Apple Pay Launching in Canada With American Express on November 17

Apple Pay is expected to expand to its third market this week, launching in Canada this Tuesday, November, 17, reports iPhone in Canada. As previously announced, Apple Pay will be launching through an exclusive partnership with American Express, initially limiting the reach of Apple's payments service in the country.

According to American Express, the service is set to launch this Tuesday, November 17, 2015. Customer service representatives we spoke with confirmed the date over the phone numerous times, and is in line with what you’ve told us as well.

As reported by The Globe and Mail last month, sources indicate Apple partnered with American Express in order to expedite the Apple Pay launch in the country, as discussions with the major Canadian banks and other credit card companies had been "dragging."

Beyond Canada, Apple is also partnering with American Express to bring Apple Pay to Australia by the end of the year and to Spain, Singapore, and Hong Kong next year. Apple Pay launched in the United States alongside iOS 8 in September 2014 and expanded to the United Kingdom in July of this year.

Popular Stories

Apple is not expected to release a standard iPhone 18 model this year, according to a growing number of reports that suggest the company is planning a significant change to its long-standing annual iPhone launch cycle.

Despite the immense success of the iPhone 17 in 2025, the iPhone 18 is not expected to arrive until the spring of 2027, leaving the iPhone 17 in the lineup as the latest...

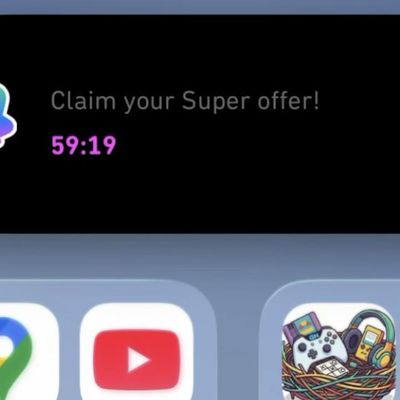

Language learning app Duolingo has apparently been using the iPhone's Live Activity feature to display ads on the Lock Screen and the Dynamic Island, which violates Apple's design guidelines.

According to multiple reports on Reddit, the Duolingo app has been displaying an ad for a "Super offer," which is Duolingo's paid subscription option.

Apple's guidelines for Live Activity state that...

The company behind the BlackBerry-like Clicks Keyboard accessory for the iPhone today unveiled a new Android 16 smartphone called the Clicks Communicator.

The purpose-built device is designed to be used as a second phone alongside your iPhone, with the intended focus being communication over content consumption. It runs a custom Android launcher that offers a curated selection of messaging...

Apple plans to introduce a 12.9-inch MacBook in spring 2026, according to TrendForce.

In a press release this week, the Taiwanese research firm said this MacBook will be aimed at the entry-level to mid-range market, with "competitive pricing."

TrendForce did not share any further details about this MacBook, but the information that it shared lines up with several rumors about a more...

Apple is planning to release a low-cost MacBook in 2026, which will apparently compete with more affordable Chromebooks and Windows PCs. Apple's most affordable Mac right now is the $999 MacBook Air, and the upcoming low-cost MacBook is expected to be cheaper. Here's what we know about the low-cost MacBook so far.

Size

Rumors suggest the low-cost MacBook will have a display that's around 13 ...

Apple today announced a number of updates to Apple Fitness+ and activity with the Apple Watch.

The key announcements include:

New Year limited-edition award: Users can win the award by closing all three Activity Rings for seven days in a row in January.

"Quit Quitting" Strava challenge: Available in Strava throughout January, users who log 12 workouts anytime in the month will win an ...

Govee today introduced three new HomeKit-compatible lighting products, including the Govee Floor Lamp 3, the Govee Ceiling Light Ultra, and the Govee Sky Ceiling Light.

The Govee Floor Lamp 3 is the successor to the Floor Lamp 2, and it offers Matter integration with the option to connect to HomeKit. The Floor Lamp 3 offers an upgraded LuminBlend+ lighting system that can reproduce 281...

Belkin today announced a range of new charging and connectivity accessories at CES 2026, expanding its portfolio of products aimed at Apple device users.

UltraCharge Pro Power Bank 10K with Magnetic Ring

The lineup includes new Qi2 and Qi2.2 wireless chargers, magnetic power banks, a high-capacity laptop battery, and USB-C productivity accessories, with an emphasis on higher charging...