Fortune 500

By MacRumors Staff

Fortune 500 Articles

Apple Leaps Up Fortune Global 500 Rankings

Apple has leaped from third to first place for profit and from twelfth to sixth place for revenue in the Fortune Global 500 rankings of the world's biggest companies. After reaching a record high of $33.3 trillion in last year's rankings, total revenue for the world's biggest companies fell 4.8 percent to $31.7 trillion this year. Even so, the combined sales of all of the companies on the...

Read Full Article 16 comments

Apple Ranks Third in Annual Fortune 500 List With $275 Billion Revenue

Apple has regained its third-place position in the annual Fortune 500 rankings of the largest companies in the United States by revenue. Apple earned $274.5 billion in revenue in the last fiscal year, an increase of 5.5 percent, and made $57.4 billion in profit, a 3.9 percent increase. Last year, Apple fell to fourth place, but now the company returned to third place, only surpassed by...

Apple Ranked Twelfth in Fortune Global 500 for Revenue, Third for Profit

Apple has ranked third in the annual Fortune Global 500 list of the world's largest companies for profit, and twelfth for revenue. This year's Fortune Global 500 companies' operating income reached a record high of $33 trillion, close to the combined GDP of China and the United States. Together, this year's Fortune Global 500 companies employ 69.9 million people worldwide and are...

Apple Ranks Fourth in Annual Fortune 500 List of America's Largest Companies

Apple has ranked fourth in the annual Fortune 500 list of the largest companies in the United States by revenue, with $260.1 billion revenue in the 2019 fiscal year, trailing Walmart, Amazon, and ExxonMobil.Mighty Apple dipped a smidge in 2019, both in terms of sales, down 2% to $260 billion, and in its ranking, from No. 3 to No. 4. The computer and phone maker’s ability to make money cushioned ...

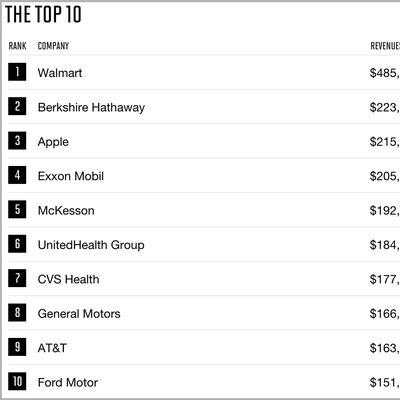

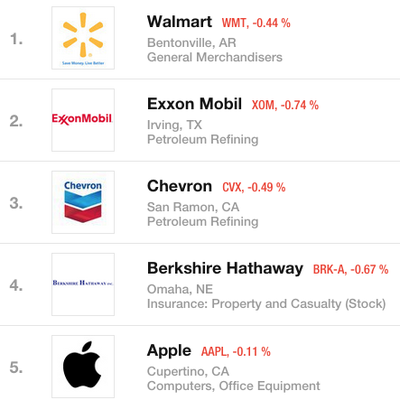

Apple Rises to Third in Annual Fortune 500 List of America's Largest Companies

Apple has ranked third in the annual Fortune 500 list of the highest-revenue-generating companies based in the United States, with $265.5 billion revenue in fiscal 2018, trailing only Walmart and oil giant ExxonMobil. Apple moved up one spot in this year's rankings, overtaking billionaire investor Warren Buffett's holding company Berkshire Hathaway. Fortune's description of Apple:Two...

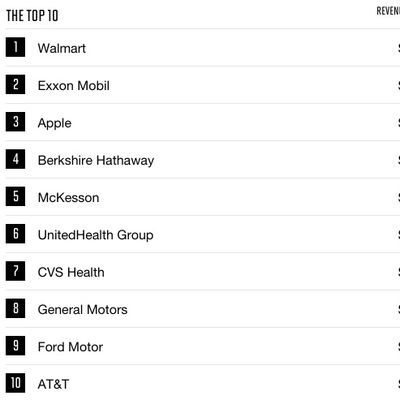

Apple Drops to #4 Spot in Annual Fortune 500 Rankings

After retaining the #3 spot on the Fortune 500 list for the past two years, in 2018 Apple has dropped one place and now sits at #4 on the list of the top U.S. corporations based on gross revenue. Apple's displacement on the list came due to Exxon Mobil rising from #4 in 2017 to #2 in 2018. The full top five spots were Walmart at #1, Exxon Mobil at #2, Berkshire Hathaway at #3, Apple at #4, and ...

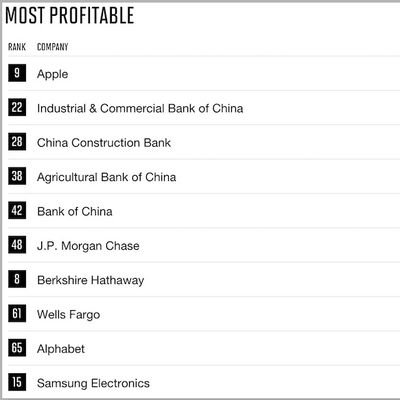

Apple Earns Title of World's Most Profitable Company on Fortune Global 500 List

In June, Apple was ranked as #3 on the 2017 Fortune 500 annual list of the top U.S. corporations based on gross revenue. Today, the Fortune Global 500 rankings have been released, using the same data collected in the earlier rankings but expanding it and adding in companies on a global scale, resulting in a list that shares the 500 largest companies in the world. Apple sits at #9 on the list...

Apple Retains #3 Spot in Annual Fortune 500 Rankings

One year after rising to claim the third spot on the annual Fortune 500 list, Apple hasn't moved places in 2017 and remains #3 on the list of the top U.S. corporations based on gross revenue. Going back seven years, Apple's previous rankings include 5th place in 2015 and 2014, 6th place in 2013, 17th place in 2012, 35th place in 2011 and 56th place in 2010. A few rankings surrounding Apple...

Apple Rises to #3 in Annual Fortune 500 Rankings

Apple rose to 3rd place in the annual Fortune 500 list of the top U.S. corporations based on gross revenue, trailing behind only Walmart and Exxon Mobil. Apple's previous rankings include 5th place in 2015 and 2014, 6th place in 2013, 17th place in 2012, 35th place in 2011 and 56th place in 2010. Other notable carriers, technology companies, and Apple suppliers on the list include AT&T (10th), ...

Apple Again Places #5 in Annual Fortune 500 Rankings

Fortune has released its annual Fortune 500 list of the top U.S. corporations based on gross revenue, which together accounted for $12.5 trillion in revenues, $945 billion in profits and $17 trillion in market value. Apple maintained the 5th spot in the rankings for the second consecutive year after steadily rising from 6th place in 2013, 17th place in 2012, 35th place in 2011 and 56th place in...