Apple Card Customer Agreement Updated for 'Upcoming' Savings Account Feature

Goldman Sachs this week updated its Apple Card customer agreement to reflect the credit card's upcoming Daily Cash savings account feature, which was expected to launch with iOS 16.1 but appears to have been delayed.

"To enable new ways to use Daily Cash like the upcoming Savings account feature, we are updating the Daily Cash Program section of your Apple Card Customer Agreement," reads an email sent to Apple Card holders this week.

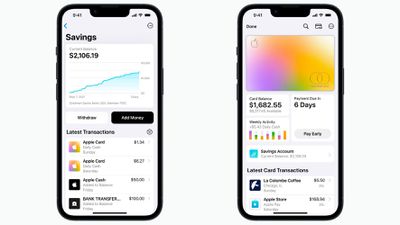

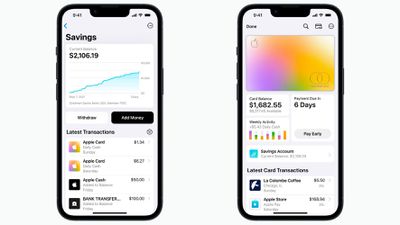

In October, Apple announced that Apple Card users would soon be able to open a new high-yield savings account from Goldman Sachs and have their Daily Cash cashback rewards automatically deposited into it, with no fees, no minimum deposits, and no minimum balance requirements. The account will be managed through the Wallet app on the iPhone.

The savings account was listed in the release notes for the iOS 16.1 Release Candidate, but it did not end up launching with that update. The savings account has not been present in any iOS 16.2 betas, so it's unclear when it will become available, but Goldman Sachs evidently continues to lay the groundwork for the feature's launch.

Once the account is set up, all Daily Cash received from that point on will be automatically deposited into it and start earning interest, unless a user opts to continue having Daily Cash added to their Apple Cash balance. Apple Card provides 2-3% Daily Cash on purchases made with Apple Pay and 1% on purchases made with the physical card.

Launched in 2019, Apple's credit card remains exclusive to the United States. Customers who sign up for an Apple Card and use it to purchase Apple products through December 25 will receive 5% Daily Cash as part of a limited-time promotion.

Popular Stories

Apple is planning to launch new MacBook Pro models as soon as early March, but if you can, this is one generation you should skip because there's something much better in the works.

We're waiting on 14-inch and 16-inch MacBook Pro models with M5 Pro and M5 Max chips, with few changes other than the processor upgrade. There won't be any tweaks to the design or the display, but later this...

Wednesday February 11, 2026 10:07 am PST by

Juli CloverApple today released iOS 26.3 and iPadOS 26.3, the latest updates to the iOS 26 and iPadOS 26 operating systems that came out in September. The new software comes almost two months after Apple released iOS 26.2 and iPadOS 26.2.

The new software can be downloaded on eligible iPhones and iPads over-the-air by going to Settings > General > Software Update.

According to Apple's release notes, ...

It has been a slow start to 2026 for Apple product launches, with only a new AirTag and a special Apple Watch band released so far. We are still waiting for MacBook Pro models with M5 Pro and M5 Max chips, the iPhone 17e, a lower-cost MacBook with an iPhone chip, long-rumored updates to the Apple TV and HomePod mini, and much more.

Apple is expected to release/update the following products...

Apple plans to announce the iPhone 17e on Thursday, February 19, according to Macwelt, the German equivalent of Macworld.

The report said the iPhone 17e will be announced in a press release on the Apple Newsroom website, so do not expect an event for this device specifically.

The iPhone 17e will be a spec-bumped successor to the iPhone 16e. Rumors claim the device will have four key...

Apple acquired Canadian graph database company Kuzu last year, it has emerged.

The acquisition, spotted by AppleInsider, was completed in October 2025 for an undisclosed sum. The company's website was subsequently taken down and its Github repository was archived, as is commonplace for Apple acquisitions.

Kuzu was "an embedded graph database built for query speed, scalability, and easy of ...