Barclays Anticipating 'Imminent' Support for Apple Pay in United Kingdom

MacRumors has learned that a high-level executive at Barclays, one of the largest banks in the United Kingdom, anticipates "imminent" support of Apple Pay in the country. Apple Pay in the U.K. is expected to go live on Tuesday, although it remains unclear if Barclays will be a first wave launch partner because of its delayed negotiations with Apple about the mobile payments service.

Apple confirmed at WWDC last month that Apple Pay will be available in the U.K. in July, but stopped short of providing a specific launch date. Recently released employee training documents have suggested the launch could come next week, on July 14, and some Santander customers were able to add their cards to Passbook for use with Apple Pay and make purchases ahead of that date.

Barclays was notably absent from Apple's list of banks that will support Apple Pay in the U.K. at launch or soon after, which presently includes HSBC, Lloyds Bank, Bank of Scotland, Royal Bank of Scotland, First Direct, Halifax, M&S Bank, MBNA, NatWest, Nationwide, Santander, TSB and Ulster Bank. The bank's subsidiary Barclaycard has offered an Apple Rewards Visa Card for several years.

Barclaycard recently expanded its "bPay" lineup of wearable solutions for contactless payments to include a wristband, key fob and sticker, leading to speculation that Barclays may be electing to use its own mobile payments services as opposed to Apple Pay, similar to how some retailers maintained exclusivity to the CurrentC platform last year. Today's confirmation, however, indicates otherwise.

Popular Stories

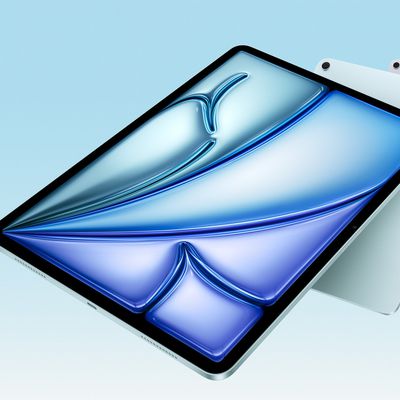

Apple plans to release an iPhone 17e and an iPad Air with an M4 chip "in the coming weeks," according to the latest word from Bloomberg's Mark Gurman.

"Apple retail employees say that inventory of the iPhone 16e has basically dried out and the iPad Air is seeing shortages as well," said Gurman. "I've been expecting new versions of both (iPhone 17e and M4 iPad Air) in the coming weeks."...

Apple plans to launch a rebranded "Sales Coach" app on the iPhone and iPad later this month, according to a source familiar with the matter.

"Sales Coach" will arrive as an update to Apple's existing "SEED" app, and it will continue to provide sales tips and training resources to Apple Store and Apple Authorized Reseller employees around the world. For example, there are articles and videos...

Apple is planning to launch new MacBook Pro models as soon as early March, but if you can, this is one generation you should skip because there's something much better in the works.

We're waiting on 14-inch and 16-inch MacBook Pro models with M5 Pro and M5 Max chips, with few changes other than the processor upgrade. There won't be any tweaks to the design or the display, but later this...

While the iPhone 18 Pro and iPhone 18 Pro Max are still seven months away, an analyst has revealed five new features the devices will allegedly have.

Rumored color options for the iPhone 18 Pro models

In a research note with investment firm GF Securities on Thursday, analyst Jeff Pu outlined the following upgrades for the iPhone 18 Pro models:

Smaller Dynamic Island: It has been rumored...

Wednesday February 11, 2026 10:07 am PST by

Juli CloverApple today released iOS 26.3 and iPadOS 26.3, the latest updates to the iOS 26 and iPadOS 26 operating systems that came out in September. The new software comes almost two months after Apple released iOS 26.2 and iPadOS 26.2.

The new software can be downloaded on eligible iPhones and iPads over-the-air by going to Settings > General > Software Update.

According to Apple's release notes, ...