AT&T and Sprint Trade Barbs Over T-Mobile Merger

Sprint CEO Dan Hesse has been a constant critic of the proposed AT&T/T-Mobile merger, hammering the deal as bad for competition and bad for consumers. However, Hesse said yesterday that he isn't an opponent of all telecom mergers, but believes that the Department of Justice would view an alternate merger pair -- such as T-Mobile and Sprint, perhaps -- very differently.

However, if such a hypothetical deal were reached, “You could make a very, very strong argument” that the antitrust regulators would approve it, Hesse said. He said the hypothetical combination of of two value players could allow a strong competitor to Verizon Wireless and AT&T.

AT&T's head lobbyist, Jim Cicconi, AT&T Senior Executive Vice President, External and Legislative Affairs had harsh words for Hesse in response:

Yesterday, the CEO of Sprint said the Department of Justice should block AT&T from merging with T-Mobile, but would have good reasons to instead allow Sprint to purchase them. For months Sprint has spoken disingenuously about their motives for opposing AT&T's merger with T-Mobile. Now, Mr. Hesse's public musings have made their motives much more clear. That they would act in their own economic interest is not surprising. That they would expect the United States Government to be a willing partner certainly is.

A federal judge set a mid-February 2012 trial date to hear the Department of Justice's arguments for blocking the merger, but denied Sprint's request to join the DoJ's suit.

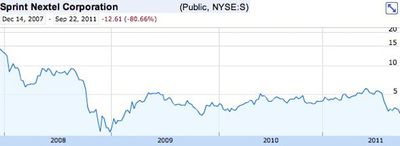

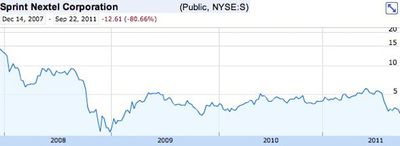

Dan Hesse and Sprint have a poor track record regarding large mergers. When Sprint and Nextel merged in 2005, the companies said the value of the merged company would be $70 billion. Today, Sprint's market cap is just over $9 billion.

Sprint's stock price is down more than 80% since Dan Hesse took over as CEO in December 2007.

Popular Stories

Since the iPhone X in 2017, all of Apple's highest-end iPhone models have featured either stainless steel or titanium frames, but it has now been rumored that this design decision will be coming to an end with the iPhone 17 Pro models later this year.

In a post on Chinese social media platform Weibo today, the account Instant Digital said that the iPhone 17 Pro models will have an aluminum...

Apple is continuing to refine and update iOS 26, and beta three features smaller changes than we saw in beta 2, plus further tweaks to the Liquid Glass design. Apple is gearing up for the next phase of beta testing, and the company has promised that a public beta is set to come out in July.

Transparency

In some apps like Apple Music, Podcasts, and the App Store, Apple has toned down the...

The calendar has turned to July, meaning that 2025 is now more than half over. And while the summer months are often quiet for Apple, the company still has more than a dozen products coming later this year, according to rumors.

Below, we have outlined at least 15 new Apple products that are expected to launch later this year, along with key rumored features for each.

iPhone 17 Series

iPho...

Apple should unveil the iPhone 17 series in September, and there might be one bigger difference between the Pro and Pro Max models this year.

As always, the Pro Max model will be larger than the Pro model:iPhone 17 Pro: 6.3-inch display

iPhone 17 Pro Max: 6.9-inch displayGiven the Pro Max is physically larger than the Pro, it has more internal space, allowing for a larger battery and...

In 2020, Apple added a digital car key feature to its Wallet app, allowing users to lock, unlock, and start a compatible vehicle with an iPhone or Apple Watch. The feature is currently offered by select automakers, including Audi, BMW, Hyundai, Kia, Genesis, Mercedes-Benz, Volvo, and a handful of others, and it is set to expand further.

Apple has a web page with a list of vehicle models that ...

In select U.S. states, residents can add their driver's license or state ID to the Wallet app on the iPhone and Apple Watch, providing a convenient and contactless way to display proof of identity or age at select airports and businesses, and in select apps.

Unfortunately, this feature continues to roll out very slowly since it was announced in 2021, with only nine U.S. states, Puerto Rico,...

New renders today provide the best look yet relocated Apple logo and redesigned MagSafe magnet array of the iPhone 17 Pro and iPhone 17 Pro Max.

Image via Majin Bu.

Several of the design changes coming to the iPhone 17 Pro model have been rumored for some time, such as the elongated camera bump that spans the full width of the device, with the LiDAR Scanner and flash moving to the right side.

...

Apple is expanding the ability to add an Apple Account Card to the Wallet app to more countries, according to backend Apple Pay changes.

With iOS 15.5, Apple updated the Wallet app to allow users to add an Apple Account Card, which displays the Apple credit balance associated with an Apple ID.

If you receive an Apple gift card, for example, it is added to an Apple Account that is also...

Apple's next-generation iPhone 17 Pro and iPhone 17 Pro Max are just over two months away, and there are plenty of rumors about the devices.

Below, we recap key changes rumored for the iPhone 17 Pro models.

Latest Rumors

These rumors surfaced in June and July:Apple logo repositioned: Apple's logo may have a lower position on the back of the iPhone 17 Pro models, compared to previous...