter getting better than seasonal performance?

A: We talked about it on a year-over-year basis because that's how most people look at it, we expect a record for March quarter, solid growth on a year-over-year basis. We still expect significant supply constraints but less than what we saw in December. You can do the math around sequential, but given where we are in the environment, the difficult compare on iPhone and on Services, we're very happy with the way we're guiding and the way the business is going right now.

2:51 pm: Q: Product and 5G upgrade cycle, a point in time where the view from some that iPhone was ex-growth and that's been proven wrong. The level of confidence that iPhone continues to grow in the future and the avenues for that growth?

A: iPhone has become an integral part of so many people's lives, now more than ever. Active install base continues to grow and is now at an all-time high. During December, as we had mentioned, we had a record number of upgraders and switchers grew strong double-digit which speaks to the strength of the product. 98% customer sat. Doing well throughout geogrpahies. Some of the geos that we track and how many units we have on top-selling model charts. Even though this is the second product announcement that has 5G in it, we're still in the early innings of 5G. If you look at the install base and how many people are on 5G vs not, we don't release those numbers but you can do some math and estimate those. We have an optimistic view on iPhone long term.

2:54 pm: Q: Relationship between iOS install base and the subsequent performance you see in services or paid subs? How do you look at existing services business in terms of the growth you get in terms of customers who are already subscribers vs net new or green field subscribers?

A: 785 million subs, relative to the total number of products offered and the customers they're offered too, there's still a lot of room to grow there. The way that I look at it, there's a lot more green field in front of us.

On services engagement and how we think about customers, obviously it's important for us that customers are engaged on our services platforms and the ones that we have, we know that the more engaged they are, the more likely they are to stay with Apple for the long term. We track all those metrics and they're very important for us. We improve the quality and quantity of our offerings, and we've launched a lot of new services. We care about new customers as well, and that's why we keep track of the install base and a lot of other metrics. We care about upgraders and switchers with products, and it's a combination of the two, put it together and it provides a level of growth from the services business. $72 billion of revenue on services, the size of a Fortune 50 company. Couldn't happen without contributions from both existing and new customers.

2:56 pm: Q: Content tends to be socially responsible and healthy, is this a constraint for Apple to purchase studios or shows when they come up, or has it been financial?

A: We don't make financial decisions on content, we try to find great content that has a reason for being. We love Ted Lasso and the other shows that have a reason for existing and have a good message and may make people feel better at the end of it. I don't think we've narrowed our universe of things we're selecting from. There's plenty to pick from out there, and I think we're doing a pretty good job of it as we speak.

2:58 pm: Q: Do you see a situation where Apple plays a more active role in health, or people require a watch to be worn for critical monitoring? How do you think about Watch in that context?

A: No days go by without someone telling me about a health alert, whether cardiovascular, or a lot of people have told me they fell and knocked unconscious and the watch responded for them to emergency contacts and emergency personnel. There's a lot that we're doing today, and my sense has always been that there's more here. We continue to pull the string and see where it takes us. We're really satisfied with how we're doing in this area. We are fundamentally changing people's lives and in some cases saving people's lives, so it's an area of great interest.

2:58 pm: The call has completed.