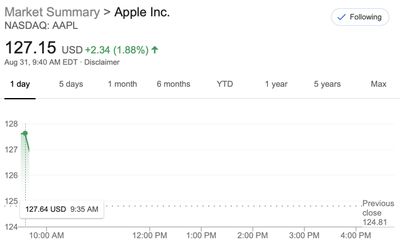

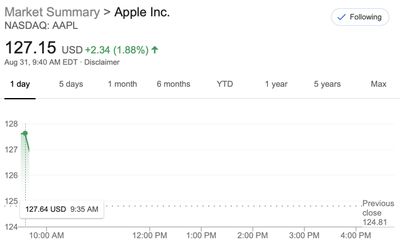

Apple Shares Rise as Trading Begins Following Four-for-One Stock Split

Apple's four-for-one stock split takes effect today, with the company's share price dropping from roughly $500 to around $125 as of the start of trading this morning.

The strong rise in Apple's stock price over the past five months has continued today, with shares trading nearly 3% higher in the first few minutes of trading. Apple shares have pared their gains since then, but are still up around 2% today.

Apple's overall market value of over $2 trillion is unaffected, as investors received three additional shares for every share of Apple stock they previously owned.

Popular Stories

Apple will launch its new iPhone 17 series in two months, and the iPhone 17 Pro models are expected to get a new design for the rear casing and the camera area. But more significant changes to the lineup are not expected until next year, when the iPhone 18 models arrive.

If you're thinking of trading in your iPhone for this year's latest, consider the following features rumored to be coming...

In select U.S. states, residents can add their driver's license or state ID to the Wallet app on the iPhone and Apple Watch, providing a convenient and contactless way to display proof of identity or age at select airports and businesses, and in select apps.

Unfortunately, this feature continues to roll out very slowly since it was announced in 2021, with only nine U.S. states, Puerto Rico,...

Since the iPhone X in 2017, all of Apple's highest-end iPhone models have featured either stainless steel or titanium frames, but it has now been rumored that this design decision will be coming to an end with the iPhone 17 Pro models later this year.

In a post on Chinese social media platform Weibo today, the account Instant Digital said that the iPhone 17 Pro models will have an aluminum...

Three out of four iPhone 17 models will feature more RAM than the equivalent iPhone 16 models, according to a new leak that aligns with previous rumors.

The all-new iPhone 17 Air, the iPhone 17 Pro, and the iPhone 17 Pro Max will each be equipped with 12GB of RAM, according to Fixed Focus Digital, an account with more than two million followers on Chinese social media platform Weibo. The...

Apple is expanding the ability to add an Apple Account Card to the Wallet app to more countries, according to backend Apple Pay changes.

With iOS 15.5, Apple updated the Wallet app to allow users to add an Apple Account Card, which displays the Apple credit balance associated with an Apple ID.

If you receive an Apple gift card, for example, it is added to an Apple Account that is also...

Apple does not plan to refresh any Macs with updated M5 chips in 2025, according to Bloomberg's Mark Gurman. Updated MacBook Air and MacBook Pro models are now planned for the first half of 2026.

Gurman previously said that Apple would debut the M5 MacBook Pro models in late 2025, but his newest report suggests that Apple is "considering" pushing them back to 2026. Apple is now said to be...

Apple is continuing to refine and update iOS 26, and beta three features smaller changes than we saw in beta 2, plus further tweaks to the Liquid Glass design. Apple is gearing up for the next phase of beta testing, and the company has promised that a public beta is set to come out in July.

Transparency

In some apps like Apple Music, Podcasts, and the App Store, Apple has toned down the...

If you pay for iCloud storage on your iPhone, did you know that Apple offers you five perks beyond the extra storage space, at no additional cost?

Here are the perks included with all iCloud+ plans:Private Relay keeps your Safari browsing history entirely private from network providers, websites, and even Apple.

Hide My Email generates unique, random email addresses whenever needed.

Hom...